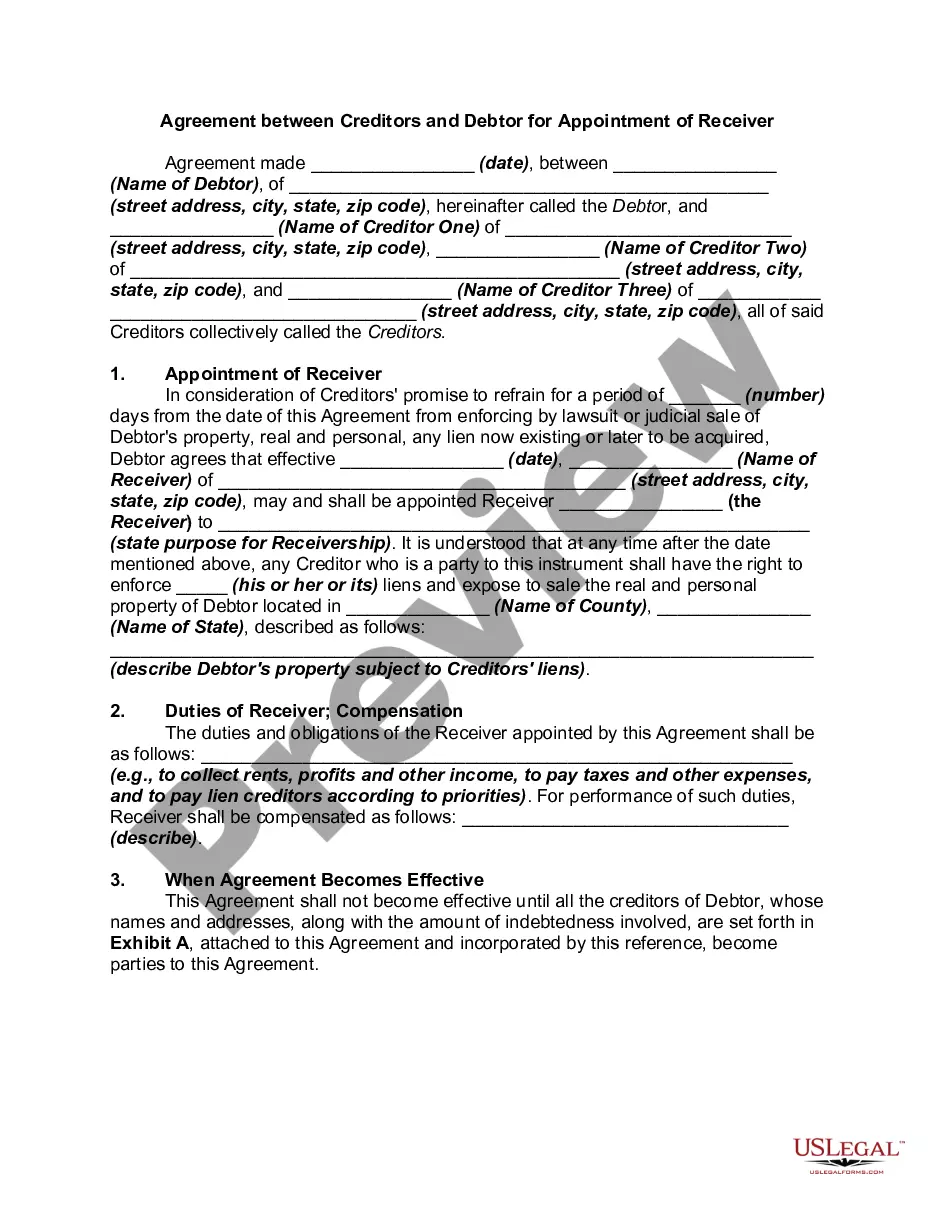

A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Agreement between Creditors and Debtor for Appointment of Receiver is a legal agreement that outlines the terms and conditions agreed upon by the creditors and the debtor when appointing a receiver to manage the financial affairs of the debtor. This agreement is particularly relevant in cases where the debtor is in financial distress and is unable to meet their financial obligations. The parties involved in the agreement include the creditors, who are owed money by the debtor, and the debtor, who is seeking the appointment of a receiver to handle their financial matters. The appointment of a receiver can be a useful solution as it helps in protecting the interests of the creditors and ensures a fair distribution of assets. The agreement typically includes the following key provisions: 1. Purpose: The agreement clearly states the purpose for appointing a receiver, such as to manage the debtor's assets, preserve their value, and facilitate the repayment of debts to the creditors. 2. Appointment of Receiver: It specifies the name and qualifications of the receiver to be appointed. The receiver is an unbiased third party who will take charge of managing the debtor's assets, liquidating them, and distributing the proceeds to the creditors. 3. Powers and Duties of Receiver: This section outlines the specific powers granted to the receiver, including the ability to collect debts, control and administer assets, enter into contracts, and take legal actions on behalf of the debtor. 4. Rights and Obligations of Creditors: The agreement also details the rights and obligations of the creditors, such as the requirement to provide accurate and up-to-date information about their claims, and their rights to participate in the distribution of assets. 5. Reporting: The receiver is often required to provide regular reports to the creditors, the court, or other concerned parties, detailing the progress of the receivership, financial transactions, and any relevant updates. 6. Compensation and Expenses: This section addresses the receiver's compensation for their services and the reimbursement of any expenses incurred during the receivership process. The payment terms and method are generally specified in this section. Different types of Harris Texas Agreement between Creditors and Debtor for Appointment of Receiver can vary based on the nature and complexity of the debtor's financial situation. Some common variations include: 1. Voluntary Agreement: This type is entered into voluntarily by the debtor and creditors without the involvement of a court. 2. Court-Ordered Agreement: In certain cases, a court may order the appointment of a receiver based on the request of either the debtor or the creditors. 3. Limited Powers Agreement: This type of agreement may limit the powers and scope of the receiver's authority to specific tasks or assets, focusing on certain aspects of the debtor's financial affairs. In summary, the Harris Texas Agreement between Creditors and Debtor for Appointment of Receiver is a crucial legal document that helps establish the terms and conditions for appointing a receiver in a debtor-creditor relationship. It aims to protect the interests of both parties while working towards the efficient management and distribution of assets to repay outstanding debts.Harris Texas Agreement between Creditors and Debtor for Appointment of Receiver is a legal agreement that outlines the terms and conditions agreed upon by the creditors and the debtor when appointing a receiver to manage the financial affairs of the debtor. This agreement is particularly relevant in cases where the debtor is in financial distress and is unable to meet their financial obligations. The parties involved in the agreement include the creditors, who are owed money by the debtor, and the debtor, who is seeking the appointment of a receiver to handle their financial matters. The appointment of a receiver can be a useful solution as it helps in protecting the interests of the creditors and ensures a fair distribution of assets. The agreement typically includes the following key provisions: 1. Purpose: The agreement clearly states the purpose for appointing a receiver, such as to manage the debtor's assets, preserve their value, and facilitate the repayment of debts to the creditors. 2. Appointment of Receiver: It specifies the name and qualifications of the receiver to be appointed. The receiver is an unbiased third party who will take charge of managing the debtor's assets, liquidating them, and distributing the proceeds to the creditors. 3. Powers and Duties of Receiver: This section outlines the specific powers granted to the receiver, including the ability to collect debts, control and administer assets, enter into contracts, and take legal actions on behalf of the debtor. 4. Rights and Obligations of Creditors: The agreement also details the rights and obligations of the creditors, such as the requirement to provide accurate and up-to-date information about their claims, and their rights to participate in the distribution of assets. 5. Reporting: The receiver is often required to provide regular reports to the creditors, the court, or other concerned parties, detailing the progress of the receivership, financial transactions, and any relevant updates. 6. Compensation and Expenses: This section addresses the receiver's compensation for their services and the reimbursement of any expenses incurred during the receivership process. The payment terms and method are generally specified in this section. Different types of Harris Texas Agreement between Creditors and Debtor for Appointment of Receiver can vary based on the nature and complexity of the debtor's financial situation. Some common variations include: 1. Voluntary Agreement: This type is entered into voluntarily by the debtor and creditors without the involvement of a court. 2. Court-Ordered Agreement: In certain cases, a court may order the appointment of a receiver based on the request of either the debtor or the creditors. 3. Limited Powers Agreement: This type of agreement may limit the powers and scope of the receiver's authority to specific tasks or assets, focusing on certain aspects of the debtor's financial affairs. In summary, the Harris Texas Agreement between Creditors and Debtor for Appointment of Receiver is a crucial legal document that helps establish the terms and conditions for appointing a receiver in a debtor-creditor relationship. It aims to protect the interests of both parties while working towards the efficient management and distribution of assets to repay outstanding debts.