A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

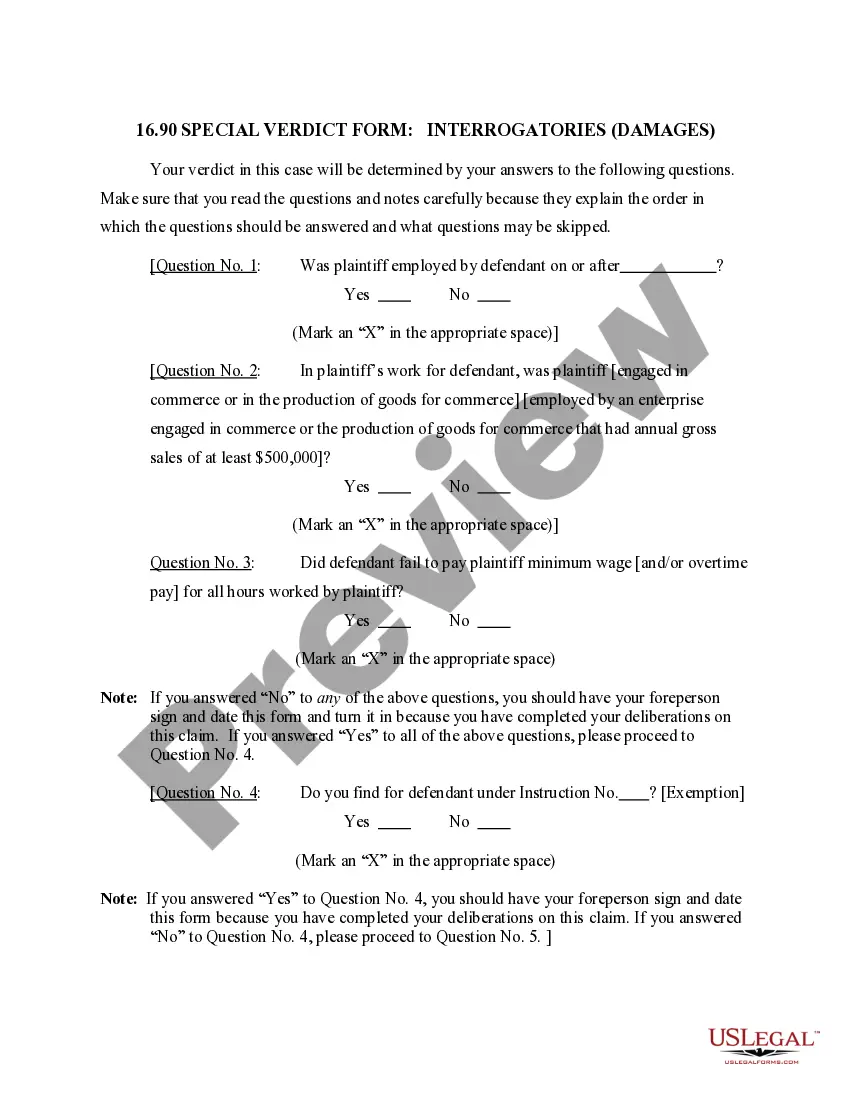

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montgomery Maryland Agreement between Creditors and Debtor for Appointment of Receiver is a legally binding document that outlines the terms and conditions agreed upon by a debtor and its creditors regarding the appointment of a receiver. This agreement is designed to ensure fair treatment of all parties involved in the debt recovery process and provides a framework for the receiver's role and responsibilities. Keywords: Montgomery Maryland, agreement, creditors, debtor, appointment, receiver. Types of Montgomery Maryland Agreement between Creditors and Debtor for Appointment of Receiver: 1. General Agreement: This type of agreement outlines the general terms and conditions applicable to the appointment of a receiver in Montgomery Maryland. It covers the essential elements such as the purpose, rights, and obligations of the receiver, the powers granted, and the duration of the receiver's appointment. 2. Agreement for Specific Debts: In cases where there are specific debts or liabilities at hand, this type of agreement narrows down the focus to address those specific issues. It may include details about the receiver's responsibilities in managing and recovering those particular debts or assets. 3. Agreement for Business Restructuring: This type of agreement is applicable when the debtor is a business entity. It focuses on restructuring the business operations and finances to ensure its viability and long-term sustainability. The agreement may outline the receiver's role in assessing the financial situation, implementing necessary changes, and fostering communication between the creditors and debtor. 4. Agreement for Real Estate Receivership: When the underlying assets involved are primarily real estate properties, this type of agreement specifies the receiver's role in managing and preserving the properties, handling lease agreements, and seeking potential buyers or tenants. It may also address any outstanding debts related to the real estate, such as mortgages or liens. 5. Agreement for Personal Receivership: In cases where the debtor is an individual, this type of agreement governs the appointment of a personal receiver to manage the individual's assets, finances, and debts. It may include provisions for debt repayment plans, asset liquidation, or negotiations with creditors to reach mutually beneficial solutions. Ultimately, the Montgomery Maryland Agreement between Creditors and Debtor for Appointment of Receiver serves as a crucial tool to navigate the debt recovery process while safeguarding the rights and interests of all parties involved. It is essential to consult legal professionals when drafting or executing such agreements to ensure compliance with local laws and regulations.Montgomery Maryland Agreement between Creditors and Debtor for Appointment of Receiver is a legally binding document that outlines the terms and conditions agreed upon by a debtor and its creditors regarding the appointment of a receiver. This agreement is designed to ensure fair treatment of all parties involved in the debt recovery process and provides a framework for the receiver's role and responsibilities. Keywords: Montgomery Maryland, agreement, creditors, debtor, appointment, receiver. Types of Montgomery Maryland Agreement between Creditors and Debtor for Appointment of Receiver: 1. General Agreement: This type of agreement outlines the general terms and conditions applicable to the appointment of a receiver in Montgomery Maryland. It covers the essential elements such as the purpose, rights, and obligations of the receiver, the powers granted, and the duration of the receiver's appointment. 2. Agreement for Specific Debts: In cases where there are specific debts or liabilities at hand, this type of agreement narrows down the focus to address those specific issues. It may include details about the receiver's responsibilities in managing and recovering those particular debts or assets. 3. Agreement for Business Restructuring: This type of agreement is applicable when the debtor is a business entity. It focuses on restructuring the business operations and finances to ensure its viability and long-term sustainability. The agreement may outline the receiver's role in assessing the financial situation, implementing necessary changes, and fostering communication between the creditors and debtor. 4. Agreement for Real Estate Receivership: When the underlying assets involved are primarily real estate properties, this type of agreement specifies the receiver's role in managing and preserving the properties, handling lease agreements, and seeking potential buyers or tenants. It may also address any outstanding debts related to the real estate, such as mortgages or liens. 5. Agreement for Personal Receivership: In cases where the debtor is an individual, this type of agreement governs the appointment of a personal receiver to manage the individual's assets, finances, and debts. It may include provisions for debt repayment plans, asset liquidation, or negotiations with creditors to reach mutually beneficial solutions. Ultimately, the Montgomery Maryland Agreement between Creditors and Debtor for Appointment of Receiver serves as a crucial tool to navigate the debt recovery process while safeguarding the rights and interests of all parties involved. It is essential to consult legal professionals when drafting or executing such agreements to ensure compliance with local laws and regulations.