A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

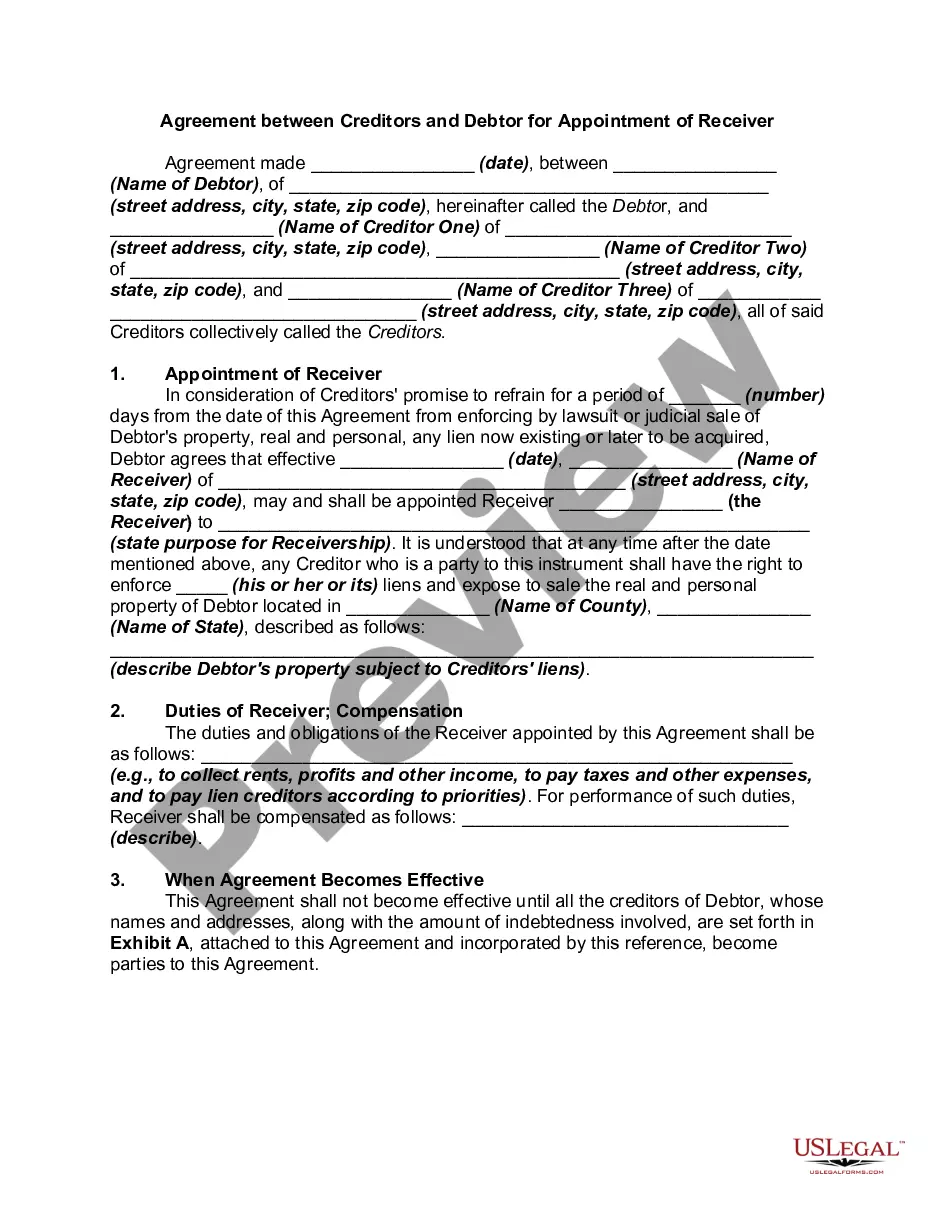

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Antonio Texas Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions agreed upon by the creditors and debtors in the event of financial distress or insolvency. It seeks to establish a framework for the appointment of a receiver, who acts as a neutral third party responsible for managing the debtor's assets and ensuring fair distribution among the creditors. This agreement typically includes several key elements, including: 1. Parties involved: The agreement identifies the creditors, debtors, and any other relevant parties involved in the agreement. 2. Financial obligations: It outlines the debtors' financial obligations, including the outstanding debts, due dates, and payment terms. 3. Appointment of Receiver: The agreement defines the process and criteria for appointing a receiver to take control of the debtor's assets and business operations. 4. Receiver's powers and responsibilities: It specifies the receiver's authority to manage, sell, or liquidate the debtor's assets, collect outstanding debts, and distribute proceeds among the creditors. 5. Duties of the parties: The document outlines the responsibilities and obligations of each party, including providing necessary information, cooperation, and access to relevant records. 6. Confidentiality: It may include provisions to maintain confidentiality regarding the receiver's actions, financial information, and other sensitive matters. 7. Dispute resolution: The agreement may include a clause specifying the mechanism for resolving any disputes that may arise during the execution of the agreement, such as mediation or arbitration. There could be different types or variations of San Antonio Texas Agreement between Creditors and Debtor for the Appointment of Receiver based on specific circumstances. Some potential variations include: 1. Voluntary Agreement: This type of agreement is entered into willingly by both the debtors and creditors when they anticipate financial distress or insolvency. It allows them to jointly appoint a receiver to protect their interests and facilitate a smooth resolution process. 2. Involuntary Agreement: In certain cases, creditors may initiate legal proceedings to obtain a court order for the appointment of a receiver. This type of agreement is enforced by the court upon finding the debtor unable to fulfill its financial obligations. 3. Post-Judgment Agreement: This agreement may occur after a judgment has been obtained against the debtor. It outlines the terms for the appointment of a receiver to enforce the judgment and collect the outstanding debt. 4. Specific Purpose Agreement: In some instances, creditors and debtors may enter into an agreement to appoint a receiver for a particular purpose, such as managing specific assets or projects to maximize their value and protect the creditors' interests. In conclusion, San Antonio Texas Agreement between Creditors and Debtor for Appointment of Receiver is a crucial legal document that helps establish a fair and structured framework for managing financial distress or insolvency situations. The specific type and terms of this agreement may vary depending on the circumstances and parties involved.San Antonio Texas Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions agreed upon by the creditors and debtors in the event of financial distress or insolvency. It seeks to establish a framework for the appointment of a receiver, who acts as a neutral third party responsible for managing the debtor's assets and ensuring fair distribution among the creditors. This agreement typically includes several key elements, including: 1. Parties involved: The agreement identifies the creditors, debtors, and any other relevant parties involved in the agreement. 2. Financial obligations: It outlines the debtors' financial obligations, including the outstanding debts, due dates, and payment terms. 3. Appointment of Receiver: The agreement defines the process and criteria for appointing a receiver to take control of the debtor's assets and business operations. 4. Receiver's powers and responsibilities: It specifies the receiver's authority to manage, sell, or liquidate the debtor's assets, collect outstanding debts, and distribute proceeds among the creditors. 5. Duties of the parties: The document outlines the responsibilities and obligations of each party, including providing necessary information, cooperation, and access to relevant records. 6. Confidentiality: It may include provisions to maintain confidentiality regarding the receiver's actions, financial information, and other sensitive matters. 7. Dispute resolution: The agreement may include a clause specifying the mechanism for resolving any disputes that may arise during the execution of the agreement, such as mediation or arbitration. There could be different types or variations of San Antonio Texas Agreement between Creditors and Debtor for the Appointment of Receiver based on specific circumstances. Some potential variations include: 1. Voluntary Agreement: This type of agreement is entered into willingly by both the debtors and creditors when they anticipate financial distress or insolvency. It allows them to jointly appoint a receiver to protect their interests and facilitate a smooth resolution process. 2. Involuntary Agreement: In certain cases, creditors may initiate legal proceedings to obtain a court order for the appointment of a receiver. This type of agreement is enforced by the court upon finding the debtor unable to fulfill its financial obligations. 3. Post-Judgment Agreement: This agreement may occur after a judgment has been obtained against the debtor. It outlines the terms for the appointment of a receiver to enforce the judgment and collect the outstanding debt. 4. Specific Purpose Agreement: In some instances, creditors and debtors may enter into an agreement to appoint a receiver for a particular purpose, such as managing specific assets or projects to maximize their value and protect the creditors' interests. In conclusion, San Antonio Texas Agreement between Creditors and Debtor for Appointment of Receiver is a crucial legal document that helps establish a fair and structured framework for managing financial distress or insolvency situations. The specific type and terms of this agreement may vary depending on the circumstances and parties involved.