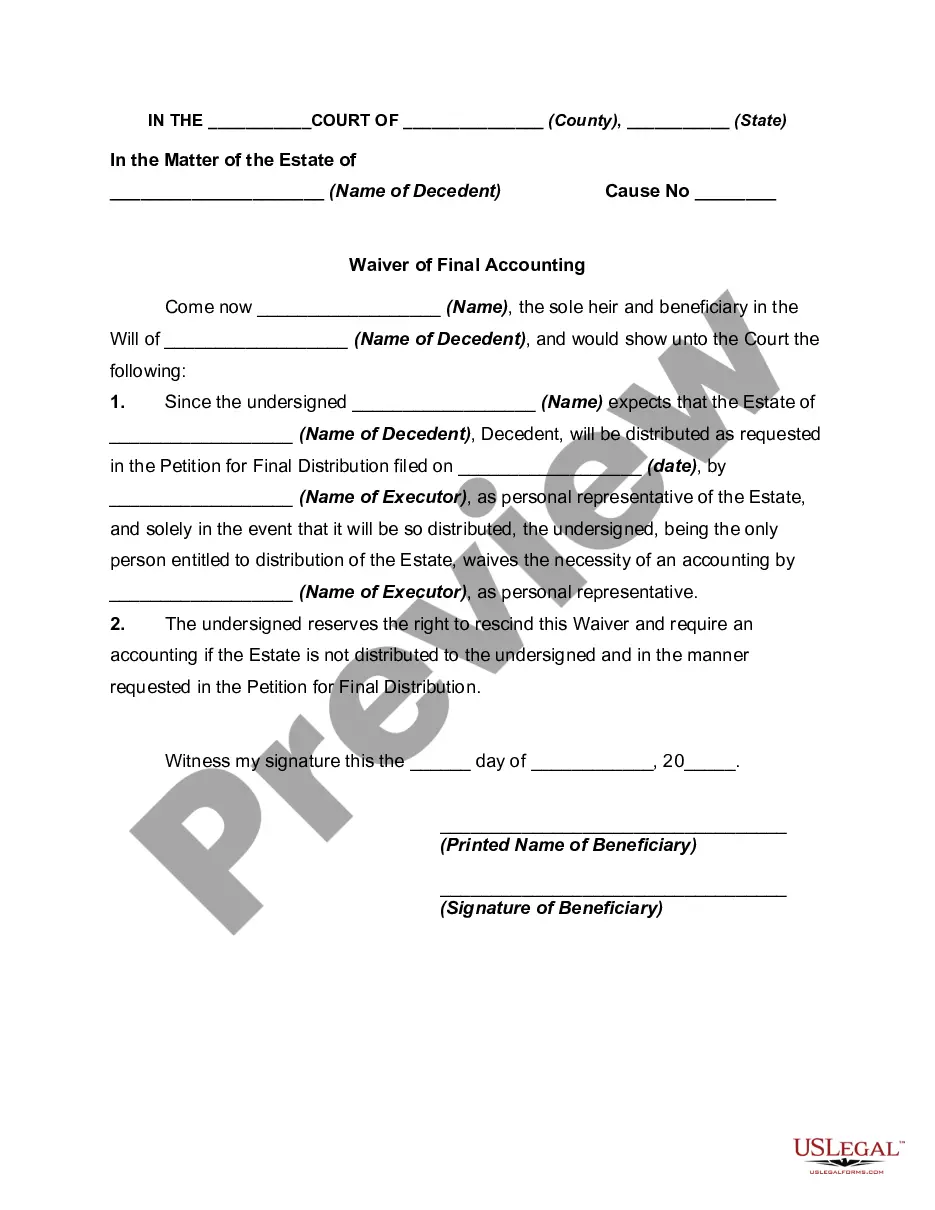

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

Fulton Georgia Waiver of Final Accounting by Sole Beneficiary: A Comprehensive Guide Keywords: Fulton Georgia, waiver of final accounting, sole beneficiary, types. Introduction: In Fulton County, Georgia, the waiver of final accounting by the sole beneficiary is a legal document that releases the executor or personal representative from the obligation of filing a final accounting. This waiver is typically signed by a sole beneficiary, who is the sole recipient of an estate or trust. By waiving the final accounting, the beneficiary acknowledges that they have received all assets due to them and releases the executor from further duty to provide an accounting of the estate. Types of Fulton Georgia Waiver of Final Accounting by Sole Beneficiary: 1. Simple or General Waiver: The simple or general waiver is the most common type of Fulton Georgia waiver of final accounting. It is a straightforward document where the sole beneficiary simply states that they acknowledge receipt of all assets and waive the requirement of a final accounting. This waiver is relatively simple and does not require extensive legal language. 2. Conditional Waiver: A conditional waiver is a type of waiver that is executed by the sole beneficiary with specific conditions attached. These conditions may include stipulations such as the executor providing a summary of assets or an informal accounting. The execution of a conditional waiver grants the executor the ability to fulfill these conditions while still being released from the obligation of a formal final accounting. 3. Limited Waiver: A limited waiver is a specific type of Fulton Georgia waiver of final accounting where the sole beneficiary waives the final accounting for certain aspects of the estate. This waiver may apply to specific assets or specific periods within the administration of the estate. The limited waiver allows the sole beneficiary to waive their right to a final accounting for those particular assets or periods, while still maintaining the right for others. 4. Partial Waiver: A partial waiver is another variation of Fulton Georgia waiver of final accounting, where the sole beneficiary waives the requirement of a full and comprehensive final accounting and agrees to accept a partial accounting instead. This type of waiver is often utilized when there are complex assets or circumstances that make a complete accounting challenging or impractical. The partial waiver enables the executor to provide a limited accounting, focusing on specific assets or transactions rather than the entire estate. Conclusion: The Fulton Georgia waiver of final accounting by sole beneficiary is a legal document that offers flexibility to both the sole beneficiary and the executor in the administration of an estate or trust. By understanding the different types of waivers available, the sole beneficiary can make informed decisions regarding the level of accounting required, keeping in mind their rights and obligations under the law. It is essential to consult with an attorney specializing in estate or trust matters to ensure compliance with Fulton Georgia rules and regulations when executing a waiver of final accounting.Fulton Georgia Waiver of Final Accounting by Sole Beneficiary: A Comprehensive Guide Keywords: Fulton Georgia, waiver of final accounting, sole beneficiary, types. Introduction: In Fulton County, Georgia, the waiver of final accounting by the sole beneficiary is a legal document that releases the executor or personal representative from the obligation of filing a final accounting. This waiver is typically signed by a sole beneficiary, who is the sole recipient of an estate or trust. By waiving the final accounting, the beneficiary acknowledges that they have received all assets due to them and releases the executor from further duty to provide an accounting of the estate. Types of Fulton Georgia Waiver of Final Accounting by Sole Beneficiary: 1. Simple or General Waiver: The simple or general waiver is the most common type of Fulton Georgia waiver of final accounting. It is a straightforward document where the sole beneficiary simply states that they acknowledge receipt of all assets and waive the requirement of a final accounting. This waiver is relatively simple and does not require extensive legal language. 2. Conditional Waiver: A conditional waiver is a type of waiver that is executed by the sole beneficiary with specific conditions attached. These conditions may include stipulations such as the executor providing a summary of assets or an informal accounting. The execution of a conditional waiver grants the executor the ability to fulfill these conditions while still being released from the obligation of a formal final accounting. 3. Limited Waiver: A limited waiver is a specific type of Fulton Georgia waiver of final accounting where the sole beneficiary waives the final accounting for certain aspects of the estate. This waiver may apply to specific assets or specific periods within the administration of the estate. The limited waiver allows the sole beneficiary to waive their right to a final accounting for those particular assets or periods, while still maintaining the right for others. 4. Partial Waiver: A partial waiver is another variation of Fulton Georgia waiver of final accounting, where the sole beneficiary waives the requirement of a full and comprehensive final accounting and agrees to accept a partial accounting instead. This type of waiver is often utilized when there are complex assets or circumstances that make a complete accounting challenging or impractical. The partial waiver enables the executor to provide a limited accounting, focusing on specific assets or transactions rather than the entire estate. Conclusion: The Fulton Georgia waiver of final accounting by sole beneficiary is a legal document that offers flexibility to both the sole beneficiary and the executor in the administration of an estate or trust. By understanding the different types of waivers available, the sole beneficiary can make informed decisions regarding the level of accounting required, keeping in mind their rights and obligations under the law. It is essential to consult with an attorney specializing in estate or trust matters to ensure compliance with Fulton Georgia rules and regulations when executing a waiver of final accounting.