In some states, a seller is required to disclose known facts that materially affect the value of the property that are not known and readily observable to the buyer. The Seller is required to disclose to a buyer all known facts that materially affect the value of the property which are not readily observable and are not known to the buyer. That disclosure requirement exists whether or not the seller occupied the property. A Vacant Land Disclosure Statement specifically designed for the disclosure of facts related to vacant land is used in such states.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

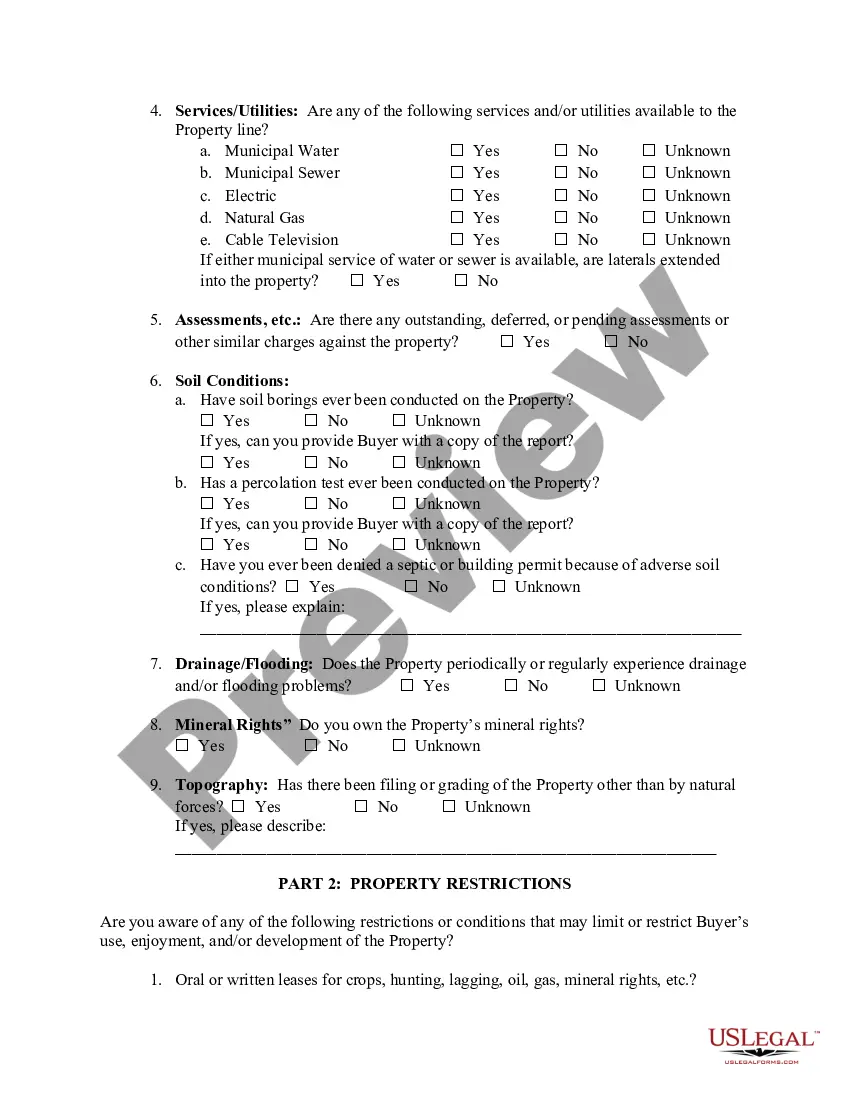

Collin Texas Seller's Disclosure Statement for Vacant Land is an essential document used in real estate transactions to provide transparency between sellers and potential buyers. This disclosure form is specifically designed for vacant land properties within Collin County, Texas. The purpose of this disclosure statement is to inform potential buyers about any known issues or defects relating to the vacant land being sold. It aims to protect buyers from purchasing land with hidden problems while ensuring sellers are honest and forthcoming about the condition of their property. The Collin Texas Seller's Disclosure Statement for Vacant Land typically covers various aspects of the land, such as: 1. Legal Description: This section provides a detailed description of the vacant land, including its boundaries, lot number, and any relevant survey information. 2. Utilities and Services: Sellers must disclose information regarding utilities and services available on the land, such as water, sewer, electricity, gas, telephone, and internet service providers. Any limitations or restrictions on these services should be clearly stated. 3. Environmental Conditions: This part of the disclosure statement requires sellers to disclose any environmental conditions or hazards on the property, such as flood zones, wetlands, radon, soil contamination, or previous uses that may have caused pollution. 4. Easements and Right-of-Ways: Sellers must disclose if there are any existing easements or right-of-ways that affect the vacant land. This includes details of utility easements, access rights, road expansions, or encroachments on neighboring properties. 5. Zoning and Restrictions: Buyers need to know the zoning regulations and any restrictions imposed on the land. Sellers must disclose if the land is zoned for residential, commercial, agricultural, or any other specific purposes. Additionally, any homeowner association (HOA) rules or restrictions should be specified. 6. Tax and Special Assessments: Sellers are required to disclose any outstanding taxes, assessments, or liens against the property. This includes information on property taxes, special district assessments, or pending tax assessments. It is important to note that while the above information covers the general aspects, specific details covered in the Collin Texas Seller's Disclosure Statement for Vacant Land may vary depending on the real estate agency or legal requirements. Different types or versions of this disclosure statement may exist, but the general purpose remains the same — to provide transparency and protect both sellers and buyers in real estate transactions involving vacant land within Collin County, Texas.Collin Texas Seller's Disclosure Statement for Vacant Land is an essential document used in real estate transactions to provide transparency between sellers and potential buyers. This disclosure form is specifically designed for vacant land properties within Collin County, Texas. The purpose of this disclosure statement is to inform potential buyers about any known issues or defects relating to the vacant land being sold. It aims to protect buyers from purchasing land with hidden problems while ensuring sellers are honest and forthcoming about the condition of their property. The Collin Texas Seller's Disclosure Statement for Vacant Land typically covers various aspects of the land, such as: 1. Legal Description: This section provides a detailed description of the vacant land, including its boundaries, lot number, and any relevant survey information. 2. Utilities and Services: Sellers must disclose information regarding utilities and services available on the land, such as water, sewer, electricity, gas, telephone, and internet service providers. Any limitations or restrictions on these services should be clearly stated. 3. Environmental Conditions: This part of the disclosure statement requires sellers to disclose any environmental conditions or hazards on the property, such as flood zones, wetlands, radon, soil contamination, or previous uses that may have caused pollution. 4. Easements and Right-of-Ways: Sellers must disclose if there are any existing easements or right-of-ways that affect the vacant land. This includes details of utility easements, access rights, road expansions, or encroachments on neighboring properties. 5. Zoning and Restrictions: Buyers need to know the zoning regulations and any restrictions imposed on the land. Sellers must disclose if the land is zoned for residential, commercial, agricultural, or any other specific purposes. Additionally, any homeowner association (HOA) rules or restrictions should be specified. 6. Tax and Special Assessments: Sellers are required to disclose any outstanding taxes, assessments, or liens against the property. This includes information on property taxes, special district assessments, or pending tax assessments. It is important to note that while the above information covers the general aspects, specific details covered in the Collin Texas Seller's Disclosure Statement for Vacant Land may vary depending on the real estate agency or legal requirements. Different types or versions of this disclosure statement may exist, but the general purpose remains the same — to provide transparency and protect both sellers and buyers in real estate transactions involving vacant land within Collin County, Texas.