Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

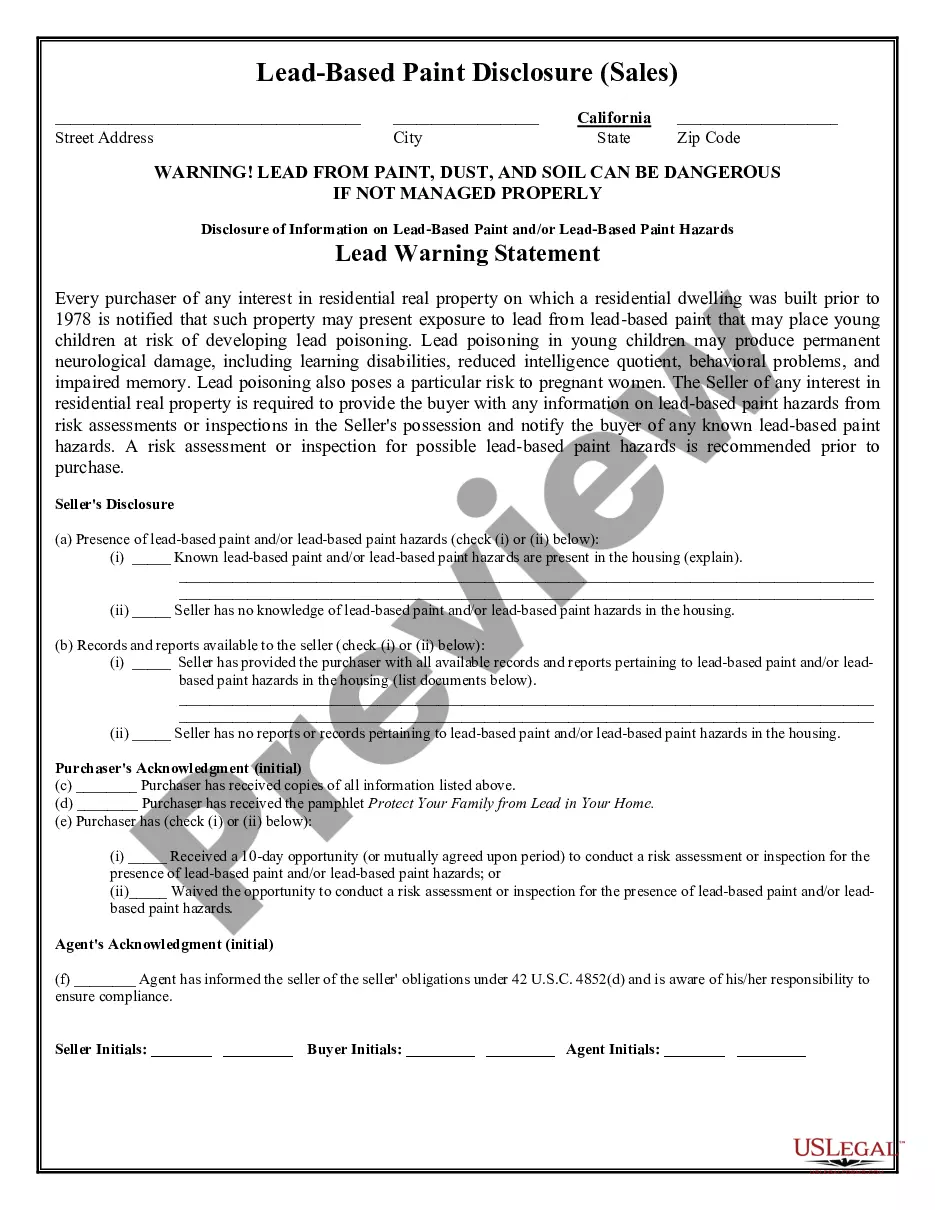

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Dallas Texas Revenue Sharing Agreement is a legal document that outlines the financial arrangement between the City of Dallas and various entities, organizations, or individuals involved in revenue-generating projects or partnerships within the city. This agreement is designed to ensure a fair and equitable distribution of revenue generated from these projects that directly contribute to the growth and development of Dallas. Under this Revenue Sharing Agreement, the City of Dallas enters into partnerships with different entities, including private businesses, non-profit organizations, or even other government agencies. The agreement typically specifies the terms and conditions of revenue sharing, including the percentage of revenue that each party is entitled to receive. One type of Dallas Texas Revenue Sharing Agreement is the Public-Private Partnership (PPP). PPP involve collaboration between a private entity and the City of Dallas to develop, operate, or manage a specific project or facility such as infrastructure development, transportation systems, or public amenities. The revenue sharing component in a PPP determines how the generated revenue from the project will be divided between the private entity and the city. Another type of Revenue Sharing Agreement in Dallas Texas includes agreements with non-profit organizations. These agreements are typically aimed at supporting cultural, educational, or charitable initiatives within the city. The revenue generated through fundraising efforts or events is shared between the non-profit organization and the city, helping to fund various community programs and initiatives. Furthermore, Dallas Texas Revenue Sharing Agreements can also be established between the City of Dallas and other government entities, such as neighboring municipalities or state agencies. These agreements enable cooperative efforts to generate revenue through joint projects or initiatives, which are then shared between the involved parties proportionally or as mutually agreed. Keywords: Dallas Texas, Revenue Sharing Agreement, City of Dallas, financial arrangement, fair and equitable, revenue-generating projects, partnerships, growth and development, private businesses, non-profit organizations, government agencies, terms and conditions, percentage, Public-Private Partnership, infrastructure development, transportation systems, public amenities, collaboration, non-profit initiatives, fundraising efforts, community programs, charitable, neighboring municipalities, state agencies, cooperative efforts, joint projects, proportionally.Dallas Texas Revenue Sharing Agreement is a legal document that outlines the financial arrangement between the City of Dallas and various entities, organizations, or individuals involved in revenue-generating projects or partnerships within the city. This agreement is designed to ensure a fair and equitable distribution of revenue generated from these projects that directly contribute to the growth and development of Dallas. Under this Revenue Sharing Agreement, the City of Dallas enters into partnerships with different entities, including private businesses, non-profit organizations, or even other government agencies. The agreement typically specifies the terms and conditions of revenue sharing, including the percentage of revenue that each party is entitled to receive. One type of Dallas Texas Revenue Sharing Agreement is the Public-Private Partnership (PPP). PPP involve collaboration between a private entity and the City of Dallas to develop, operate, or manage a specific project or facility such as infrastructure development, transportation systems, or public amenities. The revenue sharing component in a PPP determines how the generated revenue from the project will be divided between the private entity and the city. Another type of Revenue Sharing Agreement in Dallas Texas includes agreements with non-profit organizations. These agreements are typically aimed at supporting cultural, educational, or charitable initiatives within the city. The revenue generated through fundraising efforts or events is shared between the non-profit organization and the city, helping to fund various community programs and initiatives. Furthermore, Dallas Texas Revenue Sharing Agreements can also be established between the City of Dallas and other government entities, such as neighboring municipalities or state agencies. These agreements enable cooperative efforts to generate revenue through joint projects or initiatives, which are then shared between the involved parties proportionally or as mutually agreed. Keywords: Dallas Texas, Revenue Sharing Agreement, City of Dallas, financial arrangement, fair and equitable, revenue-generating projects, partnerships, growth and development, private businesses, non-profit organizations, government agencies, terms and conditions, percentage, Public-Private Partnership, infrastructure development, transportation systems, public amenities, collaboration, non-profit initiatives, fundraising efforts, community programs, charitable, neighboring municipalities, state agencies, cooperative efforts, joint projects, proportionally.