Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

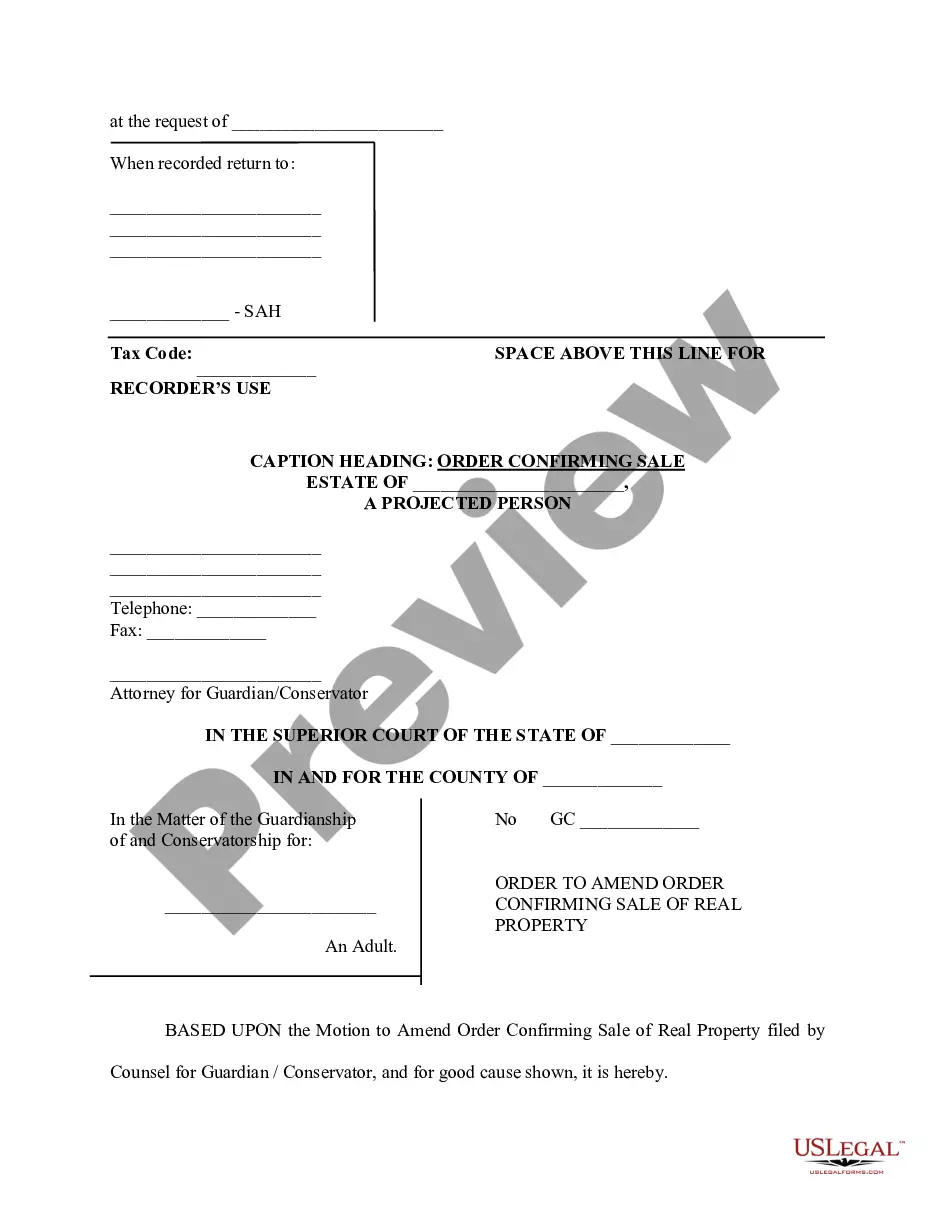

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Harris Texas Revenue Sharing Agreement is a financial arrangement established between the Harris County government and other entities within the county to allocate funds and resources in a mutually beneficial manner. This agreement aims to distribute revenue and resources fairly and transparently, ensuring a sustainable and prosperous economic development for all stakeholders involved. One notable type of Harris Texas Revenue Sharing Agreement is the Municipal Revenue Sharing Agreement. This agreement is specific to municipalities within Harris County, outlining the terms and conditions for revenue allocation among cities, towns, and villages. It determines how certain tax revenues, such as sales tax, property tax, or local government funds, will be shared among the municipalities based on predetermined formulas or agreed-upon percentages. Another type of Harris Texas Revenue Sharing Agreement is the School District Revenue Sharing Agreement. This agreement pertains to the distribution of revenue and resources among different school districts operating within Harris County. It ensures that funding is allocated fairly among the districts, taking into account factors such as student population, district size, and specific educational needs. This agreement promotes educational equity and enhances the quality of education across the county. The County Revenue Sharing Agreement is yet another type of Harris Texas Revenue Sharing Agreement. It primarily focuses on revenue sharing between the Harris County government and other entities operating within the county, such as special districts, municipal utility districts, or county services. It establishes a framework for the distribution of taxes, fees, and other revenue sources, ensuring that the funds are distributed equitably, considering factors like population, infrastructure needs, and service demands. Furthermore, there might also be specific agreements related to revenue sharing in areas such as transportation, healthcare, or public safety within Harris County. These agreements aim to foster collaboration, resource sharing, and financial support among respective entities, ultimately enhancing the overall quality of life and services in the region. In conclusion, the Harris Texas Revenue Sharing Agreement serves as a vital mechanism for coordinating revenue and resource allocation among various entities within Harris County. By encompassing different types of agreements like the Municipal, School District, County, and sector-specific agreements, this framework ensures a fair and effective distribution of funds, facilitating economic growth, and enhancing public services throughout the county.The Harris Texas Revenue Sharing Agreement is a financial arrangement established between the Harris County government and other entities within the county to allocate funds and resources in a mutually beneficial manner. This agreement aims to distribute revenue and resources fairly and transparently, ensuring a sustainable and prosperous economic development for all stakeholders involved. One notable type of Harris Texas Revenue Sharing Agreement is the Municipal Revenue Sharing Agreement. This agreement is specific to municipalities within Harris County, outlining the terms and conditions for revenue allocation among cities, towns, and villages. It determines how certain tax revenues, such as sales tax, property tax, or local government funds, will be shared among the municipalities based on predetermined formulas or agreed-upon percentages. Another type of Harris Texas Revenue Sharing Agreement is the School District Revenue Sharing Agreement. This agreement pertains to the distribution of revenue and resources among different school districts operating within Harris County. It ensures that funding is allocated fairly among the districts, taking into account factors such as student population, district size, and specific educational needs. This agreement promotes educational equity and enhances the quality of education across the county. The County Revenue Sharing Agreement is yet another type of Harris Texas Revenue Sharing Agreement. It primarily focuses on revenue sharing between the Harris County government and other entities operating within the county, such as special districts, municipal utility districts, or county services. It establishes a framework for the distribution of taxes, fees, and other revenue sources, ensuring that the funds are distributed equitably, considering factors like population, infrastructure needs, and service demands. Furthermore, there might also be specific agreements related to revenue sharing in areas such as transportation, healthcare, or public safety within Harris County. These agreements aim to foster collaboration, resource sharing, and financial support among respective entities, ultimately enhancing the overall quality of life and services in the region. In conclusion, the Harris Texas Revenue Sharing Agreement serves as a vital mechanism for coordinating revenue and resource allocation among various entities within Harris County. By encompassing different types of agreements like the Municipal, School District, County, and sector-specific agreements, this framework ensures a fair and effective distribution of funds, facilitating economic growth, and enhancing public services throughout the county.