Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

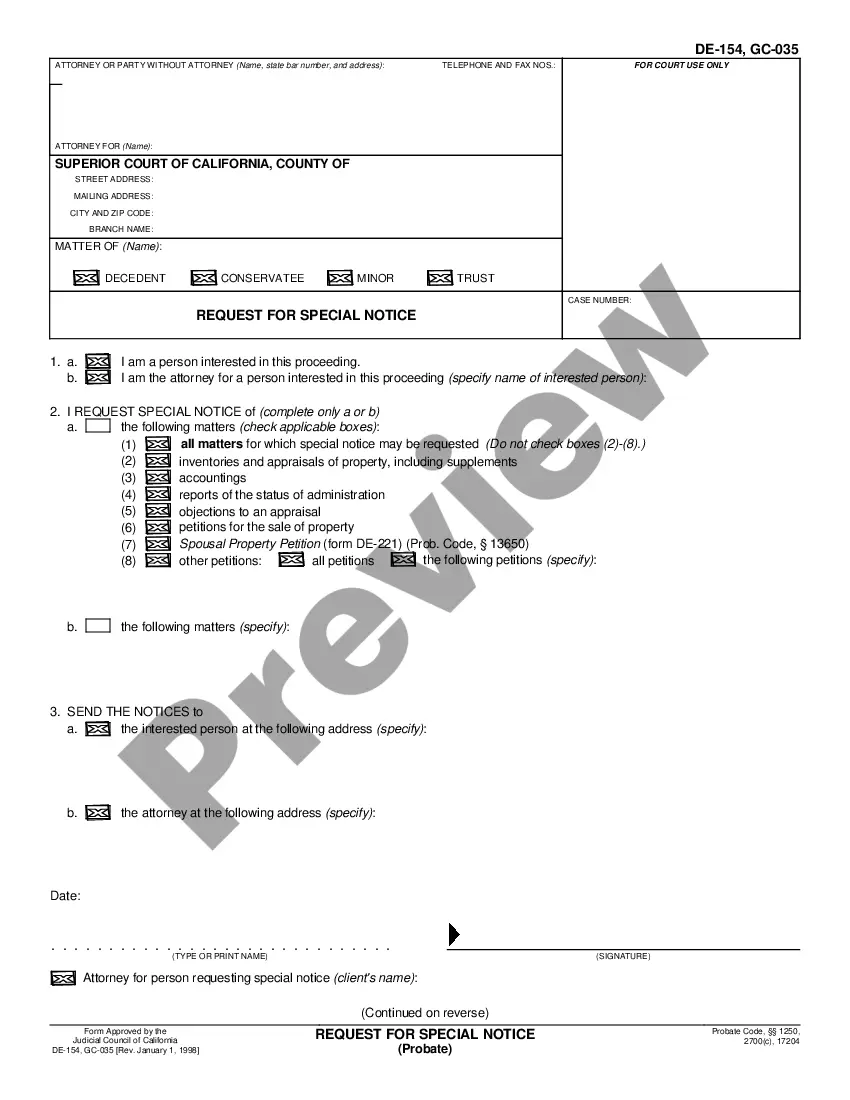

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Salt Lake Utah Revenue Sharing Agreement is a legally binding contract between the Salt Lake County and its constituent municipalities in Utah that outlines the distribution and allocation of revenues generated through various sources. This agreement ensures a fair and equitable sharing of resources among the participating entities. The main objective of the Salt Lake Utah Revenue Sharing Agreement is to foster cooperation and collaboration between the county and its municipalities to support economic development, fund essential public services, and promote overall growth throughout the region. The agreement typically covers multiple revenue streams, including but not limited to: 1. Sales and use tax: This revenue source is crucial as it allows the county and its municipalities to collect a percentage of the sales taxes imposed on goods and services purchased within their jurisdictions. The revenue sharing agreement determines how this revenue is distributed among the participating entities based on factors like population, economic activity, and other predetermined criteria. 2. Property tax: Property tax revenues generated from residential, commercial, and industrial properties within the county and its municipalities are also included in the revenue sharing agreement. The agreement specifies how this revenue is shared among the entities, taking into account factors such as property value, tax rates, and administrative costs. 3. Grants and federal funding: Salt Lake County and its municipalities may receive grants and federal funds for various projects and initiatives. A revenue sharing agreement can outline how these funds will be distributed among the participating entities, providing guidelines on eligibility, allocation methods, and reporting requirements. 4. User fees: Revenue generated from user fees, such as those collected from parking, recreational facilities, or permits, can also be included in the agreement. It outlines how these fees will be divided among the entities, ensuring a fair distribution based on usage and other relevant factors. It is important to note that there may be multiple types of revenue sharing agreements specific to Salt Lake Utah. These agreements can vary depending on the participating entities, the specific revenue sources included, and the distribution criteria established. Examples of different types of revenue sharing agreements in Salt Lake Utah could include intergovernmental agreements, regional agreements, or joint-funding agreements, among others. Overall, the Salt Lake Utah Revenue Sharing Agreement plays a pivotal role in ensuring transparency, promoting collaboration, and maintaining a balanced distribution of revenues among the county and its municipalities, thereby fostering sustainable economic growth and development in the region.Salt Lake Utah Revenue Sharing Agreement is a legally binding contract between the Salt Lake County and its constituent municipalities in Utah that outlines the distribution and allocation of revenues generated through various sources. This agreement ensures a fair and equitable sharing of resources among the participating entities. The main objective of the Salt Lake Utah Revenue Sharing Agreement is to foster cooperation and collaboration between the county and its municipalities to support economic development, fund essential public services, and promote overall growth throughout the region. The agreement typically covers multiple revenue streams, including but not limited to: 1. Sales and use tax: This revenue source is crucial as it allows the county and its municipalities to collect a percentage of the sales taxes imposed on goods and services purchased within their jurisdictions. The revenue sharing agreement determines how this revenue is distributed among the participating entities based on factors like population, economic activity, and other predetermined criteria. 2. Property tax: Property tax revenues generated from residential, commercial, and industrial properties within the county and its municipalities are also included in the revenue sharing agreement. The agreement specifies how this revenue is shared among the entities, taking into account factors such as property value, tax rates, and administrative costs. 3. Grants and federal funding: Salt Lake County and its municipalities may receive grants and federal funds for various projects and initiatives. A revenue sharing agreement can outline how these funds will be distributed among the participating entities, providing guidelines on eligibility, allocation methods, and reporting requirements. 4. User fees: Revenue generated from user fees, such as those collected from parking, recreational facilities, or permits, can also be included in the agreement. It outlines how these fees will be divided among the entities, ensuring a fair distribution based on usage and other relevant factors. It is important to note that there may be multiple types of revenue sharing agreements specific to Salt Lake Utah. These agreements can vary depending on the participating entities, the specific revenue sources included, and the distribution criteria established. Examples of different types of revenue sharing agreements in Salt Lake Utah could include intergovernmental agreements, regional agreements, or joint-funding agreements, among others. Overall, the Salt Lake Utah Revenue Sharing Agreement plays a pivotal role in ensuring transparency, promoting collaboration, and maintaining a balanced distribution of revenues among the county and its municipalities, thereby fostering sustainable economic growth and development in the region.