Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

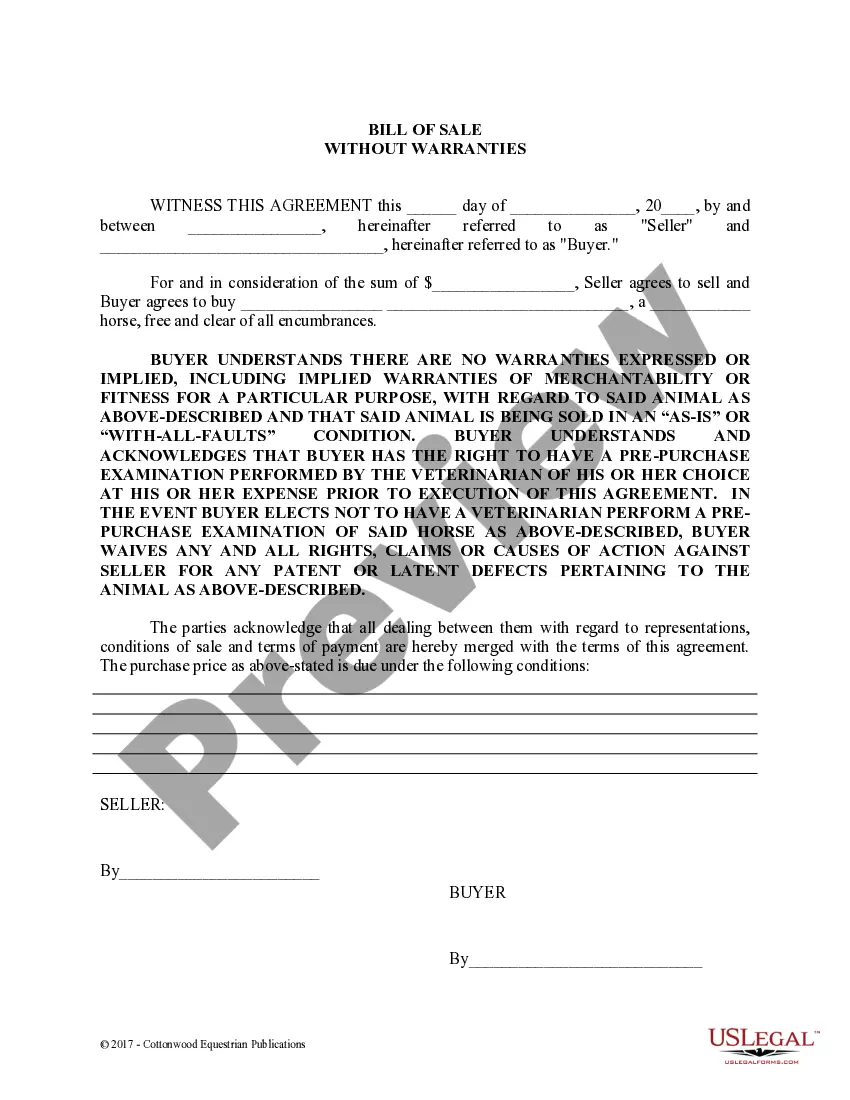

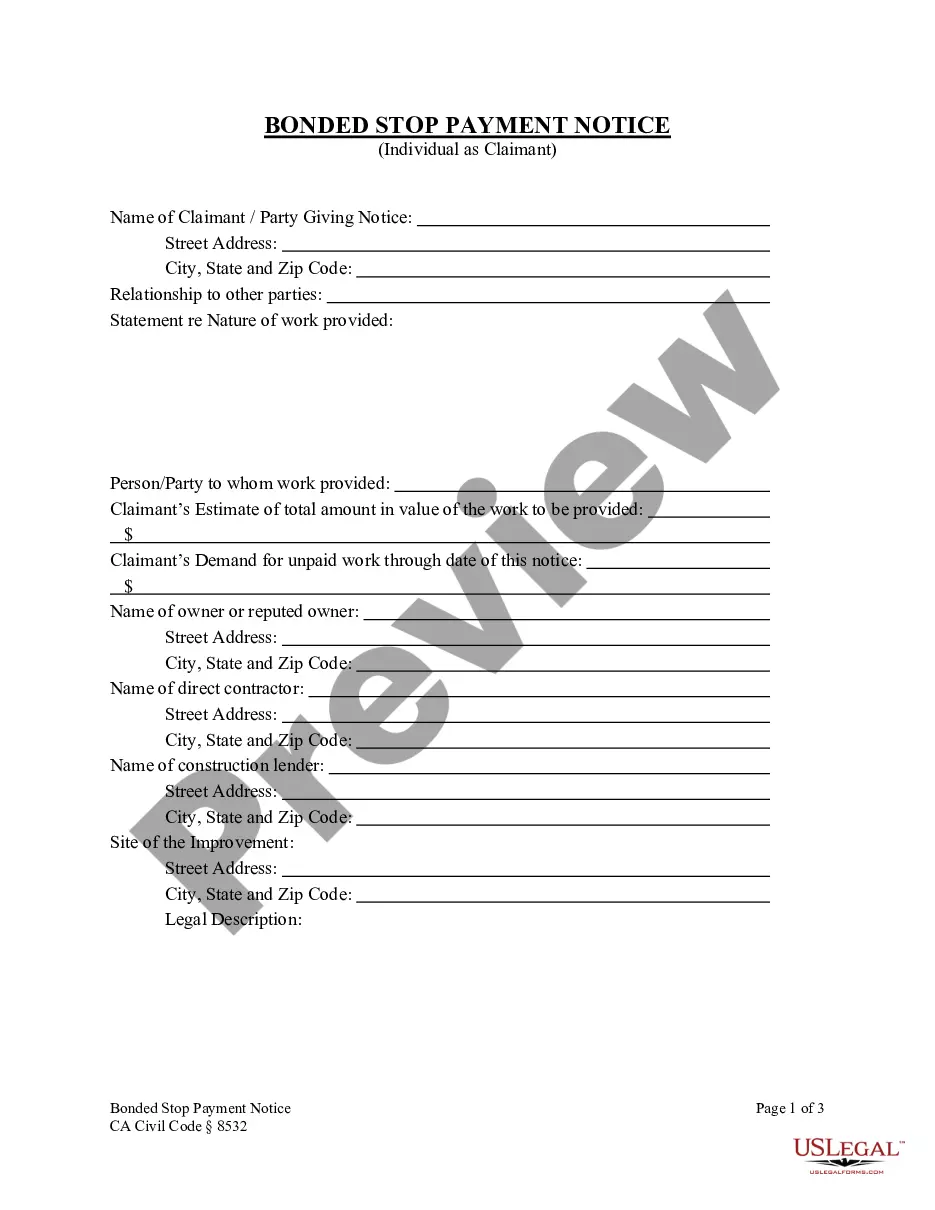

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Diego California Revenue Sharing Agreement refers to a fiscal agreement between the city of San Diego, California, and other entities, aimed at distributing revenue generated from various sources. This agreement is a crucial financial tool that fosters collaboration and equitable distribution of funds among involved parties. The San Diego California Revenue Sharing Agreement is designed to ensure fair allocation of financial resources derived from taxes, fees, investments, or any other revenue streams. It serves as a framework for distributing the generated funds based on predefined criteria, such as population size, economic indicators, or specific project participation. There are different types of San Diego California Revenue Sharing Agreements that cater to various circumstances and collaborations: 1. Municipal Revenue Sharing Agreement: This agreement is executed between the City of San Diego and its municipal counterparts within the region. It aims to promote harmony and cooperation in utilizing revenue earned collectively to benefit the broader community. 2. County Revenue Sharing Agreement: San Diego County Revenue Sharing Agreement focuses on revenue distribution among the various cities and unincorporated areas within the county's jurisdiction. It facilitates the equitable allocation of funds generated within the county to enhance regional welfare and development. 3. Public-Private Revenue Sharing Agreement: This type of agreement involves collaboration between the City of San Diego and private entities. It outlines the sharing of revenue generated through joint projects, such as public infrastructure development, tourism initiatives, or public-private partnerships (PPP). 4. State-City Revenue Sharing Agreement: This agreement involves sharing revenue between the state government of California and the City of San Diego. It ensures the city receives a fair portion of state-generated revenue for its operation, public services, and development projects. Key keywords to include: San Diego, California, Revenue Sharing Agreement, fiscal agreement, financial resources, taxes, fees, investments, revenue streams, distribution, collaborative, fair allocation, population size, economic indicators, project participation, municipal, county, public-private, state-city, regional welfare, development, collaboration, private entities, public infrastructure, tourism initiatives, public-private partnerships (PPP).