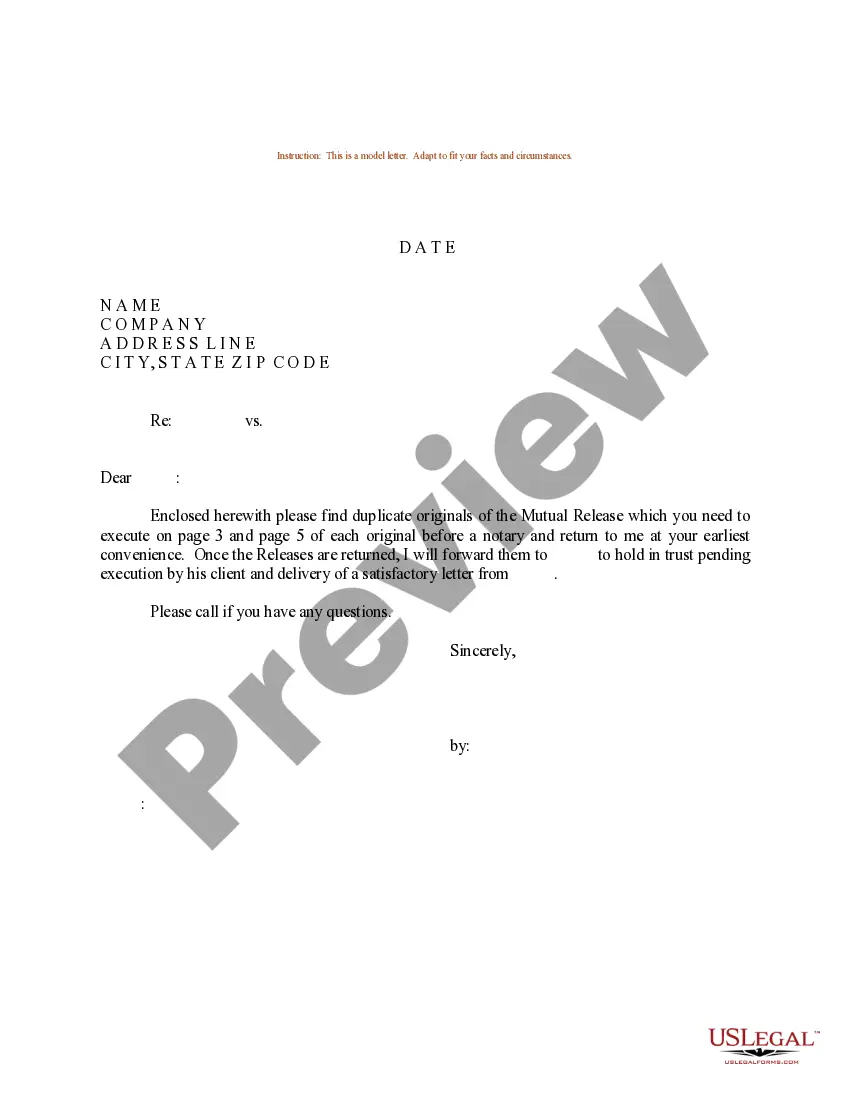

Dear [Executor/Administrator], RE: Assets and Liabilities of Decedent's Estate — Cuyahoga County, Ohio I hope this letter finds you well during this challenging time. As the appointed executor/administrator of the late [Decedent's Full Name]'s estate in Cuyahoga County, Ohio, it is crucial to gather and manage the assets and liabilities associated with the estate. Firstly, it is important to understand the various types of assets and liabilities that may exist within the estate. These can include, but are not limited to: 1. Real Estate: This refers to any property owned by the decedent at the time of their passing. Such properties may include residential homes, commercial buildings, vacant land, or rental properties. It is vital to conduct an accurate appraisal of these real estate holdings to establish their market value. 2. Financial Accounts: These encompass bank accounts, investment portfolios, retirement funds, stocks, and bonds held by the decedent. Gathering information about these accounts, including bank statements, statements of investments, and retirement account details, is crucial to evaluate their worth. 3. Personal Property: This category entails any tangible assets owned by the decedent, such as vehicles, jewelry, artwork, furniture, and personal belongings. A comprehensive inventory of these items, along with their estimated value, should be compiled for an accurate assessment. 4. Business Interests: If the decedent had owned or held shares in any businesses or partnerships, it is essential to identify them and obtain proper documentation. This may include business agreements, stock certificates, and partnership agreements. 5. Debts and Liabilities: It is equally important to identify any outstanding debts or liabilities of the decedent. This could include mortgages, credit card debts, loans, or outstanding tax obligations. Gathering relevant documents, such as loan agreements, credit card statements, and tax records, will help ensure a thorough evaluation of the estate's liabilities. To successfully fulfill your duties, you will need to follow specific procedures in accordance with the laws and regulations of Cuyahoga County, Ohio. It is advisable to consult with a knowledgeable attorney or seek guidance from the Cuyahoga County Probate Court to ensure compliance with legal requirements. Attached to this letter, you will find a checklist detailing all the necessary steps you should follow to properly identify, manage, and distribute the assets and liabilities associated with the decedent's estate. This checklist will provide you with a comprehensive guide and assist you in organizing the process efficiently. Please note that this letter serves as an introductory guide and should not substitute professional legal advice. Each estate is unique, and specific circumstances may require additional actions or considerations. We understand the importance of handling this process with sensitivity and professionalism, and we are committed to assisting you every step of the way. If you need any further guidance or have questions, please do not hesitate to contact our office. Thank you for entrusting us with the responsibility of managing the assets and liabilities of the decedent's estate. We look forward to working with you closely throughout this process. Sincerely, [Your Name] [Your Title/Organization] [Your Contact Information]

Cuyahoga Ohio Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out Cuyahoga Ohio Sample Letter For Assets And Liabilities Of Decedent's Estate?

If you need to get a reliable legal paperwork supplier to obtain the Cuyahoga Sample Letter for Assets and Liabilities of Decedent's Estate, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to locate and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Cuyahoga Sample Letter for Assets and Liabilities of Decedent's Estate, either by a keyword or by the state/county the form is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Cuyahoga Sample Letter for Assets and Liabilities of Decedent's Estate template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Cuyahoga Sample Letter for Assets and Liabilities of Decedent's Estate - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.

Ways an Executor Cannot Override a Beneficiary An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.

To summarize, the executor does not automatically have to disclose accounting to beneficiaries. However, if the beneficiaries request this information from the executor, it is the executor's responsibility to provide it. In most cases, the executor will provide informal accounting to the beneficiaries.

If the executor has distributed the estate without the beneficiary having approved the accounts then they will be personally liable for any loss suffered by the beneficiary. However it is not always possible to get beneficiaries to agree to the proposed distributions.

A letter of probate is a court order that authorizes an executor or administrator to handle the administrative matters of a deceased person's collective estate. Probate refers to the entire process of administering the estates of the deceased, with court supervision.

If the executor or administrator distributes any part of the assets of the estate within three months after the death of the decedent, the executor or administrator shall be personally liable only to those claimants who present their claims within that three-month period.

Claims against the estate may be made up to six months from the date of death. A small estate that does not require the filing of a federal estate tax return and has no creditor issues often can be settled within six months of the appointment of the executor or administrator.

How does the executor's year work? The executors have a number of duties to both creditors and beneficiaries during the administration of the deceased's estate. Starting from the date of death, the executors have 12 months before they have to start distributing the estate.

Generally, only assets that the deceased person owned in his or her name alone go through probate. Everything else can probably be transferred to its new owner without probate court approval.

These can include: Probate Registry (Court) fees. Funeral expenses. Professional valuation services. Clearing and cleaning costs for a property. Legal fees for selling a property. Travel expenses. Postage costs. Settling Inheritance Tax with HMRC.