Subject: Comprehensive Insights into King Washington Sample Letter for Assets and Liabilities of Decedent's Estate Dear [Recipient's Name], We hope this letter finds you well. In response to your query regarding King Washington's Sample Letter for Assets and Liabilities of Decedent's Estate, we are pleased to provide you with a detailed description and guide to navigate this essential undertaking. King Washington offers a range of template letters specifically tailored to help you effectively manage the assets and liabilities of a decedent's estate. These letters can assist you in compiling a comprehensive record of the estate's financial affairs, ensuring a smooth and lawful distribution process. 1. King Washington Sample Letter for Verifying Assets: This type of letter aids in the initial step of confirming the existence and value of various assets within the estate. It generally addresses relevant financial institutions, such as banks, investment agencies, and insurance providers, seeking detailed information on the decedent's accounts, policies, and investments. 2. King Washington Sample Letter for Establishing Debts and Liabilities: This letter proves beneficial when attempting to assess the decedent's outstanding obligations and liabilities. It facilitates communication with creditors, mortgage holders, and relevant agencies capable of providing insight into any existing debts, loans, or unresolved financial commitments. 3. King Washington Sample Letter Requesting Valuation of Estate: This specific template letter assists in acquiring a professional valuation of the decedent's assets, including real estate, securities, businesses, and personal property. Contacting licensed appraisers or experts in their respective fields helps ascertain the accurate worth of these assets for proper distribution among the beneficiaries. 4. King Washington Sample Letter for Notice to Heirs and Beneficiaries: This letter is vital for informing the rightful heirs and beneficiaries about the estate's status, assets, liabilities, and distribution plans. It facilitates transparency and ensures that all interested parties remain informed throughout the entire process, minimizing potential conflicts or misunderstandings. 5. King Washington Sample Letter for Coordinating with Estate Lawyers or Executors: Executors or estate lawyers play a crucial role in managing the asset and liability distribution process. This specialized letter assists in establishing an effective line of communication with these professionals, allowing for seamless collaboration and the timely resolution of legal matters. By utilizing King Washington's Sample Letter for Assets and Liabilities of Decedent's Estate, you can expect to streamline your estate administration duties and ensure that all relevant parties are properly engaged. We sincerely appreciate your interest in King Washington's services and hope that the information provided proves valuable in your estate management journey. If you have any further queries or require additional assistance, please feel free to reach out to our dedicated customer support team. Wishing you a smooth and successful estate administration process. Best regards, [Your Name] [Your Title] [Company Name] [Contact Information]

King Washington Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out King Washington Sample Letter For Assets And Liabilities Of Decedent's Estate?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the King Sample Letter for Assets and Liabilities of Decedent's Estate, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the King Sample Letter for Assets and Liabilities of Decedent's Estate from the My Forms tab.

For new users, it's necessary to make a few more steps to get the King Sample Letter for Assets and Liabilities of Decedent's Estate:

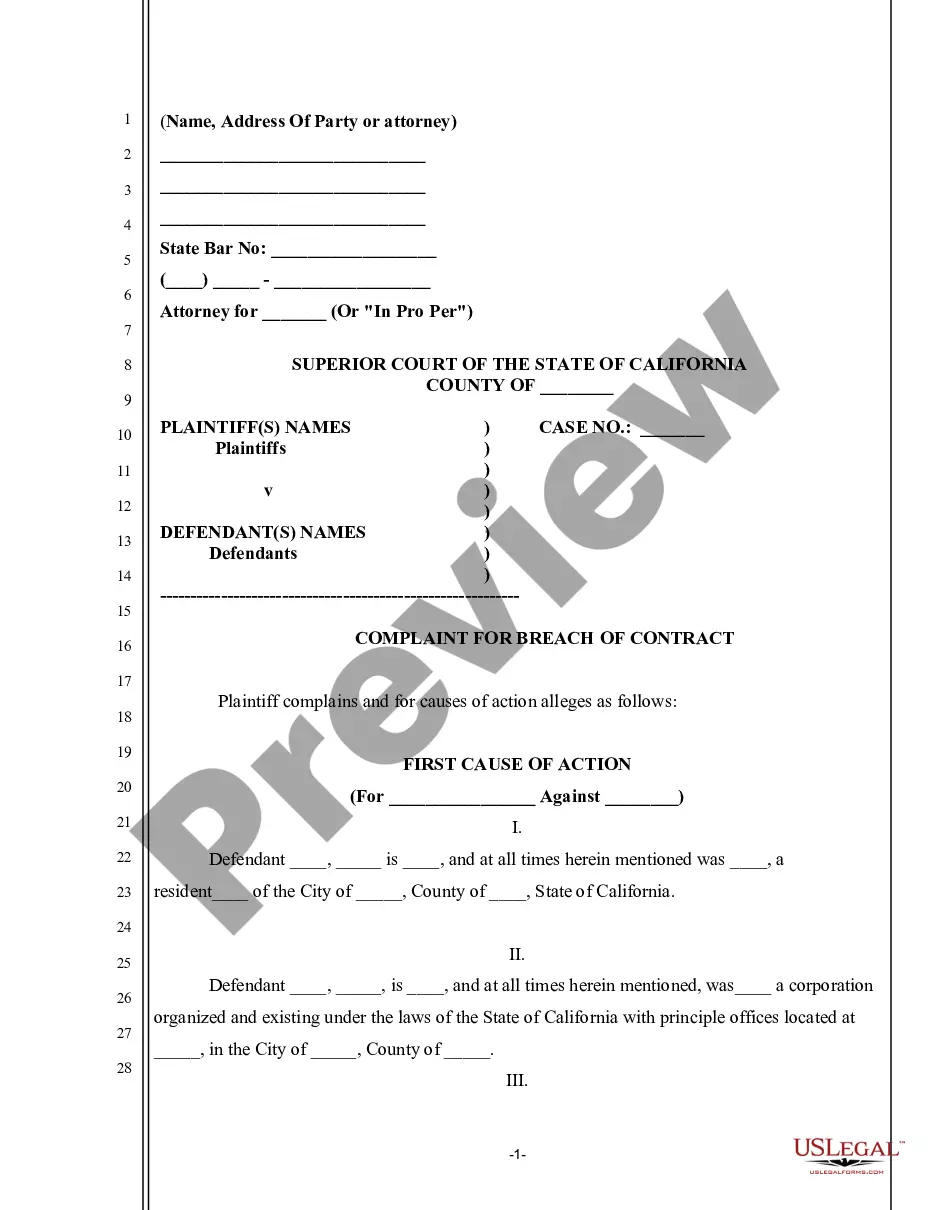

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A letter of probate is a court order that authorizes an executor or administrator to handle the administrative matters of a deceased person's collective estate. Probate refers to the entire process of administering the estates of the deceased, with court supervision.

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

Once the Grant of Probate has been issued, the executor has to keep accounts and have these ready to show beneficiaries if they ask for them.

Do not show any income earned after death as adjustments to inventory. To prepare this schedule, list any and all income earned by the estate after the date of death, such as interest on bank accounts or investments, rental income, and dividends. To prepare this schedule, list the disbursements paid by the estate.

Beneficiaries are entitled to a proper accounting of the estate. The executor must provide proper accounting, in Court format, to beneficiaries in a timely manner.

Debtsones the deceased person incurred while alive, or expenses the estate has after the deathshould be paid for with estate property. For example, if the deceased person left a checking or savings account, the executor should transfer those funds into an estate bank account and use the money to pay bills.

Place your name, address and phone number at the top of the letter, followed by the date, then the name, address and phone number of the individual or agency handling your deceased relative's estate.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth.Describe key players in the family.What matters to you?Give your trustee the power to make decisions, even when that means saying no.

The final accounting is a summary of accounts filed by the probate executor, showing details of important financial undertakings during the accounting period. This form may not outline all the information, but those records are kept for future use.

Yes. Before the executor distributes the estate, they have to give the beneficiaries a final accounting of their administration of the estate, including any fee they're charging. And the beneficiaries must agree with it for the executor to proceed.

More info

Taking care of the decedent's spiritual and religious requirements; and; taking care of the decedent's non-financial and non-religious obligations. 3. Taking care of the decedent's burial expenses, and;4. Transferring all unsecured debts and possessions that were owed to the decedent to the heirs. 5. Taking care of the decedent's funeral expenses, and;6. Any obligation to provide for the minor children. In these circumstances, the “proximate” heir of the decedent as a class is entitled to the portion of the probate estate that is distributed to each of the heirs. To determine the amount of the probate estate distribution, we look to the decedent's will, for example, or the decedent's personal representatives, if they were present at the probate hearing. In these cases, the decedent's personal representatives will give an estimate of the assets left to them by the decedent as the heirs of the decedent. As stated in section 2.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.