Judicial lien is a lien obtained by judgment, levy, sequestration or other legal or equitable process or proceeding. If a court finds that a debtor owes money to a creditor and the judgment remains unsatisfied, the creditor can ask the court to impose a lien on specific property owned and possessed by the debtor. After imposing the lien, the court issues a writ directing the local sheriff to seize the property, sell it and turn over the proceeds to the creditor.

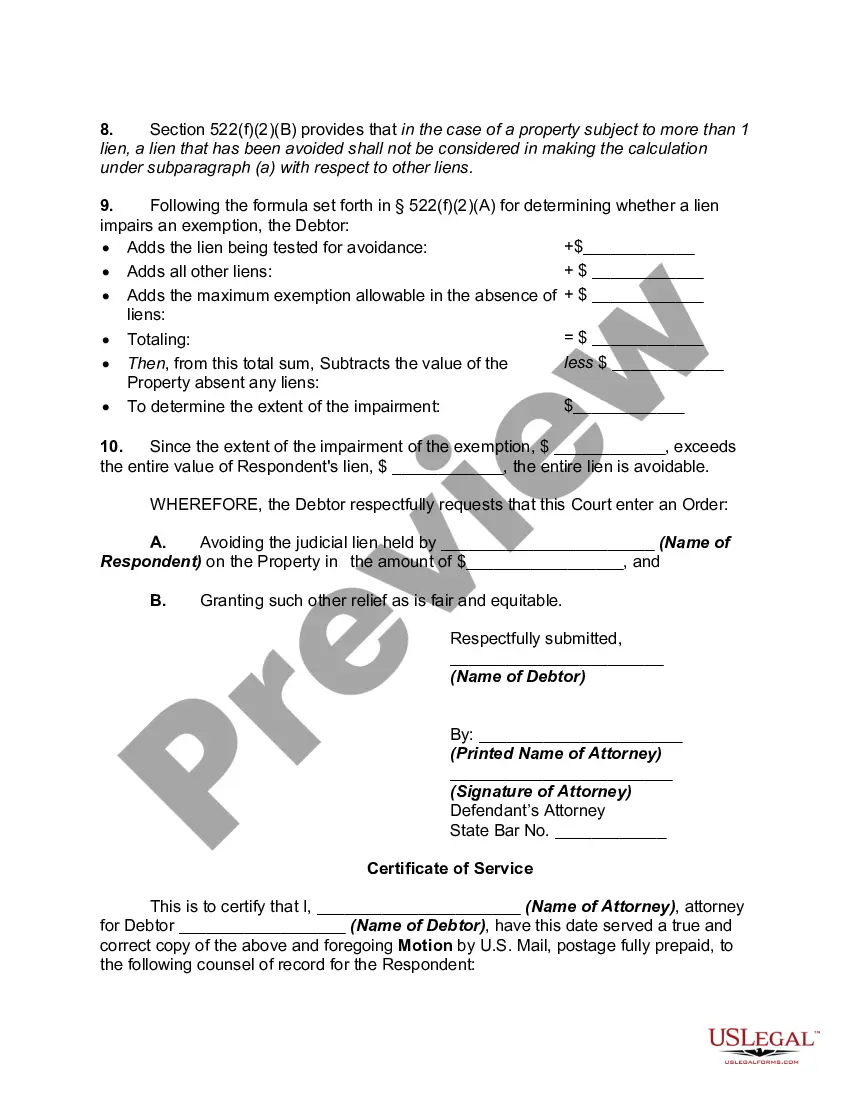

Under Bankruptcy proceedings, a creditor can obtain a judicial lien by filing a final judgment issued against a debtor through a lawsuit filed in state court. A certified copy of a final judgment may be filed in the county in which the debtor owns real property. A bankruptcy debtor can file a motion to avoid Judicial Lien. A Motion to avoid Judicial Lien can be filed by a debtor in either a chapter 7 or chapter 13 bankruptcy proceeding. In a Chapter 7 proceeding, an Order Avoiding Judicial Lien will remove the debt totally.

Collin Texas Motion to Avoid Creditor's Lien: A Comprehensive Overview In Collin County, Texas, a Motion to Avoid Creditor's Lien serves as a legal remedy that debtors can pursue to remove or nullify a creditor's lien on their property. This motion aims to provide relief to individuals struggling with overwhelming debts and protect their assets from being seized or encumbered by creditors. A Creditor's Lien is a legal claim that creditors have on a debtor's property to secure repayment of a debt. However, certain circumstances may allow debtors to avoid or invalidate this lien, safeguarding their property from being utilized as collateral for debt repayment. There are two main types of Collin Texas Motion to Avoid Creditor's Lien, each applicable under specific scenarios: 1. Collin Texas Motion to Avoid Creditor's Lien Under the Bankruptcy Code: — This type of motion is typically filed in conjunction with a Chapter 7 or Chapter 13 bankruptcy, allowing debtors to seek relief from specific liens that impair their exemptions or cause undue hardship. The Bankruptcy Code provisions provide debtors with the opportunity to protect their exempt assets and maintain a fresh start financially. 2. Collin Texas Motion to Avoid Creditor's Lien in Non-Bankruptcy Proceedings: — Independent of bankruptcy proceedings, this motion allows debtors to remove certain liens encumbering their property. This type of motion can be pursued by individuals who are not seeking bankruptcy protection but still face financial hardship and wish to protect their assets. In both scenarios, debtors are required to satisfy specific legal criteria to successfully obtain a Motion to Avoid Creditor's Lien. These criteria may include demonstrating that the lien impairs an exemption, causes an undue hardship, or lacks legal validity due to technical errors in its creation or recording. To initiate the process, debtors must file a motion with the appropriate Collin County court and provide supporting documentation, such as a detailed affidavit outlining the legal basis for avoiding the lien, evidence of the debtor's financial circumstances, and any relevant property valuation or exemption information. Once filed, the motion will be reviewed by the court, and if approved, a formal order will be issued, avoiding the creditor's lien and potentially releasing the affected property from any claim or attachment. This order ensures that the debtor can retain the exempt property despite their outstanding debts. It is crucial for individuals considering a Collin Texas Motion to Avoid Creditor's Lien to consult with legal professionals well-versed in debtor rights, bankruptcy laws, and property exemptions. These experts can provide guidance and representation throughout the process, increasing the likelihood of a successful motion and protection of the debtor's assets. Overall, a Collin Texas Motion to Avoid Creditor's Lien offers vital legal protection for individuals facing financial difficulties.Collin Texas Motion to Avoid Creditor's Lien: A Comprehensive Overview In Collin County, Texas, a Motion to Avoid Creditor's Lien serves as a legal remedy that debtors can pursue to remove or nullify a creditor's lien on their property. This motion aims to provide relief to individuals struggling with overwhelming debts and protect their assets from being seized or encumbered by creditors. A Creditor's Lien is a legal claim that creditors have on a debtor's property to secure repayment of a debt. However, certain circumstances may allow debtors to avoid or invalidate this lien, safeguarding their property from being utilized as collateral for debt repayment. There are two main types of Collin Texas Motion to Avoid Creditor's Lien, each applicable under specific scenarios: 1. Collin Texas Motion to Avoid Creditor's Lien Under the Bankruptcy Code: — This type of motion is typically filed in conjunction with a Chapter 7 or Chapter 13 bankruptcy, allowing debtors to seek relief from specific liens that impair their exemptions or cause undue hardship. The Bankruptcy Code provisions provide debtors with the opportunity to protect their exempt assets and maintain a fresh start financially. 2. Collin Texas Motion to Avoid Creditor's Lien in Non-Bankruptcy Proceedings: — Independent of bankruptcy proceedings, this motion allows debtors to remove certain liens encumbering their property. This type of motion can be pursued by individuals who are not seeking bankruptcy protection but still face financial hardship and wish to protect their assets. In both scenarios, debtors are required to satisfy specific legal criteria to successfully obtain a Motion to Avoid Creditor's Lien. These criteria may include demonstrating that the lien impairs an exemption, causes an undue hardship, or lacks legal validity due to technical errors in its creation or recording. To initiate the process, debtors must file a motion with the appropriate Collin County court and provide supporting documentation, such as a detailed affidavit outlining the legal basis for avoiding the lien, evidence of the debtor's financial circumstances, and any relevant property valuation or exemption information. Once filed, the motion will be reviewed by the court, and if approved, a formal order will be issued, avoiding the creditor's lien and potentially releasing the affected property from any claim or attachment. This order ensures that the debtor can retain the exempt property despite their outstanding debts. It is crucial for individuals considering a Collin Texas Motion to Avoid Creditor's Lien to consult with legal professionals well-versed in debtor rights, bankruptcy laws, and property exemptions. These experts can provide guidance and representation throughout the process, increasing the likelihood of a successful motion and protection of the debtor's assets. Overall, a Collin Texas Motion to Avoid Creditor's Lien offers vital legal protection for individuals facing financial difficulties.