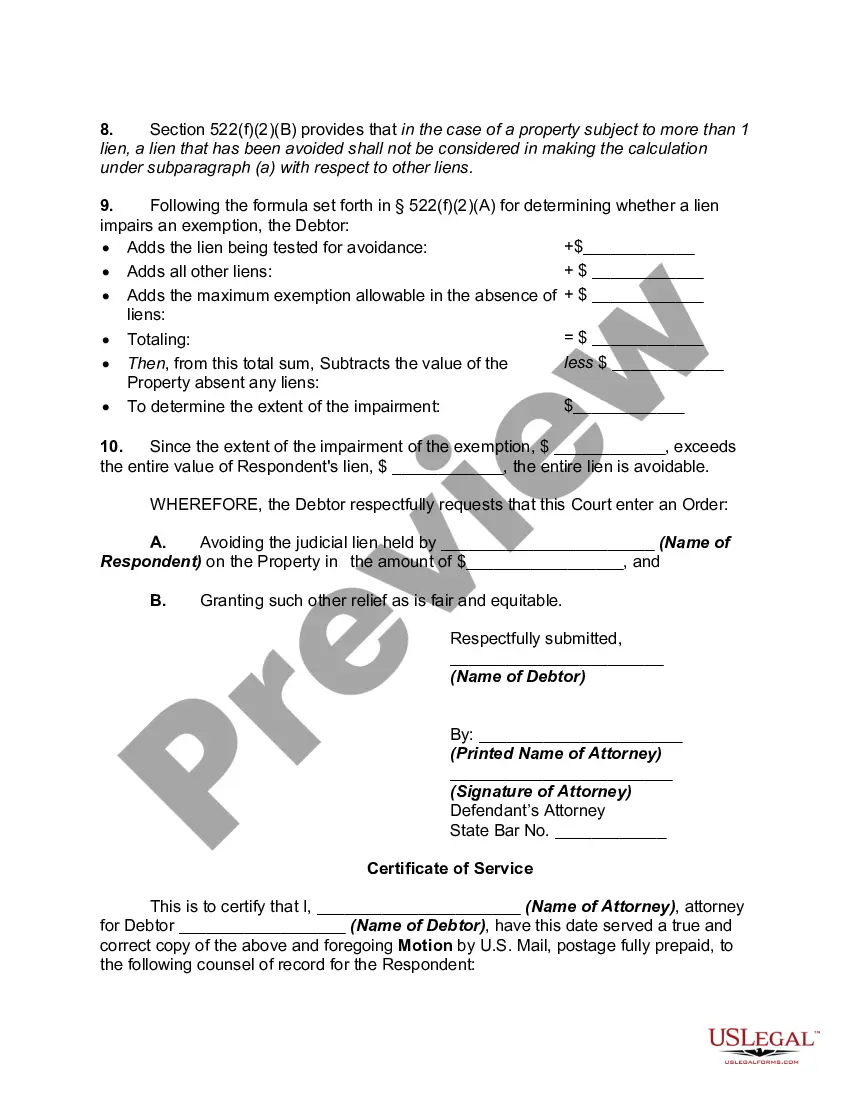

Judicial lien is a lien obtained by judgment, levy, sequestration or other legal or equitable process or proceeding. If a court finds that a debtor owes money to a creditor and the judgment remains unsatisfied, the creditor can ask the court to impose a lien on specific property owned and possessed by the debtor. After imposing the lien, the court issues a writ directing the local sheriff to seize the property, sell it and turn over the proceeds to the creditor.

Under Bankruptcy proceedings, a creditor can obtain a judicial lien by filing a final judgment issued against a debtor through a lawsuit filed in state court. A certified copy of a final judgment may be filed in the county in which the debtor owns real property. A bankruptcy debtor can file a motion to avoid Judicial Lien. A Motion to avoid Judicial Lien can be filed by a debtor in either a chapter 7 or chapter 13 bankruptcy proceeding. In a Chapter 7 proceeding, an Order Avoiding Judicial Lien will remove the debt totally.

Travis Texas Motion to Avoid Creditor's Lien is a legal process that individuals can use to protect their assets from being seized by creditors. This motion enables individuals to assert their exemptions under Texas law and request the court to remove or avoid a creditor's lien on their property. In Travis County, Texas, there are several types of Motion to Avoid Creditor's Lien that can be filed depending on the specific circumstances. These include: 1. Homestead Exemption: One of the most commonly used types of Motion to Avoid Creditor's Lien in Travis County is the homestead exemption. This motion allows homeowners to protect their primary residence from being subject to a creditor's lien. By asserting the homestead exemption, individuals can safeguard a certain amount of equity in their home from creditors. 2. Personal Property Exemption: Another type of Motion to Avoid Creditor's Lien in Travis County relates to personal property exemptions. This motion allows individuals to protect certain items of personal property, such as household goods, furniture, clothing, jewelry, and tools of trade, from being seized by creditors. By asserting these exemptions, individuals can ensure that they retain essential assets necessary for their daily life and work. 3. Motor Vehicle Exemption: If you own a vehicle, you can also file a Motion to Avoid Creditor's Lien specifically related to your motor vehicle. This motion allows individuals to protect a certain amount of equity in their vehicle from being subject to a creditor's lien. By asserting the motor vehicle exemption, you can retain your transportation and avoid losing it to creditors. 4. Wages Exemption: In some cases, individuals may need to file a Motion to Avoid Creditor's Lien on their wages. This motion allows individuals to protect a portion of their income from being garnished by creditors. By asserting the wages' exemption, individuals can ensure they have sufficient income to cover their living expenses. When filing a Travis Texas Motion to Avoid Creditor's Lien, it is essential to provide detailed documentation and evidence supporting your claim for exemptions. This may include financial records, property appraisals, and documentation of your financial situation. It is advisable to consult with an attorney familiar with Texas exemption laws to navigate the process successfully and maximize your chances of protecting your assets. By asserting your exemptions through a Travis Texas Motion to Avoid Creditor's Lien, you can maintain control over your property and secure a fresh start while addressing your financial obligations. Understanding the different types of motions available and seeking legal guidance can help you protect your assets effectively and avoid unnecessary loss due to creditor actions.Travis Texas Motion to Avoid Creditor's Lien is a legal process that individuals can use to protect their assets from being seized by creditors. This motion enables individuals to assert their exemptions under Texas law and request the court to remove or avoid a creditor's lien on their property. In Travis County, Texas, there are several types of Motion to Avoid Creditor's Lien that can be filed depending on the specific circumstances. These include: 1. Homestead Exemption: One of the most commonly used types of Motion to Avoid Creditor's Lien in Travis County is the homestead exemption. This motion allows homeowners to protect their primary residence from being subject to a creditor's lien. By asserting the homestead exemption, individuals can safeguard a certain amount of equity in their home from creditors. 2. Personal Property Exemption: Another type of Motion to Avoid Creditor's Lien in Travis County relates to personal property exemptions. This motion allows individuals to protect certain items of personal property, such as household goods, furniture, clothing, jewelry, and tools of trade, from being seized by creditors. By asserting these exemptions, individuals can ensure that they retain essential assets necessary for their daily life and work. 3. Motor Vehicle Exemption: If you own a vehicle, you can also file a Motion to Avoid Creditor's Lien specifically related to your motor vehicle. This motion allows individuals to protect a certain amount of equity in their vehicle from being subject to a creditor's lien. By asserting the motor vehicle exemption, you can retain your transportation and avoid losing it to creditors. 4. Wages Exemption: In some cases, individuals may need to file a Motion to Avoid Creditor's Lien on their wages. This motion allows individuals to protect a portion of their income from being garnished by creditors. By asserting the wages' exemption, individuals can ensure they have sufficient income to cover their living expenses. When filing a Travis Texas Motion to Avoid Creditor's Lien, it is essential to provide detailed documentation and evidence supporting your claim for exemptions. This may include financial records, property appraisals, and documentation of your financial situation. It is advisable to consult with an attorney familiar with Texas exemption laws to navigate the process successfully and maximize your chances of protecting your assets. By asserting your exemptions through a Travis Texas Motion to Avoid Creditor's Lien, you can maintain control over your property and secure a fresh start while addressing your financial obligations. Understanding the different types of motions available and seeking legal guidance can help you protect your assets effectively and avoid unnecessary loss due to creditor actions.