Maricopa, Arizona Sample Letter regarding Articles of Incorporation — Election of Sub-S Status: Dear [Recipient's Name], I am writing to inform you about the election of Sub-S status for our company, [Company Name], as outlined in our Articles of Incorporation. This decision to elect Sub-S status is made to take advantage of the numerous benefits it offers, such as tax advantages and liability protection. Firstly, let me highlight the significance of our Articles of Incorporation. Articles of Incorporation serve as a legal document that establishes the formation and structure of a corporation. In our case, it lays the foundation for our election of Sub-S status. By electing Sub-S status, we are opting for a special tax designation that allows us to have the benefits of a corporation while being taxed similarly to a partnership or sole proprietorship. This means that all our business income, deductions, and credits will pass through to our shareholders, ultimately avoiding the double taxation that traditional corporations are subject to. One of the key advantages of electing Sub-S status is the exemption from federal income tax at the corporate level. Instead, our shareholders will be responsible for reporting their share of the company's income on their personal tax returns. This pass-through taxation ensures that our company's profits are taxed only once. Additionally, electing Sub-S status provides limited liability protection to our shareholders. This means that their personal assets are safeguarded against corporate debts and liabilities. By choosing this option, we aim to mitigate personal risk and ensure the longevity and sustainability of our business. It is important to note that the decision to elect Sub-S status must be made within a specific timeframe, typically within 75 days of filing our Articles of Incorporation or by the 15th day of the third month of our tax year. Therefore, prompt action is required to finalize this election. In conclusion, by electing Sub-S status, we are positioning our company, [Company Name], for tax advantages and limited liability protection. This action aligns with our long-term goals and objectives, reinforcing our commitment to the success and growth of our business. We believe that this strategic decision will contribute to our overall competitiveness and financial well-being. Thank you for your attention to this matter. Feel free to contact me if you have any questions or require further information regarding the Articles of Incorporation — Election of Sub-S Status. Sincerely, [Your Name] [Your Position] Different types of Maricopa, Arizona Sample Letters regarding Articles of Incorporation — Election of Sub-S Status can include variations based on the specific company or organizational name, additional sections discussing specific tax regulations or legal requirements, or additional attachments such as completed forms or financial statements if required. However, the general content and purpose of the letter will remain the same.

Maricopa Arizona Sample Letter regarding Articles of Incorporation - Election of Sub-S Status

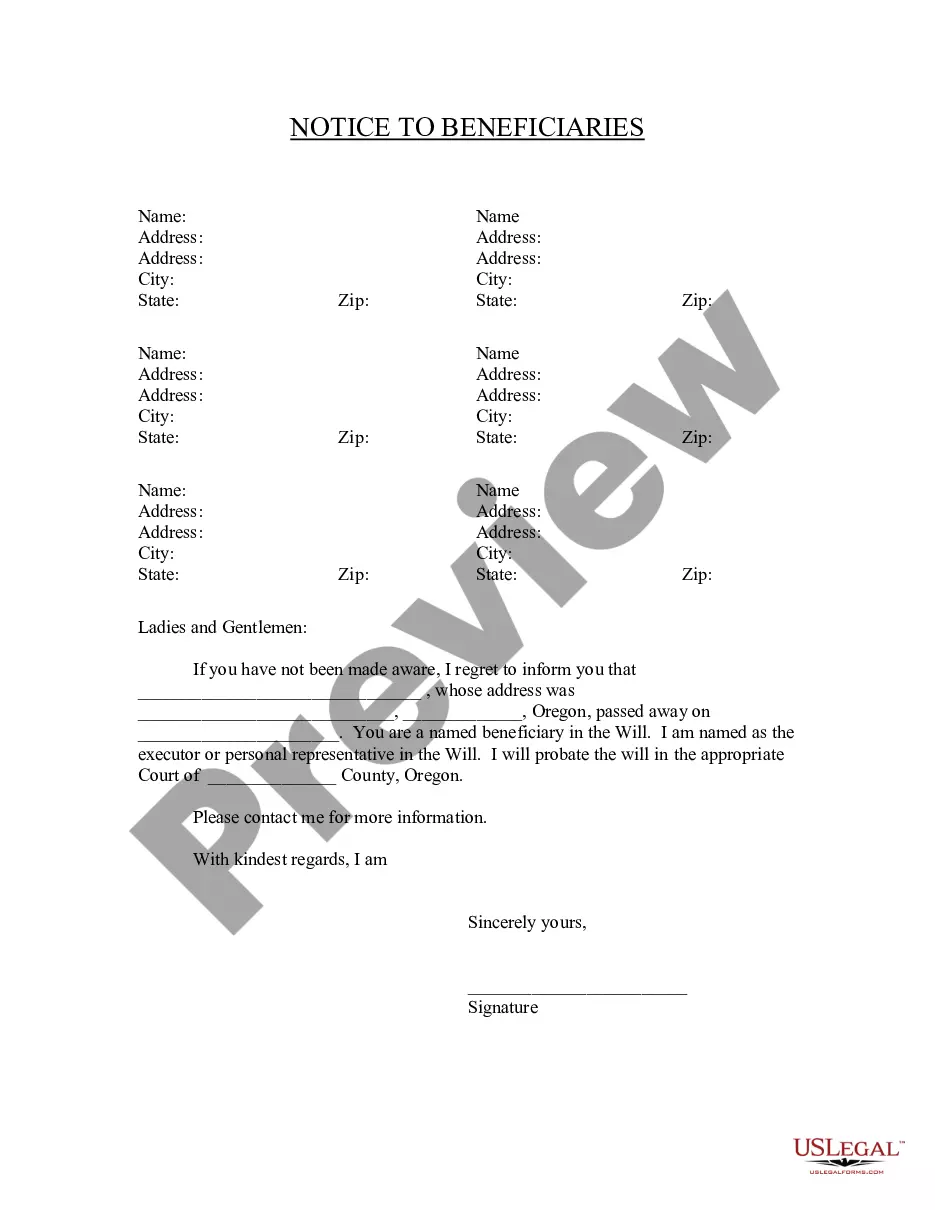

Description

How to fill out Maricopa Arizona Sample Letter Regarding Articles Of Incorporation - Election Of Sub-S Status?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Maricopa Sample Letter regarding Articles of Incorporation - Election of Sub-S Status, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any tasks related to document execution simple.

Here's how you can find and download Maricopa Sample Letter regarding Articles of Incorporation - Election of Sub-S Status.

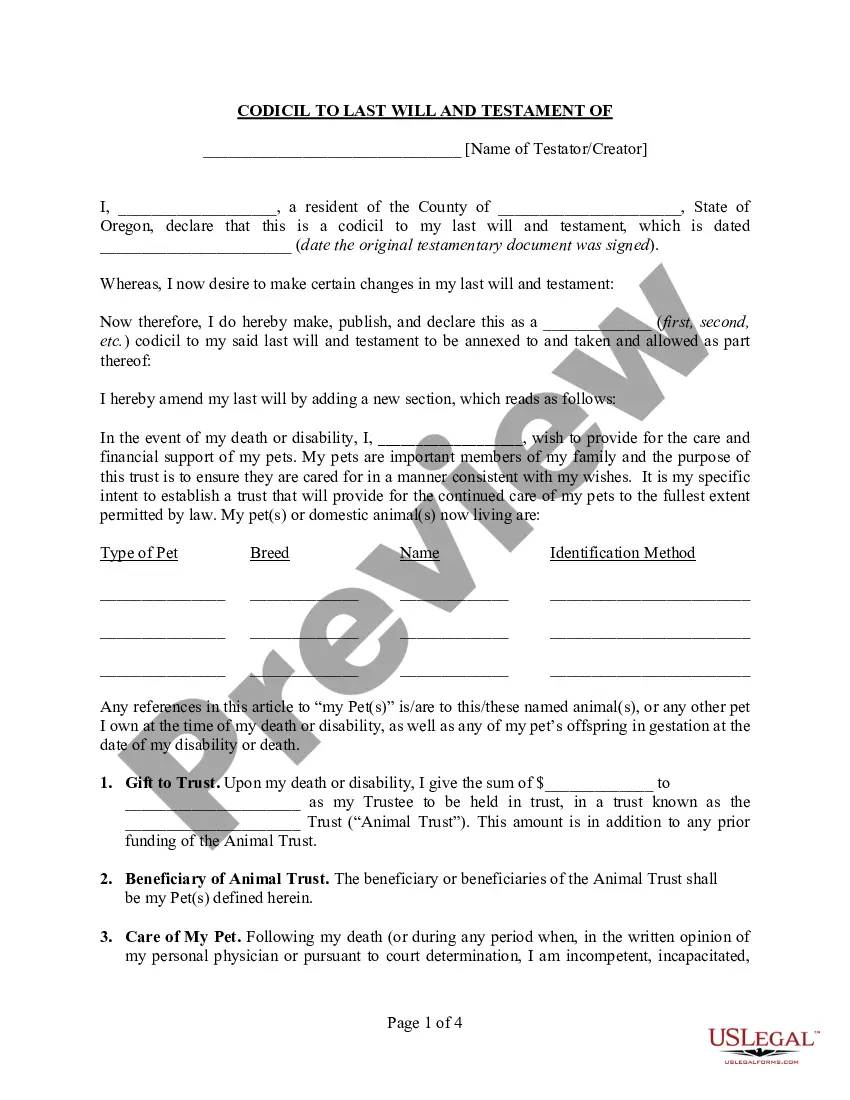

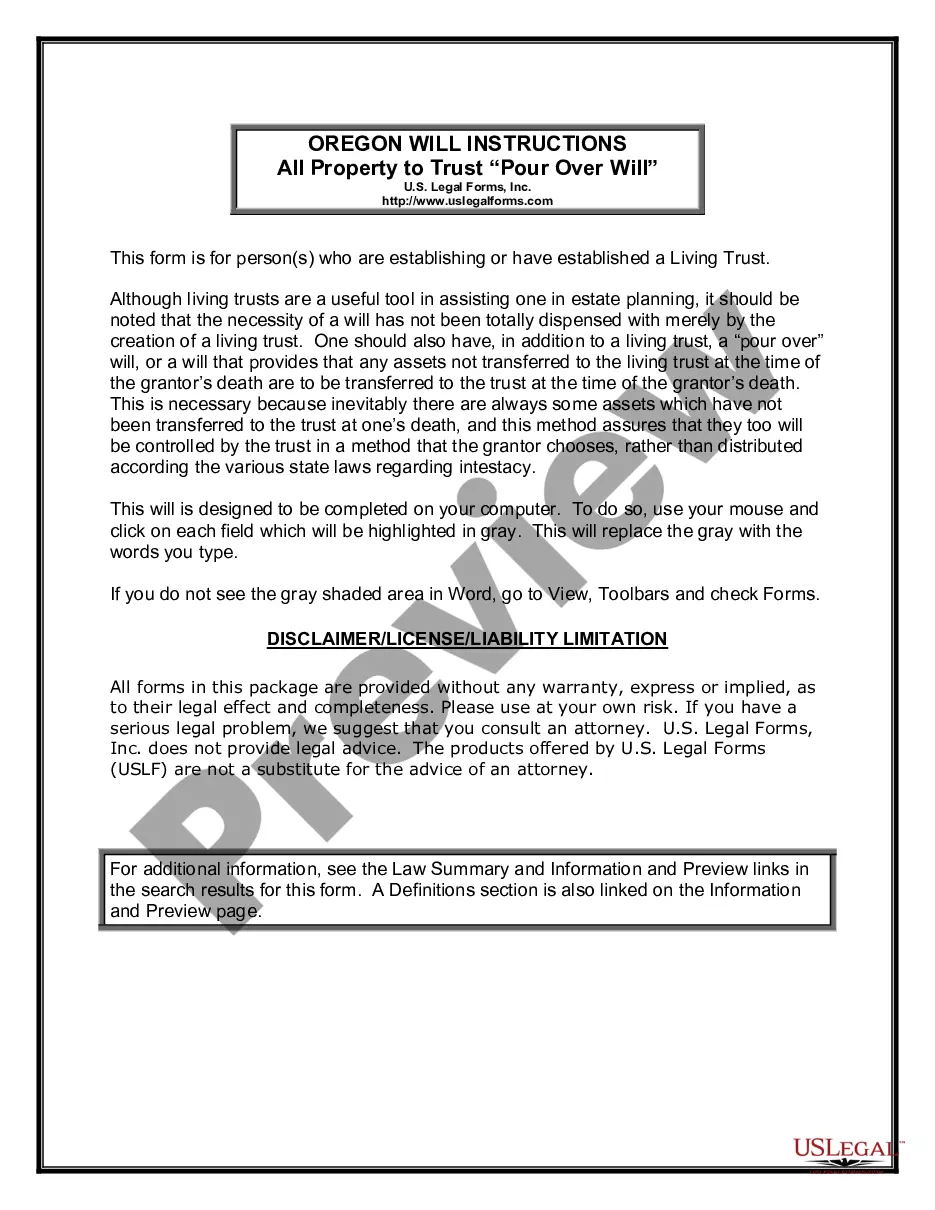

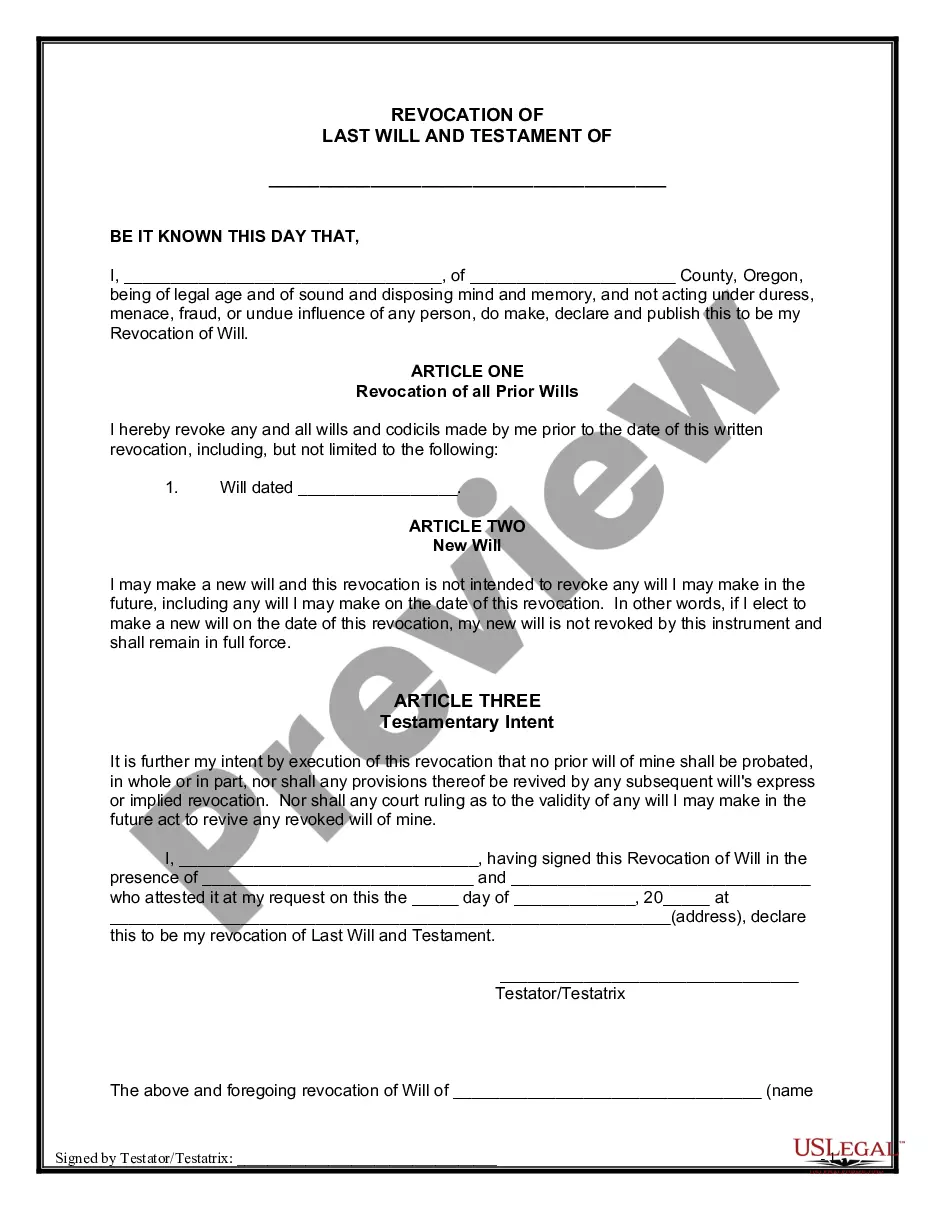

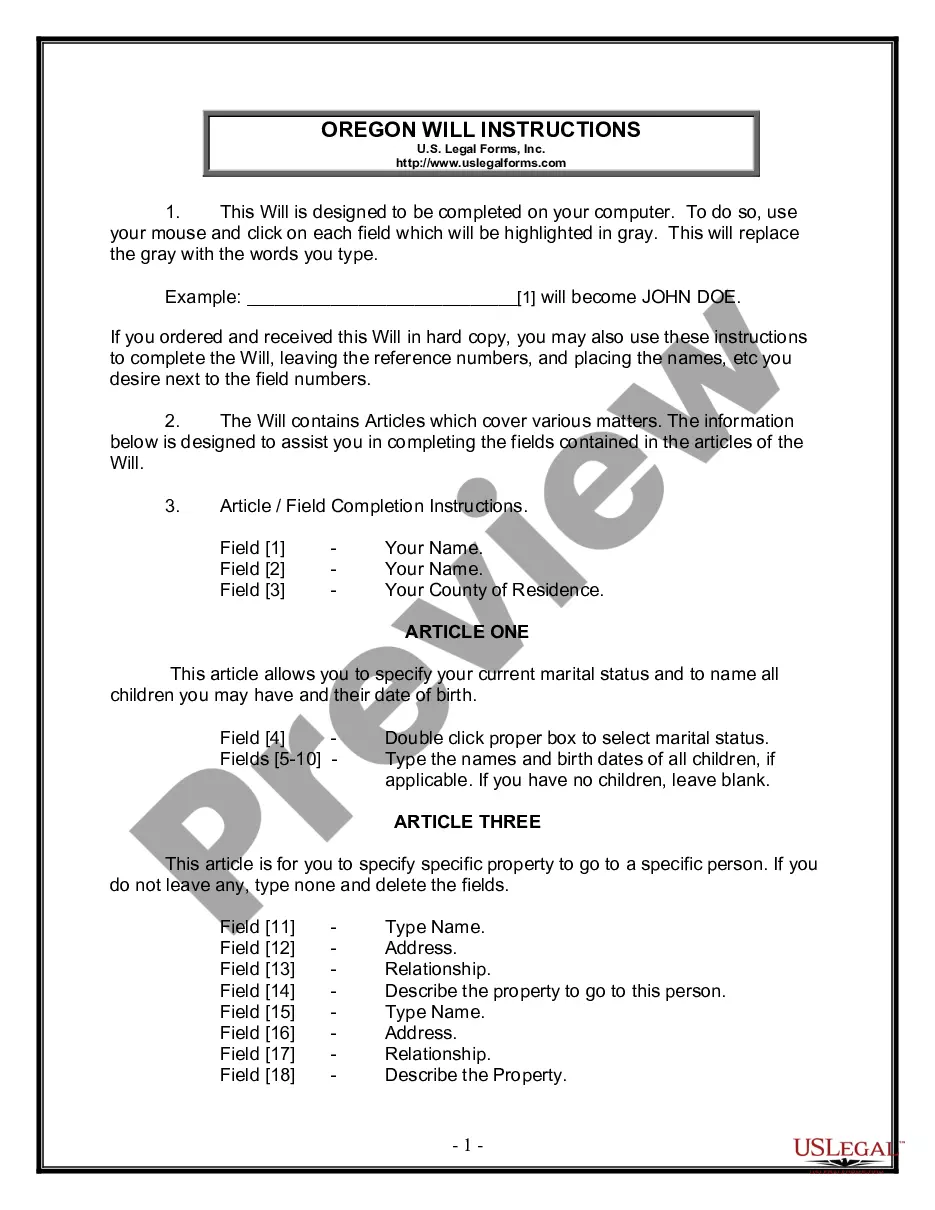

- Go over the document's preview and description (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Check the related document templates or start the search over to locate the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Maricopa Sample Letter regarding Articles of Incorporation - Election of Sub-S Status.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Maricopa Sample Letter regarding Articles of Incorporation - Election of Sub-S Status, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you have to deal with an extremely difficult situation, we recommend using the services of a lawyer to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!