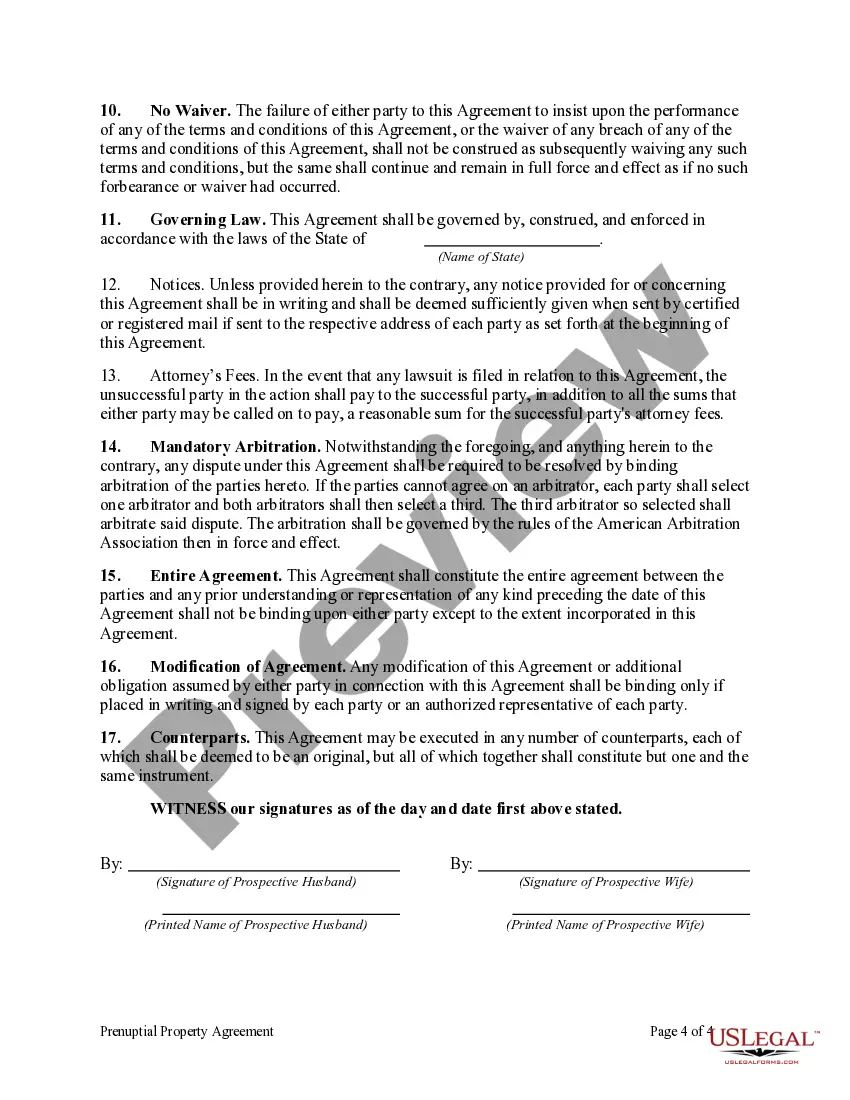

Harris Texas Prenuptial Property Agreement

Description

How to fill out Prenuptial Property Agreement?

Whether you intend to commence your enterprise, enter into a contract, seek assistance for your ID renewal, or address family-related legal issues, you must organize specific paperwork in accordance with your local statutes and regulations.

Locating the appropriate documents may require significant time and effort unless you utilize the US Legal Forms repository.

The service offers users over 85,000 expertly drafted and verified legal documents for any personal or business scenario. All files are categorized by state and area of use, making it simple and quick to select a template like Harris Prenuptial Property Agreement.

Documents available in our repository are reusable. With an active subscription, you can access all previously acquired paperwork anytime in the My documents section of your profile. Stop spending time on an endless quest for current official documents. Join the US Legal Forms platform and manage your paperwork with the largest online form library!

- Ensure the template meets your personal requirements and complies with state law regulations.

- Review the form description and check the Preview if accessible on the page.

- Utilize the search bar above to find another template relevant to your state.

- Click Buy Now to acquire the document once you identify the correct one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Harris Prenuptial Property Agreement in the file format you require.

- Print the document or complete it and sign it electronically through an online editor to save time.

Form popularity

FAQ

In California, individuals can draft their prenups. However, without a legal background, it is easy for the prenuptial agreement to be invalidated. Therefore, it is wise to hire a lawyer to write a prenup as well as making sure you understand the state's Prenuptial Agreement Law and what your options are.

Although it can vary from lawyer to lawyer, in Texas, a prenuptial agreement costs an average of $1200. And to be most effective, a prenup should just be a part of an estate planning package a will or trust, a living will, and powers of attorney. Those documents cost an average of $1,500.

Both parties must be legally capable of entering the agreement; Both parties must enter the agreement voluntarily if the agreement is entered under fraud or duress, it is not valid; The agreement must be in writing; and. The agreement must be signed by both parties.

Texas Prenup (Prenuptial) Agreement - How to Make - YouTube YouTube Start of suggested clip End of suggested clip In writing and signed by both individuals. It only activates when the couple is actually marriedMoreIn writing and signed by both individuals. It only activates when the couple is actually married neither individual is required to retain an attorney for this. Process.

To ensure that things are kept fair and neither person is signing to something they will regret later, each spouse should have their own lawyer when creating and signing a prenup in Texas.

In Texas, a postnuptial or marital property agreement is acceptable in court as long as it meets the proper requirements. Each party should obtain a lawyer and a neutral third party, preferably another lawyer, to look over the draft before finalizing.

Some states require a notarized agreement, but Texas does not. Second, the prenuptial agreement must be executed before the parties get married. A whole new set of rules applies to agreements that are entered into after the marriage takes place.

In fact, I recommend that you begin talking about a prenup with your partner while you're still dating, prior to any engagement, and to have an agreement drafted at least 3 to 4 months before the wedding.

Texas Family Code § 4.006 requires both parties to a prenup to enter into the agreement voluntarily. Otherwise, the agreement will be deemed invalid. If one party does not sign a prenup with their own free will, the court will most likely invalidate the entire agreement.

Can you write your own postnuptial agreement in California? In California, married couples may indeed write their own postnuptial agreements. This can be done using a template document or from scratch.