Dear [Tax Authority], I am writing this letter to request a tax clearance letter from Kings New York. As an individual/entity based in New York, it is necessary for me to obtain this document to demonstrate compliance with all applicable tax laws and regulations. Kings New York offers several types of sample letters for tax clearance, depending on the specific purpose and requirements. These letters are tailored to address various circumstances that individuals or businesses may encounter. Some common types of sample letters for tax clearance offered by Kings New York include: 1. Personal Tax Clearance Letter: This type of letter is suited for individuals who need to verify their tax compliance status with the concerned tax authority. It outlines the individual's tax history, payment records, and other relevant information to ensure that all tax obligations have been met. 2. Business Tax Clearance Letter: Designed for businesses, this sample letter is vital for companies seeking to establish transparent tax compliance. It provides detailed information regarding the organization's tax history, payments made, and any outstanding tax liabilities. This letter helps businesses present a clear picture of their tax standing to interested parties such as lenders, clients, or partners. 3. Non-Resident Tax Clearance Letter: For non-residents who have conducted business or earned income in New York, this letter can be instrumental in guaranteeing compliance with local tax laws. It outlines the individual's tax status as a non-resident, providing evidence of tax payments made while living or working within the state's jurisdiction. 4. Estate Tax Clearance Letter: In the case of an estate, a tax clearance letter becomes crucial to resolve tax matters related to decedents. This letter summarizes the estate's tax history, including any outstanding taxes or necessary payments, ensuring proper settlement of tax obligations and distribution of assets. Kings New York takes pride in providing comprehensive sample letters for tax clearance that are tailor-made to meet the specific needs of individuals and businesses alike. These letters are carefully crafted using the most up-to-date tax regulations and guidelines to ensure accuracy and reliability. Thank you for your prompt attention to this matter. I kindly request that you provide me with the necessary forms and instructions to obtain a Kings New York sample letter for tax clearance. Should you require any additional information or documentation, please do not hesitate to contact me. Yours sincerely, [Your Name]

Kings New York Sample Letter for Tax Clearance Letters

Description

How to fill out Kings New York Sample Letter For Tax Clearance Letters?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Kings Sample Letter for Tax Clearance Letters, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Kings Sample Letter for Tax Clearance Letters from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Kings Sample Letter for Tax Clearance Letters:

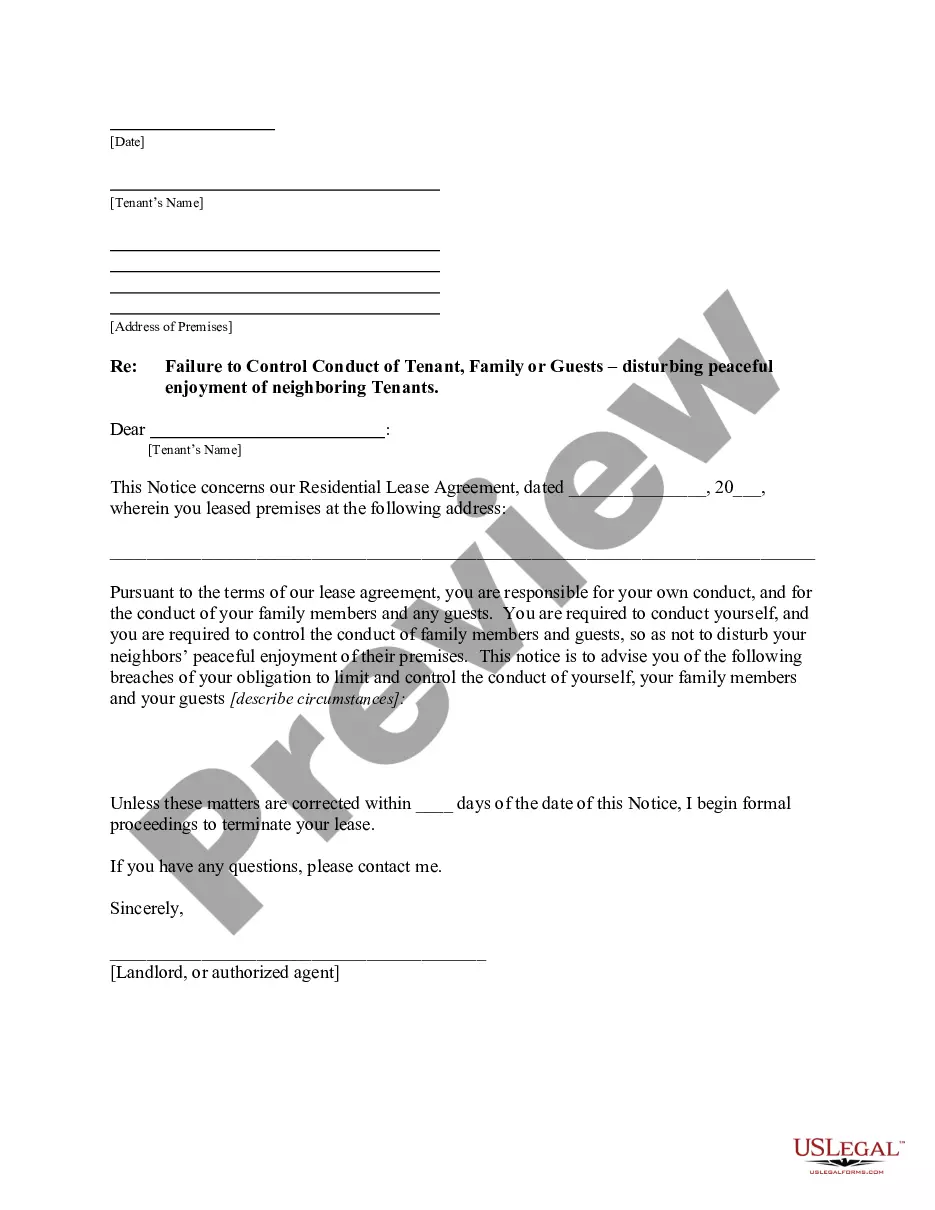

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!