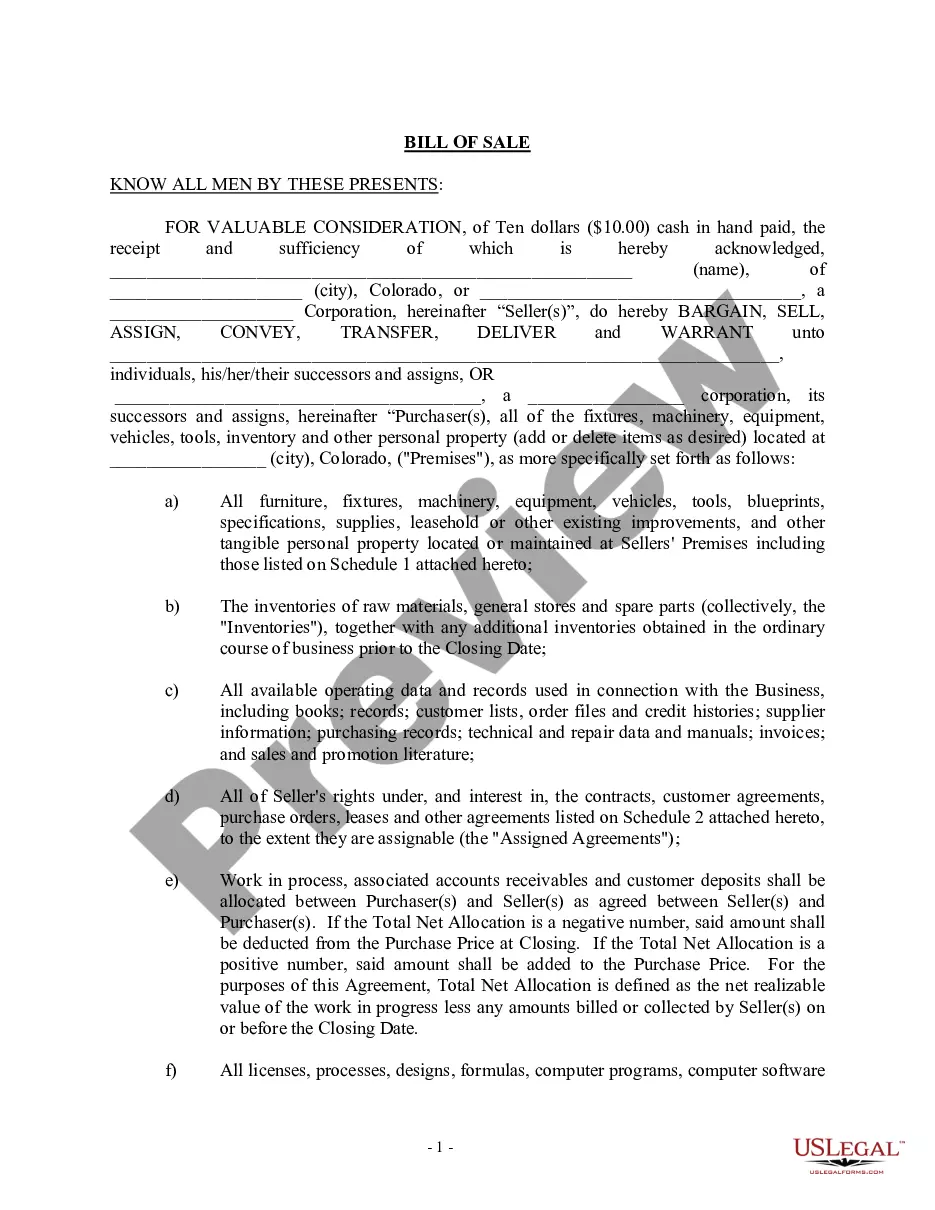

Houston Texas Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another When selling an automobile in Houston, Texas, it is essential to have a Promissory Note and Security Agreement in place. A Promissory Note is a legal document that outlines the terms of the loan and the agreement between the buyer and seller. It ensures that both parties have a clear understanding of their obligations and protects their rights. The Security Agreement, on the other hand, establishes a lien on the automobile as collateral to secure the loan. There are different types of Houston Texas Promissory Note and Security Agreement with regard to the sale of an automobile, depending on the specific circumstances and preferences of the parties involved. Let's explore some of these types: 1. Installment Sale Promissory Note and Security Agreement: This type of agreement is used when the seller agrees to sell the automobile to the buyer on an installment basis. It specifies the installments' amount, due dates, interest rates (if applicable), and any other terms agreed upon. 2. Balloon Payment Promissory Note and Security Agreement: In this type of agreement, the buyer makes smaller regular payments over a set period, with a larger "balloon" payment due at the end. This allows the buyer to make smaller monthly payments while ensuring the full amount is paid within a specific timeframe. 3. Deferred Payment Promissory Note and Security Agreement: Sometimes, a buyer may need some time before initiating payments. This type of agreement allows for deferred payments, meaning agreed-upon payments will start at a later date. It may also include interest charges during the deferred period. 4. Joint Promissory Note and Security Agreement: When multiple individuals are involved in the purchase of an automobile, such as co-buyers or co-signers, a joint agreement is necessary. It outlines the responsibilities and obligations of each party involved. Regardless of the type of Promissory Note and Security Agreement, the document should include crucial details, such as: a. Identification: The legal names, addresses, and contact details of both the buyer(s) and seller(s) involved. b. Description of the Automobile: The make, model, year, Vehicle Identification Number (VIN), and any other relevant details to properly identify the automobile. c. Purchase Price and Terms: The agreed-upon purchase price, any down payment, and the payment terms, including installments, interest rates, due dates, and duration. d. Security Interest: A clear statement that establishes the automobile as collateral for the loan, granting the seller the right to repossess the vehicle in case of default. e. Default and Remedies: The consequences of default on the loan, such as repossession, penalties, or legal action, and the remedies available to the injured party. f. Governing Law: The agreement should state that it is governed by Texas law and specify the jurisdiction in the event of a legal dispute. g. Signatures: The document must be signed and dated by all parties involved to signify their acceptance and agreement to the terms. It is crucial to consult with a legal professional when preparing a Houston Texas Promissory Note and Security Agreement to ensure compliance with the applicable state and local laws.

Houston Texas Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Houston Texas Promissory Note And Security Agreement With Regard To The Sale Of An Automobile From One Individual To Another?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Houston Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to get the Houston Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!