[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP Code] Subject: Request for Tax Exemption — Scheduled Meeting Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to request a meeting with you to discuss the tax exemption options available for [name of organization/company/business] located in Maricopa, Arizona. As you may be aware, Maricopa is a thriving city with a diverse range of businesses and organizations that contribute significantly to the local economy. Our organization, [name of organization/company/business], plays a vital role in serving the Maricopa community by [briefly describe the main activities/operations of your organization]. Given the nature of our work and its impact on the community, we believe that our organization qualifies for tax exemption status under the relevant tax laws and regulations. However, before proceeding with the formal application process, we would greatly appreciate the opportunity to meet with you and discuss the necessary steps and documentation involved. During this scheduled meeting, we would like to discuss the following key points: 1. Understanding Tax Exemption Criteria: We would like to gain a comprehensive understanding of the eligibility criteria for tax exemption in Maricopa, Arizona. Furthermore, we would appreciate guidance on specific requirements or supporting documents necessary for achieving tax exemption status. 2. Clarification on Timelines and Process: It would be extremely helpful to have clarity on the overall process timeline, documents required, and any associated fees to ensure a smooth and timely application for tax exemption. 3. Addressing Concerns and Seeking Guidance: We anticipate that questions and concerns may arise during the application process. This meeting will provide an opportunity for us to seek guidance and clarify any ambiguities or challenges that we might encounter along the way. 4. Establishing a Relationship: Lastly, we would like to establish a positive working relationship with your office to ensure ongoing compliance and be informed of any changes or updates in tax regulations that may affect our organization's tax-exempt status in the future. We highly value your expertise and involvement in guiding us through the tax exemption application process. Your insights will be invaluable in ensuring that we meet all requirements and present a thorough and compelling case for tax exemption. To schedule the meeting at your convenience, please contact me via email at [your email address] or by phone at [your phone number]. I am available to meet during normal business hours from [provide a range of dates and times that suit your schedule]. Thank you for considering our request, and we eagerly anticipate the opportunity to meet with you and discuss our tax exemption application further. Your support in this matter would greatly contribute to the continued success of our organization and the community we serve. Sincerely, [Your Name] [Your Organization/Company/Business Name] [Your Title/Position]

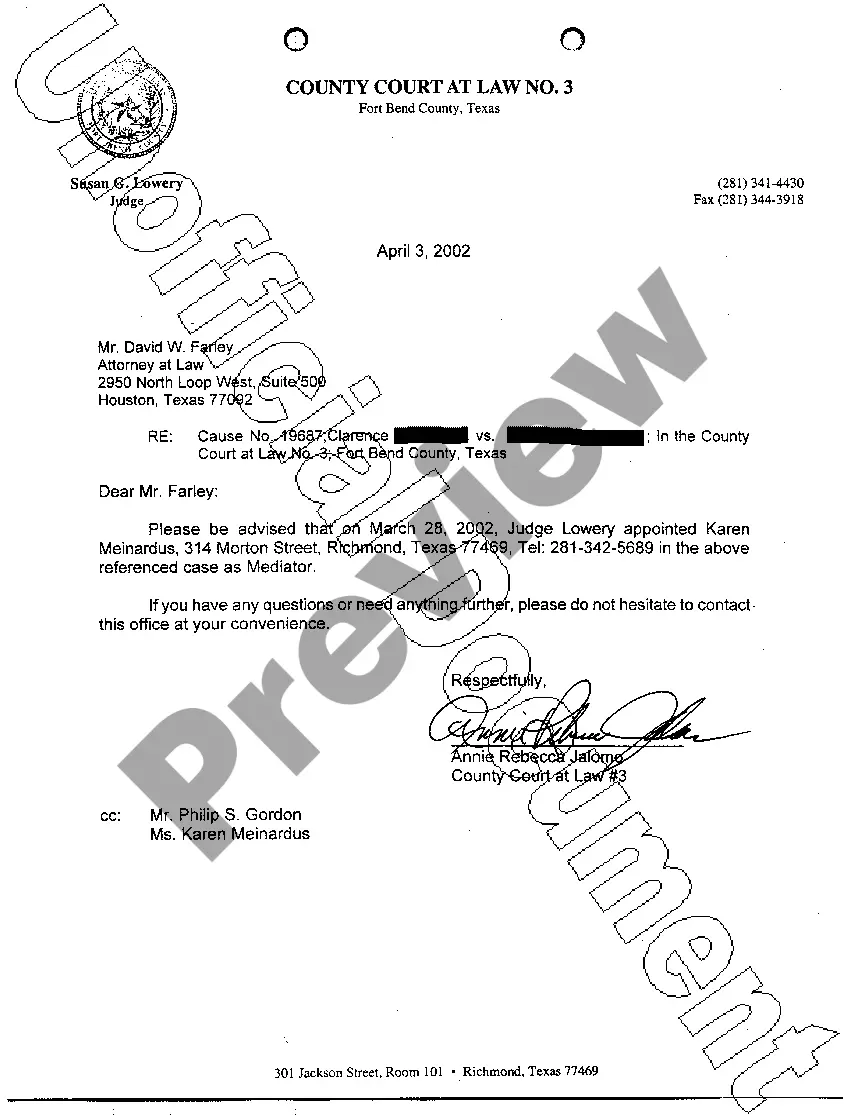

Maricopa Arizona Sample Letter for Tax Exemption - Scheduled Meeting

Description

How to fill out Maricopa Arizona Sample Letter For Tax Exemption - Scheduled Meeting?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Sample Letter for Tax Exemption - Scheduled Meeting, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the Maricopa Sample Letter for Tax Exemption - Scheduled Meeting, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Sample Letter for Tax Exemption - Scheduled Meeting:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Maricopa Sample Letter for Tax Exemption - Scheduled Meeting and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!