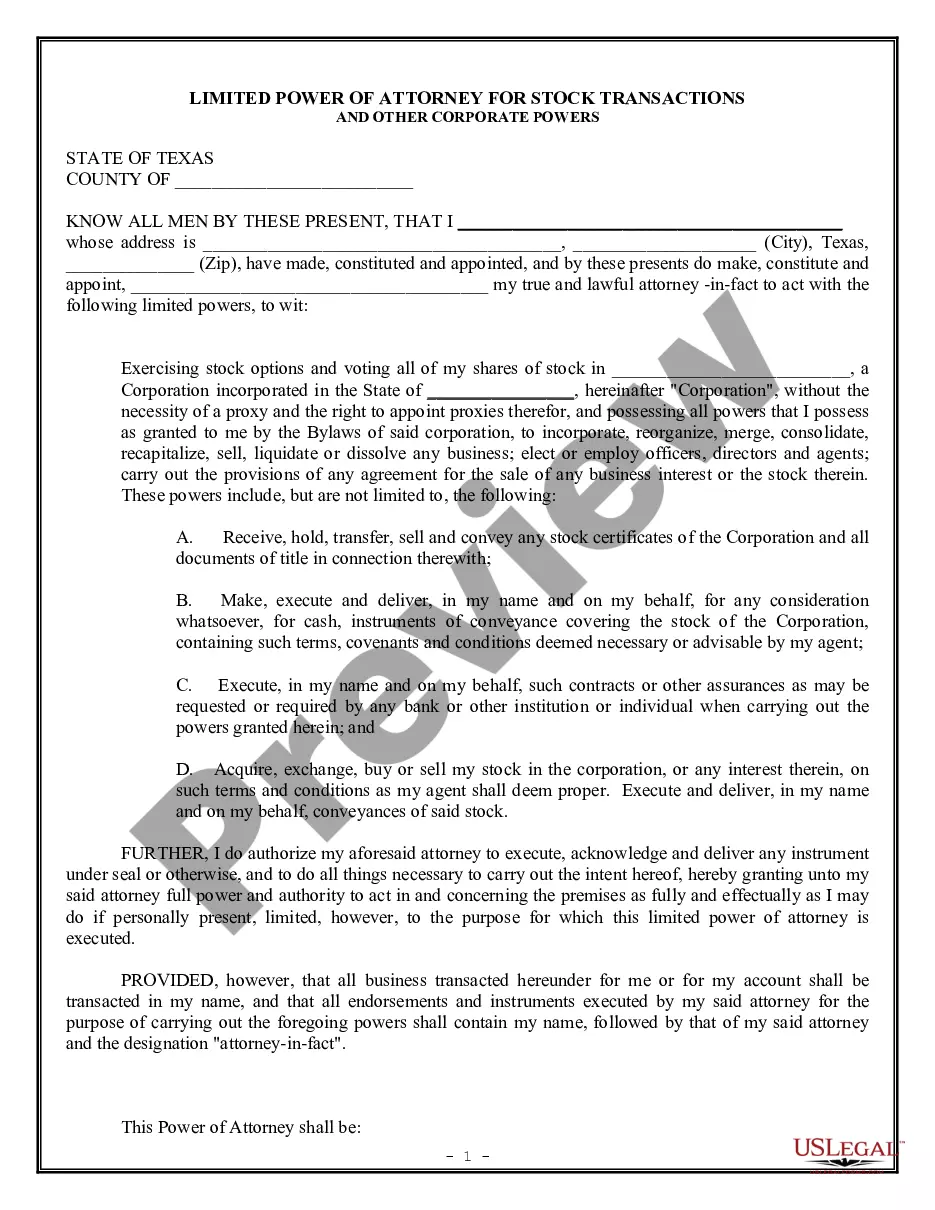

Middlesex Massachusetts Promissory Note with Payments Amortized for a Certain Number of Years is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is commonly used in Middlesex County, Massachusetts, to formalize loans where the borrower agrees to make regular payments over a fixed period. The Middlesex Massachusetts Promissory Note with Payments Amortized for a Certain Number of Years consists of several essential components. Firstly, it includes the names and contact information of the lender and borrower. Secondly, the loan amount, interest rate, and repayment terms are clearly stated. The repayment terms specify the total number of years over which the borrower will make installment payments. Amortization plays a crucial role in this type of promissory note, as it determines how the loan principal and interest are distributed throughout the repayment period. The interest and principal portions of each installment payment are calculated using an amortization schedule, which outlines the breakdown of each payment. The amortization schedule helps both parties determine how the loan will be paid off over time, ensuring transparency and accountability. There can be various types of Middlesex Massachusetts Promissory Notes with Payments Amortized for a Certain Number of Years, named accordingly to reflect specific loan scenarios. Some common types include: 1. Fixed-rate Promissory Note: This type of promissory note has a fixed interest rate throughout the loan term, ensuring that the borrower's payments remain consistent over time. 2. Adjustable-rate Promissory Note: Here, the interest rate is subject to changes based on prevailing market conditions. This type of note typically includes a provision specifying how the interest rate will be adjusted. 3. Balloon Promissory Note: In this case, the borrower makes regular payments for a set number of years; however, a final larger payment (balloon payment) is required at the end of the term to fully satisfy the loan. 4. Interest-only Promissory Note: With this note, the borrower initially makes payments that only cover the interest accrued, with the principal amount remaining unchanged. After a specified period, the borrower begins paying both principal and interest. Regardless of the specific type, a Middlesex Massachusetts Promissory Note with Payments Amortized for a Certain Number of Years provides legal protection and clarity to both lenders and borrowers. It ensures that all parties involved understand their obligations and rights, minimizing the risk of disputes or misunderstandings during the loan repayment period. It is always recommended consulting with a legal professional to draft and review such promissory notes to ensure compliance with applicable laws and regulations.

Middlesex Massachusetts Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Middlesex Massachusetts Promissory Note With Payments Amortized For A Certain Number Of Years?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Middlesex Promissory Note with Payments Amortized for a Certain Number of Years meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Middlesex Promissory Note with Payments Amortized for a Certain Number of Years, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Middlesex Promissory Note with Payments Amortized for a Certain Number of Years:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Middlesex Promissory Note with Payments Amortized for a Certain Number of Years.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!