Title: Franklin Ohio Sample Letter for Tax Exemption — Review of Sample Letter Received from Tax Collector Introduction: In this article, we will delve into the details of a sample letter for tax exemption in Franklin, Ohio. This review analyzes the content of a sample letter received from the tax collector, focusing on the essential keywords and information required for successfully applying for tax exemption. 1. Purpose of the Sample Letter: The purpose of the Franklin Ohio Sample Letter for Tax Exemption is to request the tax collector to grant exemption from specific taxes, providing valid justifications and supporting documents. This letter aims to demonstrate the applicant's eligibility for exemption based on the specific circumstances outlined. 2. Key Elements of the Sample Letter: a. Salutation and Introduction: The letter should begin with a formal salutation, addressing the tax collector appropriately, along with an introduction stating the purpose of the letter. b. Contact Information: Include the applicant's full name, address, and contact details in order for the tax collector to reach out for further communication. c. Explanation of Tax Exemption Eligibility: Provide a detailed explanation as to why the applicant qualifies for tax exemption. This may include eligibility criteria such as age, income level, property ownership details, or any other relevant qualifications. d. Supporting Documents: Attach necessary supporting documents, such as income statements, property deeds, or any other required paperwork that strengthens the case for tax exemption. e. Conclusion and Thank You: Conclude the letter by expressing gratitude for the tax collector's time and consideration. Provide appropriate contact information for any further inquiries or clarifications required by the tax collector. 3. Types of Franklin Ohio Sample Letter for Tax Exemption: a. Individual Tax Exemption Letter: This type of letter is used by an individual taxpayer to request tax exemption for personal reasons such as age, disability, or specific qualifying criteria. b. Non-profit Organization Tax Exemption Letter: This variation of the sample letter is specifically designed for non-profit organizations seeking tax exemption status, highlighting their charitable purposes and fulfilling the necessary requirements outlined by the tax authorities. c. Property Tax Exemption Letter: This specific type of letter is used to request tax exemption for property-related taxes, demonstrating ownership details and presenting valid justifications, such as property being used for specific purposes like religious or educational activities. Conclusion: Writing a detailed, well-structured, and persuasive letter is crucial when applying for tax exemption in Franklin, Ohio. By following the key elements mentioned above and tailoring your letter to the specific type of tax exemption, individuals or organizations can increase their chances of obtaining the desired tax relief.

Franklin Ohio Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

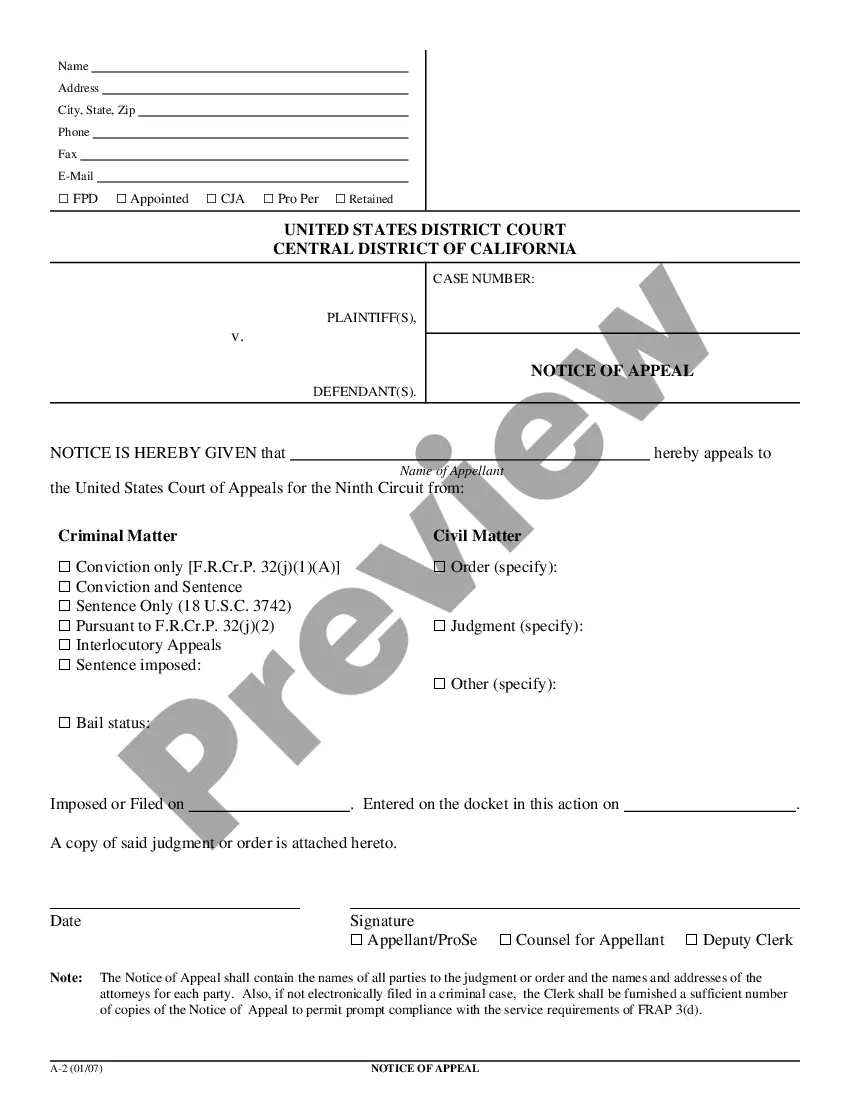

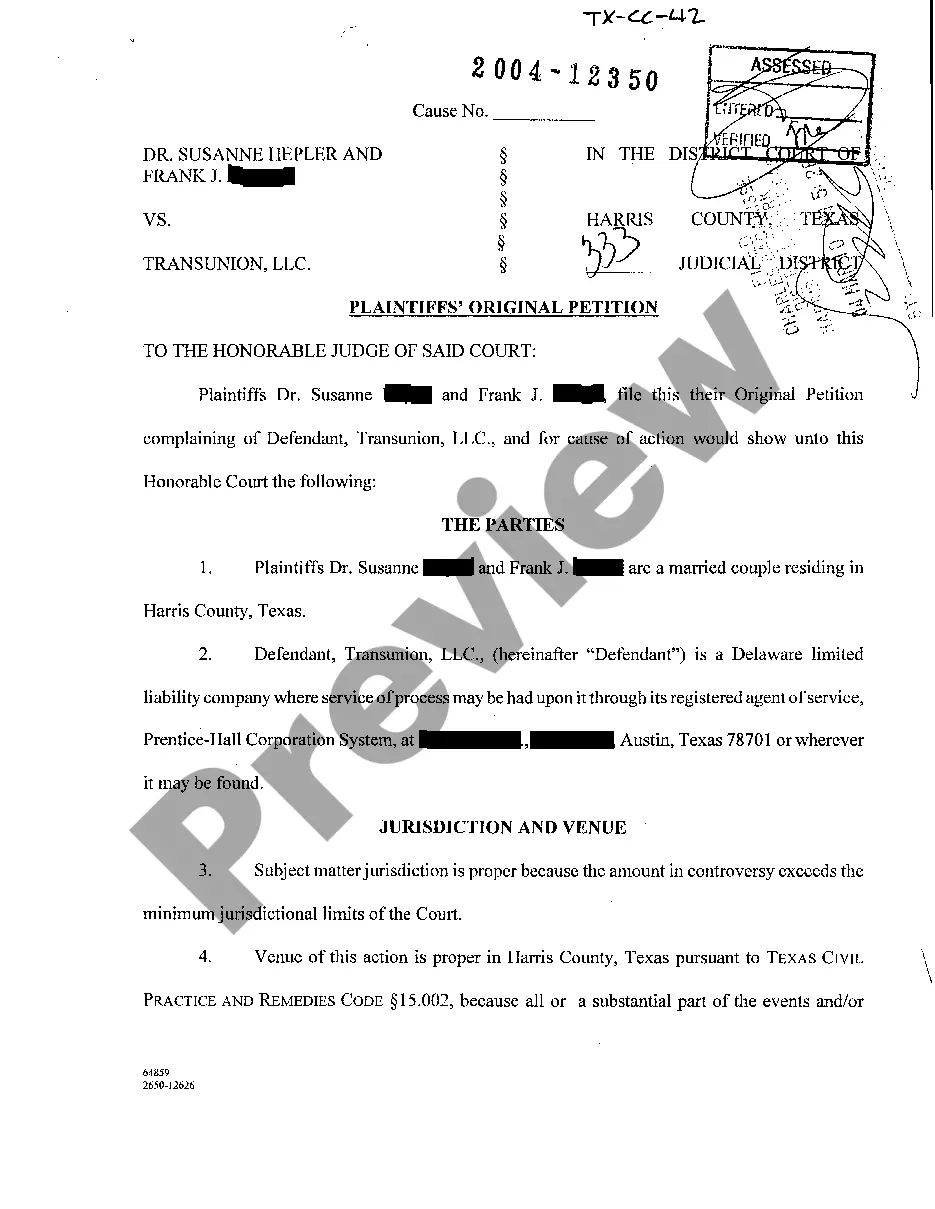

How to fill out Franklin Ohio Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a Franklin Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Franklin Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Franklin Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Franklin Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

1 : free or released from some liability or requirement to which others are subject was exempt from jury duty the estate was exempt from taxes. 2 obsolete : set apart. exempt. verb. exempted; exempting; exempts.

Us. an official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

You can download copies of original determination letters (issued January 1, 2014 and later) using our on-line search tool Tax Exempt Organization Search (TEOS). It may take 60 days or longer to process your request. You may also request an affirmation letter using Form 4506-B.

On behalf of (Foundation/Organization name), I request you to please issue the Tax Exemption Certificate for (Foundation/Organization name). (Cordially Describe your requirements). I will be at your complete disposal of any information/reports/ that you may require to process our request.

LETTER OF EXEMPTION. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local taxing authority, except for local real or personal property tax. Section 122 of the Federal Credit Union Act (12 U.S.C.

Exemption is defined as freedom from an obligation, duty or consequence. When everyone else is required to attend a meeting and you don't have to attend, this is an example of a situation where you have an exemption.

A tax exempt letter needs to include the name and contact information of the organization. Then establish the reason for the tax exempt status such as listing what the organization does that will profit the public.

To exempt a person or thing from a particular rule, duty, or obligation means to state officially that they are not bound or affected by it. exemption (026agzemp02830259n )Word forms: plural exemptions variable noun. See full entry.

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

Who do I contact with questions? If you have questions regarding your tax exemption, you can contact the IRS at 1800-829-4933.