Title: Nassau New York Sample Letter for Tax Exemption — A Comprehensive Review and Analysis of the Sample Letter Received from the Tax Collector Keywords: Nassau New York, sample letter, tax exemption, review, tax collector, detailed description Introduction: In this article, we will explore the specific details of a sample letter for tax exemption received from the tax collector in Nassau, New York. We will provide a detailed description, review the contents, and evaluate the different types of sample letters available for tax exemption purposes in Nassau. 1. Overview of Nassau County, New York: Nassau County, located on Long Island, is one of the most populous counties in New York. It is known for its vibrant communities, diverse population, and its administrative seat, the City of Nassau. As taxpayers in Nassau, it is crucial to familiarize ourselves with the local tax exemption procedures and available resources. 2. Sample Letter for Tax Exemption: When requesting a tax exemption in Nassau County, taxpayers often receive a sample letter from the tax collector's office. This letter serves as a guideline for completing the application process effectively and in line with local regulations. 3. Detailed Description of the Sample Letter Received: The sample letter for tax exemption received from the Nassau tax collector provides a clear outline of the required format, information, and supporting documents. It specifies the necessary details to be included, such as the taxpayer's name, property address, and the reason for seeking tax exemption. The letter may contain instructions on attaching relevant documentation, such as income statements, property deeds, or supporting medical records. 4. Review and Analysis of the Contents: The sample letter is carefully crafted to ensure that taxpayers understand and fulfill the requirements for tax exemption in Nassau effectively. It provides step-by-step instructions, highlighting any specific forms or deadlines that must be adhered to. Additionally, it may address any potential concerns or frequently asked questions that taxpayers may have during the application process. 5. Different Types of Nassau New York Sample Letters for Tax Exemption: While there may be variations in the sample letters received for tax exemption in Nassau County, several common types can be identified. These include letters specific to senior citizens, individuals with disabilities, veterans, and various other categories eligible for tax exemptions. Each type may have its unique requirements and criteria for qualification. Conclusion: Understanding the content and purpose of the sample letter for tax exemption received from the Nassau tax collector is essential for taxpayers in Nassau County, New York. By following the provided guidelines, individuals can ensure compliance with local regulations and make the most informed decisions regarding their tax obligations.

Nassau New York Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

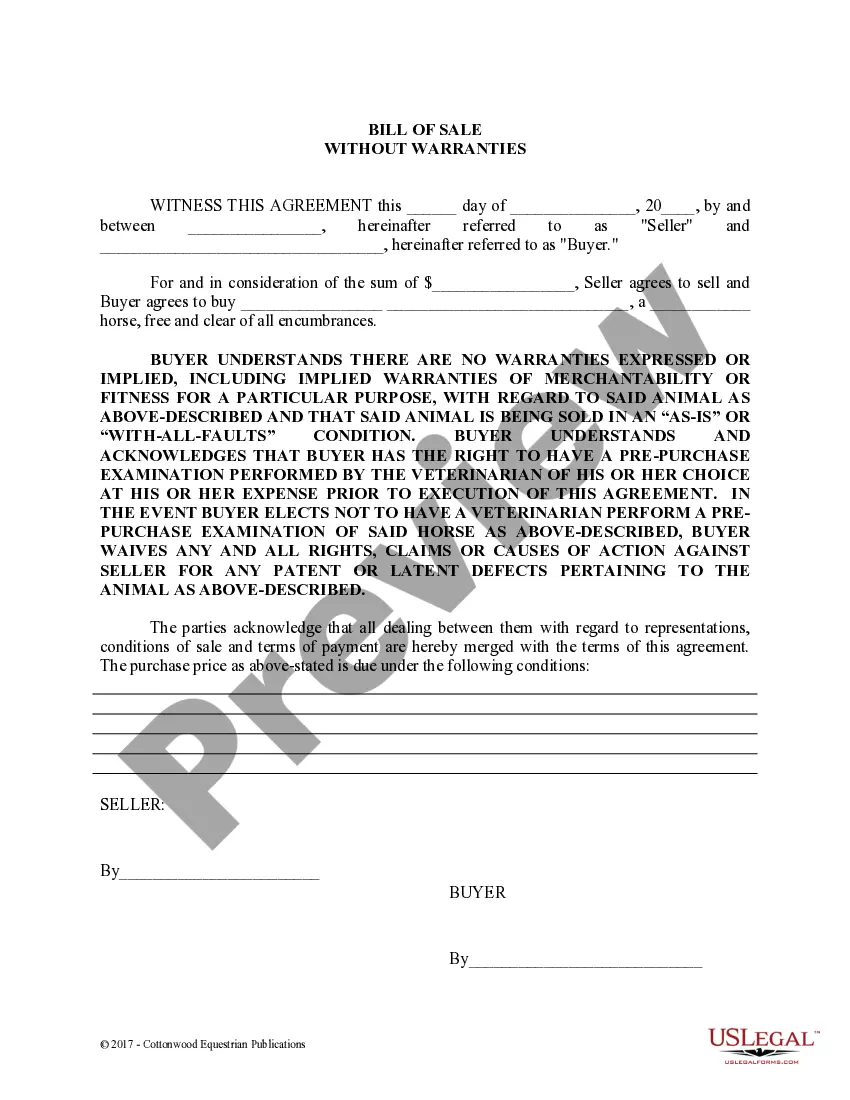

Description

How to fill out Nassau New York Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Nassau Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Nassau Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Nassau Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!