San Diego, California is a vibrant city located on the Pacific Coast of the United States. Known for its beautiful beaches, sunny and mild climate, and various attractions, San Diego is a popular destination for tourists and residents alike. When it comes to tax exemptions in San Diego, individuals and businesses may need to submit a sample letter to the tax collector's office to request exemption from certain taxes. This letter serves as a formal communication to showcase the reasons and eligibility for tax exemption. Reviewing a sample letter received from the tax collector can provide valuable insights into the necessary format, content, and language to include in your own letter. By analyzing the structure and style of a well-crafted sample letter, you can better understand how to present your case persuasively and increase your chances of securing a tax exemption. There are different types of sample letters for tax exemption that one may come across in San Diego. Some common categories include: 1. Personal Tax Exemption Letter: This type of sample letter is typically used by individuals who qualify for personal tax exemptions such as claiming dependents, disability accommodations, or exemptions for certain expenses like medical bills or student loan interest. 2. Business Tax Exemption Letter: Businesses in San Diego may request tax exemptions based on specific criteria, such as being a non-profit organization, engaging in research and development, or investing in renewable energy. Sample letters in this category focus on showcasing the business's eligibility for exemptions. 3. Property Tax Exemption Letter: Homeowners or property owners who meet certain requirements may seek property tax exemptions. Sample letters in this category emphasize factors like age, disability, veteran status, or other qualifying conditions that warrant exemption from property taxes. Overall, reviewing San Diego California Sample Letters for Tax Exemption can be highly beneficial in understanding the key components necessary for a successful request. By tailoring the content to your specific tax exemption needs and utilizing appropriate keywords, you can draft a persuasive and well-structured letter, increasing the likelihood of a positive outcome for your tax exemption request.

San Diego California Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

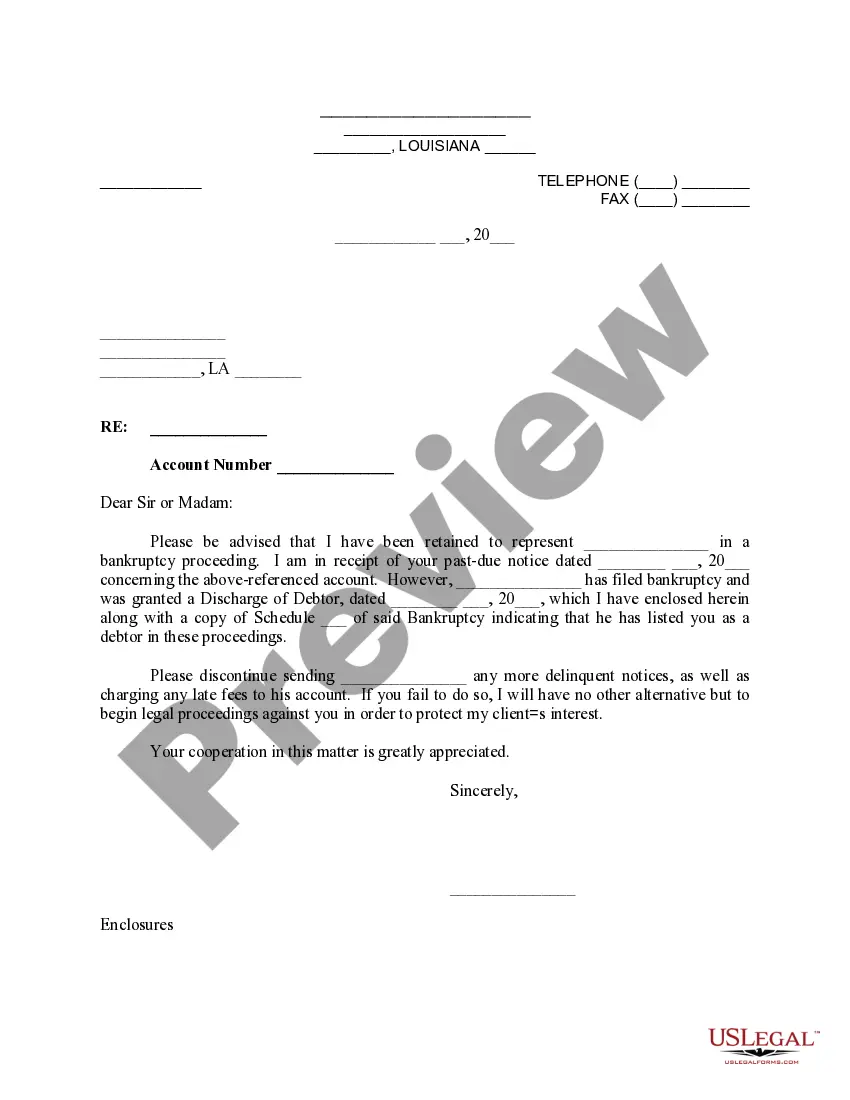

Description

How to fill out San Diego California Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

Preparing paperwork for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft San Diego Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid San Diego Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Diego Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector:

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

There are 2 ways to get tax-exempt status in California: Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application.Submission of Exemption Request (Form 3500A) If you have a federal determination letter:

To request a copy of either the exemption application (including all supporting documents) or the annual information or tax return, submit Form 4506-A, Request for a Copy of Exempt or Political Organization IRS FormPDF or Form 4506-B, Request for a Copy of Exempt Organization IRS Application or LetterPDF.

If FTB or IRS needs to reach a taxpayer to verify a return or discuss a bill, both agencies begin by sending a letter via postal mail. If the taxpayer does not respond, the FTB or IRS may reach out by phone, with courteous agents clearly identifying themselves.

This is a one-time $600 or $1,200 payment per tax return. You may receive this payment if you receive the California Earned Income Tax Credit (CalEITC) or file with an Individual Taxpayer Identification Number (ITIN). The Golden State Stimulus aims to: Support low-income Californians.

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

The California Franchise Tax Board (FTB) collects personal income taxes and corporate taxes due to the state. When you pay your state taxes, you pay them through the California FTB.

An FTB Notice can be a written statement regarding a procedure that affects taxpayers or other members of the public under the Revenue and Taxation Code (R&TC), related statutes, or regulations. In these circumstances, an FTB Notice is equivalent to an IRS Revenue Procedure.

PROPERTY TAX POSTPONEMENT PROGRAM This program gives seniors (62 or older), blind, or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual moves, sells the property, dies, or the title is passed to an ineligible person.

Social welfare organizations, schools, colleges, labor organizations, certain social clubs, veterans' organizations and organizations conducting scientific research can qualify for tax exemption if they meet the IRS requirements for tax exemption.

You can download copies of original determination letters (issued January 1, 2014 and later) using our on-line search tool Tax Exempt Organization Search (TEOS). It may take 60 days or longer to process your request. You may also request an affirmation letter using Form 4506-B.