Title: Unveiling the Travis Texas Sample Letter for Tax Exemption: A Comprehensive Review of the Sample Letter Received from the Tax Collector Introduction: The Travis Texas Sample Letter for Tax Exemption is a critical document that individuals or organizations seeking tax benefits must acquaint themselves with. In this comprehensive review, we will delve into the intricacies of the Sample Letter Received from the Tax Collector, shedding light on its purpose, content, and potential variations. 1. Understanding the Travis Texas Sample Letter for Tax Exemption: The Travis Texas Sample Letter for Tax Exemption serves as a formal request for tax relief, allowing eligible entities to apply for exemption from certain tax obligations. It acts as a proof and support document for the exemption application process. 2. Exploring the Content of the Sample Letter Received from the Tax Collector: Upon submitting a tax exemption application, individuals or organizations may receive a Sample Letter from the Tax Collector. This letter typically states their determination of whether the applicant qualifies for tax exemption or not. The contents may include: a. Identification Information: The sample letter should clearly state the name, address, and identification details of the applicant, ensuring accurate record-keeping. b. Exemption Type: The letter should specify the type of tax exemption requested, whether it is property tax, sales tax, or another category, along with a detailed explanation of the specific exemption criteria. c. Evaluative Criteria: The letter should explain the criteria used by the Tax Collector to evaluate the application and determine eligibility. This can include factors such as the applicant's nonprofit status, purpose of exemption, compliance with regulations, and financial transparency. d. Notification of Decision: The sample letter must reveal the Tax Collector's decision regarding the application, whether it has been accepted, rejected, or requires additional information. It might also mention the effective dates of the exemption if approved. 3. Possible Types or Variations of Travis Texas Sample Letter for Tax Exemption: While the exact name and content may differ, variations of the Sample Letter for Tax Exemption may be seen, depending on the specific tax jurisdiction and relevant regulations. Examples of possible types of Travis Texas Sample Letter for Tax Exemption could include: a. Travis Texas Property Tax Exemption Sample Letter: This letter specifically focuses on seeking exemptions related to property taxes in Travis County, Texas. b. Travis Texas Sales Tax Exemption Sample Letter: This type of letter is intended for individuals or organizations seeking exemptions from sales tax obligations within Travis County, Texas. c. Travis Texas Nonprofit Tax Exemption Sample Letter: Designed for nonprofit entities, this letter provides guidelines for applications seeking tax exemption based on their nonprofit status. Conclusion: Understanding the Travis Texas Sample Letter for Tax Exemption and the review of the sample letter received from the Tax Collector is vital in navigating the tax exemption process effectively. By grasping the content and possible variations, applicants can ensure their applications are complete, accurate, and meet the necessary requirements.

Travis Texas Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

How to fill out Travis Texas Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the Travis Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Travis Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Travis Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector:

- Ensure you have opened the right page with your local form.

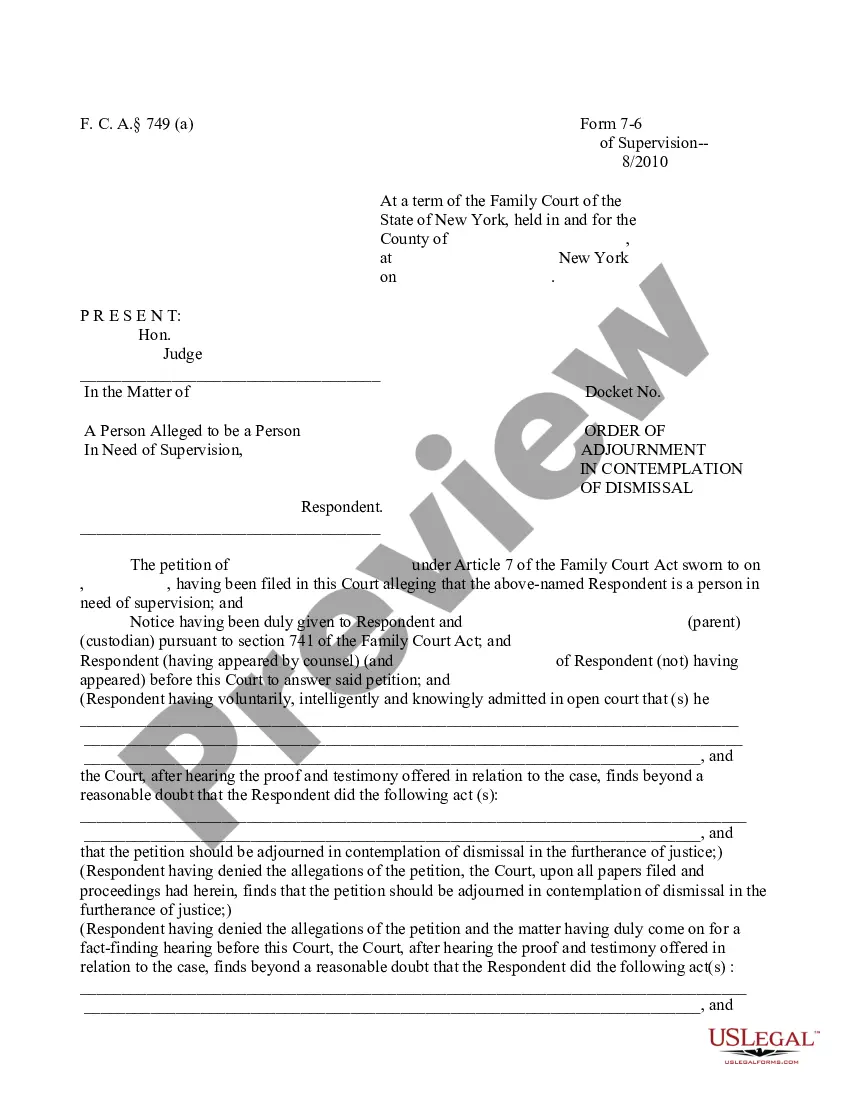

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Travis Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!