Cook County in Illinois offers tax exemptions for certain individuals and organizations. To apply for a tax exemption, applicants must submit a detailed application and supporting documents to the Cook County Assessor's Office. As part of the application process, individuals and organizations are required to submit a sample letter for tax exemption explaining their eligibility and requesting the exemption. The Cook Illinois Sample Letter for Tax Exemption — Review of Applications is a crucial part of the application process. This letter provides an opportunity for applicants to provide a concise yet comprehensive overview of their financial situation, purpose, and justification for seeking a tax exemption. It should be written in a professional and persuasive manner to ensure a successful application. There are different types of Cook Illinois Sample Letters for Tax Exemption, depending on the nature of the applicant. These include: 1. Individual Tax Exemption Letter: This type of letter is written by individuals seeking a tax exemption for their personal property, such as homestead exemptions for primary residences or exemptions based on disability or age. The letter should outline the individual's eligibility criteria and provide supporting documentation to validate their claim. 2. Non-Profit Organization Tax Exemption Letter: Non-profit organizations, including charities, religious institutions, and educational institutions, are eligible to apply for tax exemptions. The sample letter for tax exemption in this case should clearly articulate the organization's mission, activities, and financial status, emphasizing how their work benefits the community. Supporting documentation, such as articles of incorporation and financial statements, may be required. 3. Real Estate Tax Exemption Letter: This letter is specific to applicants seeking tax exemptions for their real estate properties. It could include exemptions for properties used for charitable purposes, religious worship, or educational activities. The letter needs to explain the nature of the property, how it contributes to the community at large, and provide any necessary documents, such as property deeds or lease agreements. In all types of Cook Illinois Sample Letters for Tax Exemption, it is crucial to include the applicant's complete contact information, such as name, address, phone number, and email address. Additionally, the letter should be formatted professionally, using a business letter format, and be addressed to the Cook County Assessor's Office. It is essential to review the Cook Illinois Sample Letter for Tax Exemption thoroughly before submitting it with the application. Accuracy, clarity, and completeness are key factors that will determine the success of the application. Applicants should double-check all information provided and ensure that supporting documents are attached as required. By following the guidelines provided by the Cook Illinois Sample Letter for Tax Exemption — Review of Applications, applicants can greatly increase their chances of obtaining the desired tax exemption, benefiting both individuals and organizations throughout Cook County, Illinois.

Cook Illinois Sample Letter for Tax Exemption - Review of Applications

Description

How to fill out Cook Illinois Sample Letter For Tax Exemption - Review Of Applications?

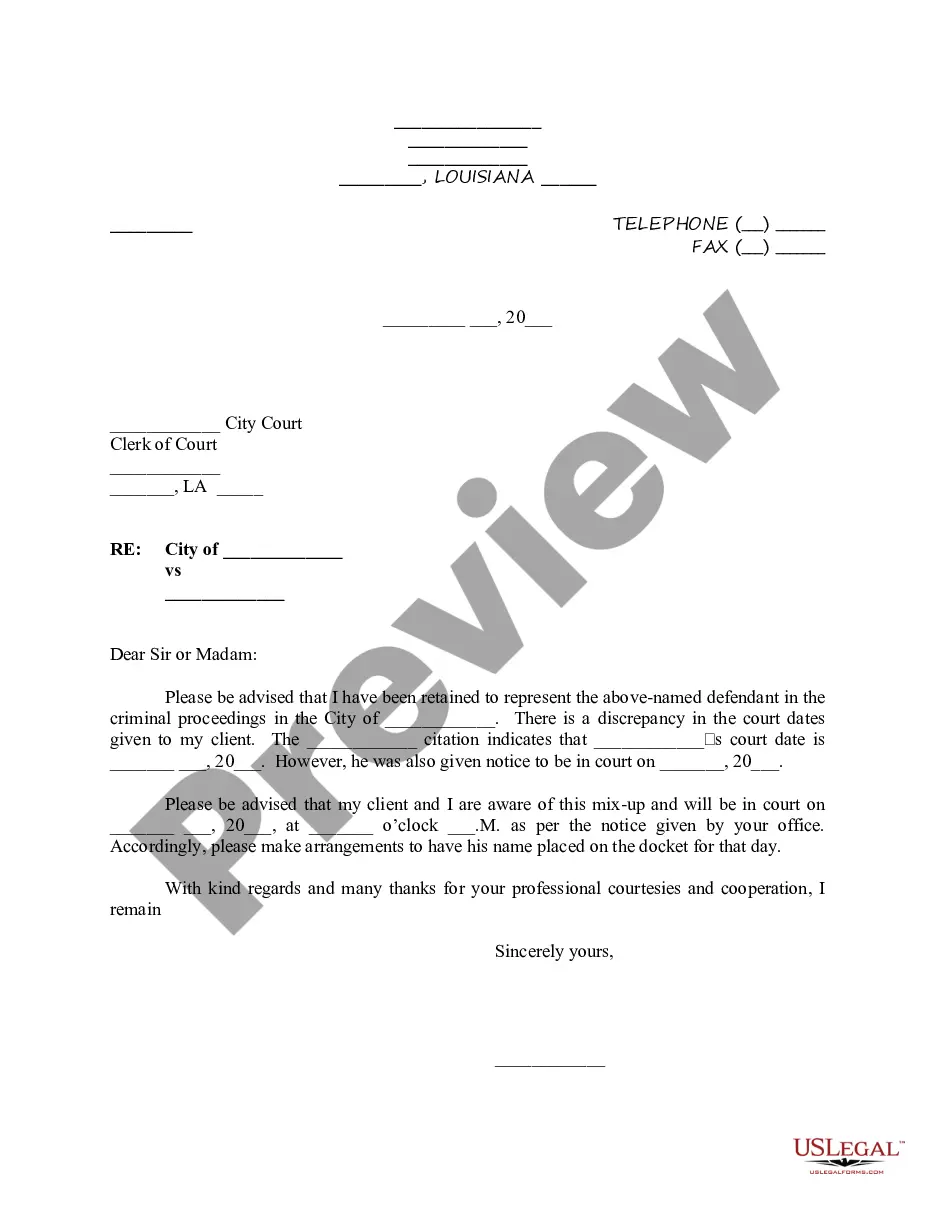

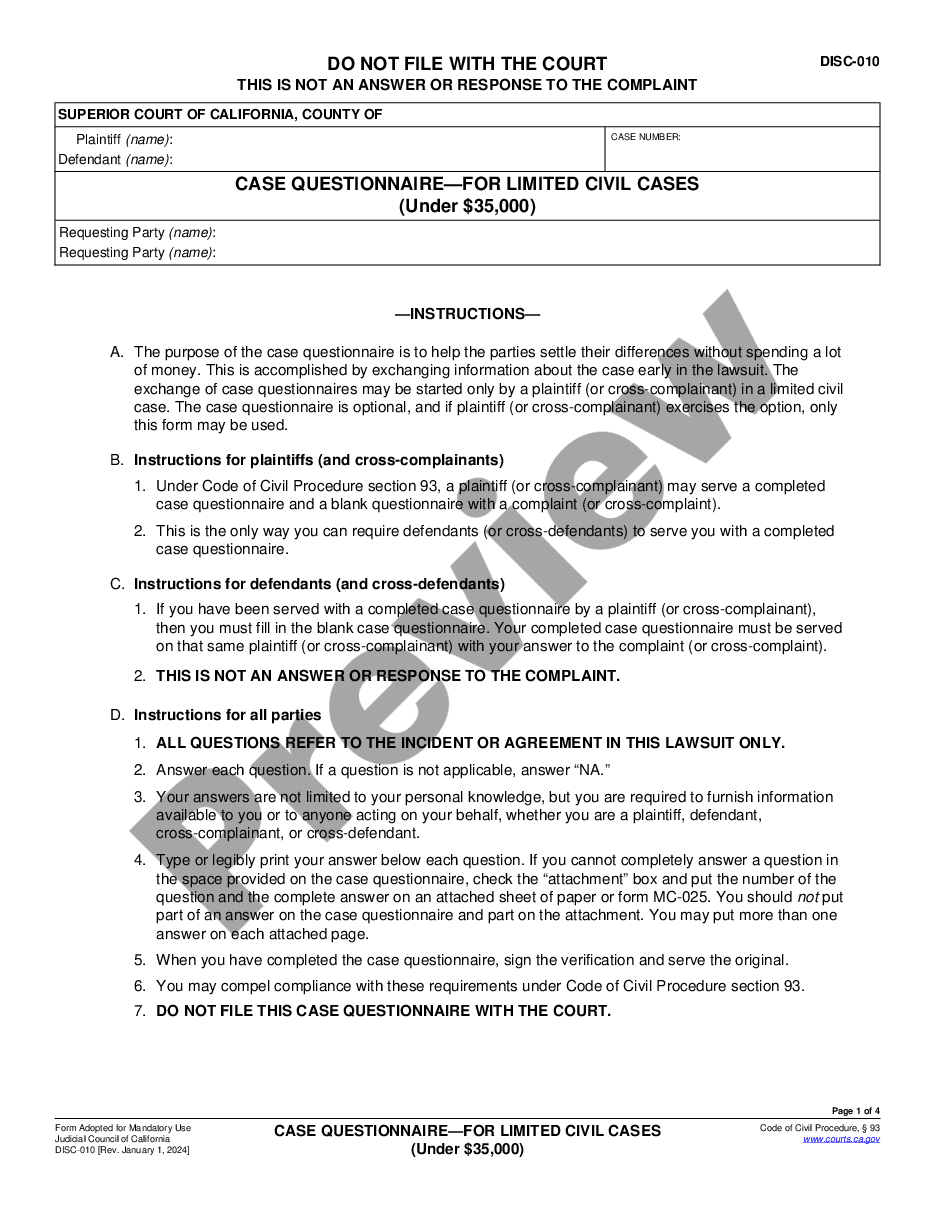

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Cook Sample Letter for Tax Exemption - Review of Applications, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Cook Sample Letter for Tax Exemption - Review of Applications from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cook Sample Letter for Tax Exemption - Review of Applications:

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Form 1023 is the IRS form used for your organization to apply for income tax-exempt status....You must apply for a sales tax exemption (E) number by sending in: Form STAX-1, Application for Sales Tax Exemption, The articles of incorporation, The by-laws, The IRS letter, reflecting federal tax-exempt status,

Purchasers may either document their tax-exempt purchases by completing Form CRT-61, Certificate of Resale, or by making their own certificate. A copy of the certificate must be provided to the retailer. Certificates of Resale should be updated at least every three years.

The senior freeze exemption works this way: Eligible senior citizens automatically receive a reduction of at least $2,000 in the EAV of their homes.

Senior Citizens Real Estate Tax Deferral Program This program allows persons 65 years of age and older to defer all or part of the real estate taxes and special assessments (up to a maximum of $5,000) on their principal residences. The deferral is similar to a loan against the property's market value.

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter Exempt on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application. The application must be submitted electronically on and must, including the appropriate user fee.

The Senior Exemption reduces the Equalized Assessed Value (EAV) of a property by $8,000. EAV is the partial value of a property used to calculate tax bills. It is important to note that the exemption amount is not the dollar amount by which a tax bill is lowered.

The Homestead Improvement Exemption may be granted automatically or a Form PTAX-323, Application for Homestead Improvement Exemption may be required by the Chief County Assessment Office. In Cook County, an application must be filed with the County Assessor along with a valuation complaint.

Social welfare organizations, schools, colleges, labor organizations, certain social clubs, veterans' organizations and organizations conducting scientific research can qualify for tax exemption if they meet the IRS requirements for tax exemption.