Orange, California is a city located in Orange County, California. It is famous for its vibrant community, beautiful landscapes, and abundant cultural offerings. With a population of approximately 140,560 residents, Orange is a thriving city that offers a range of amenities and opportunities for both residents and visitors. The Sample Letter for Tax Exemption — Review of Applications is a crucial tool for individuals and organizations seeking tax exemptions in the city of Orange, California. This letter provides a detailed explanation of the applicant's qualifications and justifications for a tax exemption, ensuring a fair and thorough review process. In Orange, there are different types of Tax Exemption Sample Letters that applicants may need to submit, depending on their circumstances. Some key variations include: 1. Personal Tax Exemption Sample Letter: This type of letter is submitted by individuals seeking tax exemption for personal reasons, such as low-income individuals, senior citizens, or disabled persons. The letter should outline the applicant's financial situation, any relevant medical conditions, and other supporting details. 2. Nonprofit Organization Tax Exemption Sample Letter: Nonprofit organizations play a vital role in Orange's community. This sample letter is essential for nonprofits seeking tax exemption status. It should include information about the organization's mission, activities, and how it benefits the community. Additionally, documentation showcasing the organization's nonprofit status, such as 501(c)(3) certification, should be attached. 3. Property Tax Exemption Sample Letter: Property owners in Orange may be eligible for tax exemptions under specific circumstances, such as historical preservation, low-income housing, or agricultural use. This sample letter should provide detailed information about the property, its intended use, and justification for the tax exemption. 4. Business Tax Exemption Sample Letter: Businesses in Orange may qualify for tax exemptions based on factors like new job creation, investment in the community, or involvement in environmentally friendly practices. This letter should outline the business's activities, contributions to the local economy, and why it deserves tax exemption. Regardless of the type of Tax Exemption Sample Letter, it is crucial to include all relevant information, such as financial statements, supporting documentation, and any additional details that strengthen the applicant's case. The letter should be professionally written, persuasive, and demonstrate a genuine need for tax exemption while adhering to the specific guidelines set by the city of Orange, California.

Orange California Sample Letter for Tax Exemption - Review of Applications

Description

How to fill out Orange California Sample Letter For Tax Exemption - Review Of Applications?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Orange Sample Letter for Tax Exemption - Review of Applications, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Orange Sample Letter for Tax Exemption - Review of Applications from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Orange Sample Letter for Tax Exemption - Review of Applications:

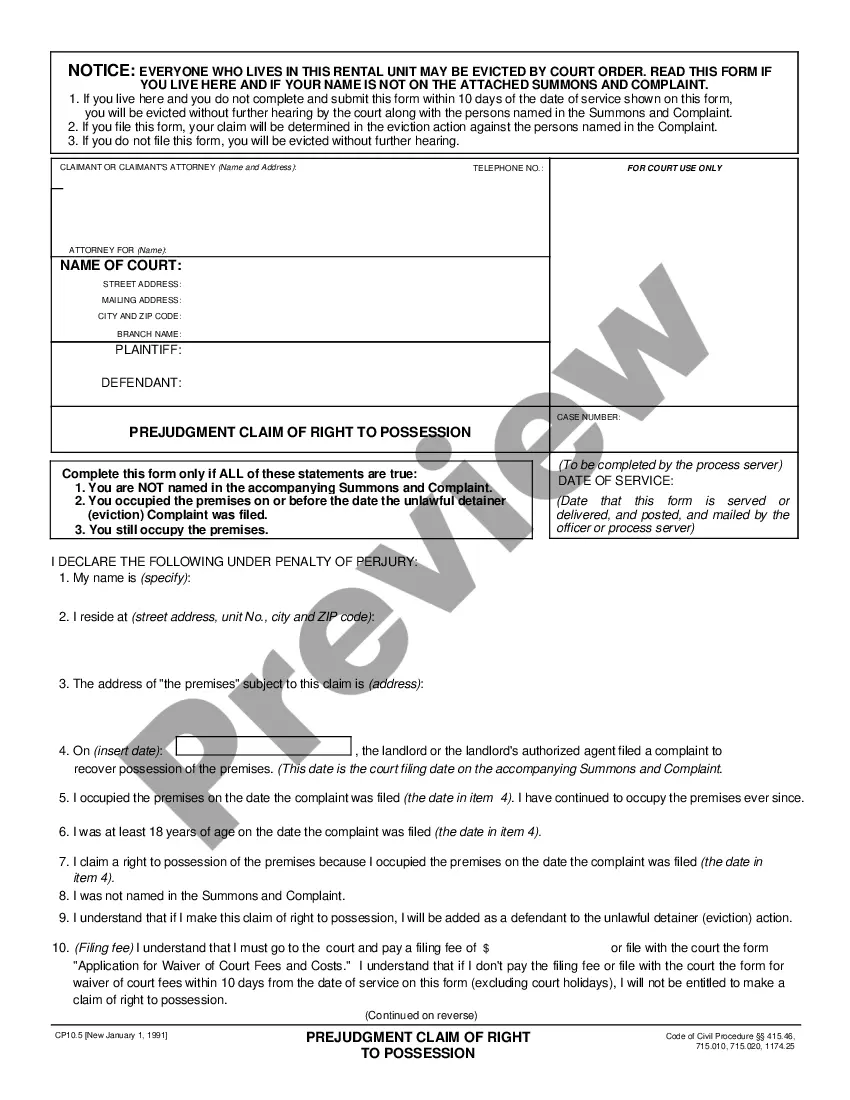

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!