Title: Bronx New York Sample Letter for Tax Exemption — Discussion of Office Equipment Qualifying for Tax Exemption Keywords: Bronx New York, tax exemption, sample letter, office equipment, qualifying, discussion Introduction: In the bustling borough of Bronx, New York, businesses have the opportunity to benefit from tax exemptions. This detailed description will focus specifically on how office equipment can qualify for tax exemption, providing insights, guidance, and sample letters to help businesses in the Bronx make the most of this opportunity. 1. Understanding Tax Exemption for Office Equipment: Tax exemption for office equipment refers to a provision that enables businesses to exclude certain office-related assets from their taxable income. Office equipment typically includes computers, printers, scanners, fax machines, desks, chairs, and other tangible assets necessary for daily operations. 2. Qualifying Office Equipment for Tax Exemption: To qualify for tax exemption, certain criteria must be met. The office equipment must be utilized solely for business purposes and have a depreciation period of more than one year. Additionally, the equipment should not be labeled as "listed property" by the Internal Revenue Service (IRS). Adequate record-keeping and documentation will be required to substantiate the eligibility for tax exemption. 3. Sample Letter for Tax Exemption — Office Equipment: a) General Sample Letter: This sample letter addresses the request for tax exemption for various office equipment assets. It highlights the business's compliance with IRS regulations and provides supporting documentation to strengthen the claim. b) Computer Equipment Sample Letter: This specific sample letter focuses on tax exemption for computer-related assets such as desktops, laptops, servers, and software. It outlines their necessity for business operations and includes relevant cost breakdowns and descriptions. c) Furniture and Fixtures Sample Letter: This sample letter centers on tax exemption exclusively for furniture and fixtures, including desks, chairs, shelves, and cabinets. It emphasizes their essential role in creating a productive work environment and considers factors such as depreciation and fair market value. 4. Tips for Writing an Effective Sample Letter: When writing a sample letter for tax exemption, it is crucial to be clear, concise, and persuasive. Use precise language, provide detailed descriptions, and include supporting evidence whenever possible. Address the letter to the appropriate authority and ensure that all required documentation is attached. Conclusion: Understanding tax exemption for office equipment in Bronx, New York, can significantly benefit businesses by reducing their tax burden. By following the guidelines provided and utilizing the sample letters tailored to office equipment, businesses can enhance their chances of successfully claiming tax exemption, resulting in increased savings and improved financial stability.

Bronx New York Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

Description

How to fill out Bronx New York Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

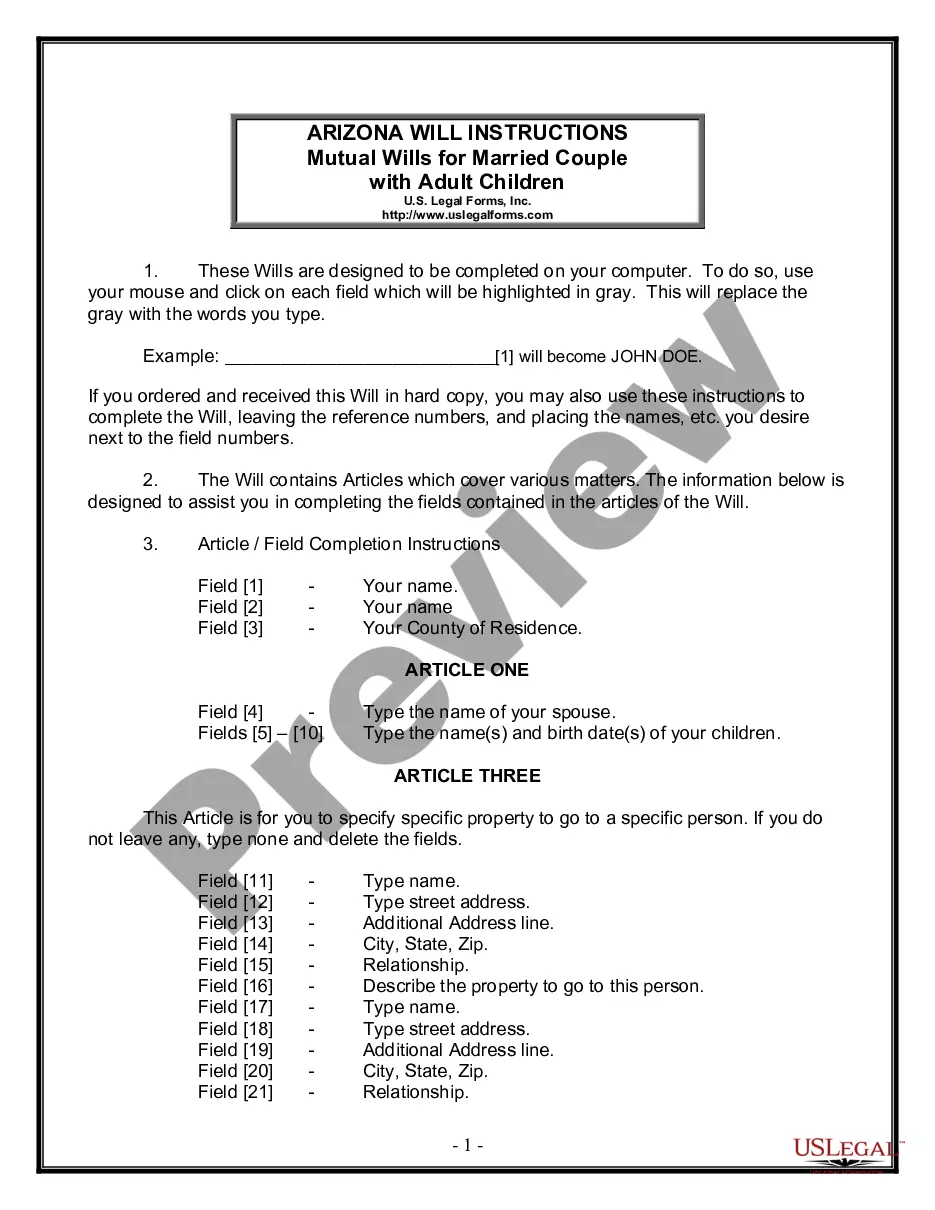

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Bronx Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Bronx Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!