Subject: San Diego, California Sample Letter for Tax Exemption — Discussion of Office Equipment Qualifying for Tax Exemption Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to provide a detailed description of tax exemption policies and guidelines regarding office equipment in San Diego, California. This information is specifically relevant for businesses seeking exemptions while purchasing office supplies. San Diego, known for its stunning beaches, vibrant culture, and thriving economy, offers several types of tax exemptions for qualifying business expenses. One such category includes exemptions for office equipment, which can significantly reduce the financial burden on local businesses. To qualify for tax exemption on office equipment, specific criteria must be met, ensuring compliance with the guidelines set forth by the San Diego County Tax Assessor's Office. These requirements typically involve the nature of the equipment and its intended use within the business setting. It is essential for businesses to draft a well-structured letter addressing the tax exemption request for office equipment. This correspondence should include relevant information such as the purpose of the office equipment, its role in enhancing operational efficiency, and how it contributes to the growth and success of the company. When crafting the letter, it is advisable to include essential keywords that help draw attention to the specific type of tax exemption being sought. Some commonly used keywords in relation to office equipment tax exemption requests in San Diego, California, include "computer equipment exemption," "printer exemption," "scanner exemption," "furniture exemption," and "communication equipment exemption." Additionally, businesses may mention the corresponding tax codes or sections of the local tax regulations pertaining to office equipment exemptions. Providing specific references can demonstrate a thorough understanding of the tax exemption policies and increase the chances of a successful application. It is worth noting that the San Diego County Tax Assessor's Office may request supporting documentation, such as invoices, purchase orders, or proof of payment, to validate the requested tax exemption. Businesses should retain copies of these documents to facilitate a smooth application process and ensure compliance with any potential auditing procedures. By adhering to the established guidelines and submitting a well-crafted letter, businesses in San Diego, California, can avail themselves of the tax exemptions on office equipment. These exemptions can alleviate the financial burden associated with acquiring essential tools and resources, ultimately fostering growth and success within the local business community. Should you have any further queries or require additional assistance in preparing the tax exemption request letter, please do not hesitate to reach out to our office. We are here to help ensure a seamless application process and maximize your chances of securing the desired tax exemption. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Title] [Company Name] [Contact Information]

San Diego California Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

Description

How to fill out San Diego California Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the San Diego Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the San Diego Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the San Diego Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption:

- Make sure you have opened the right page with your localised form.

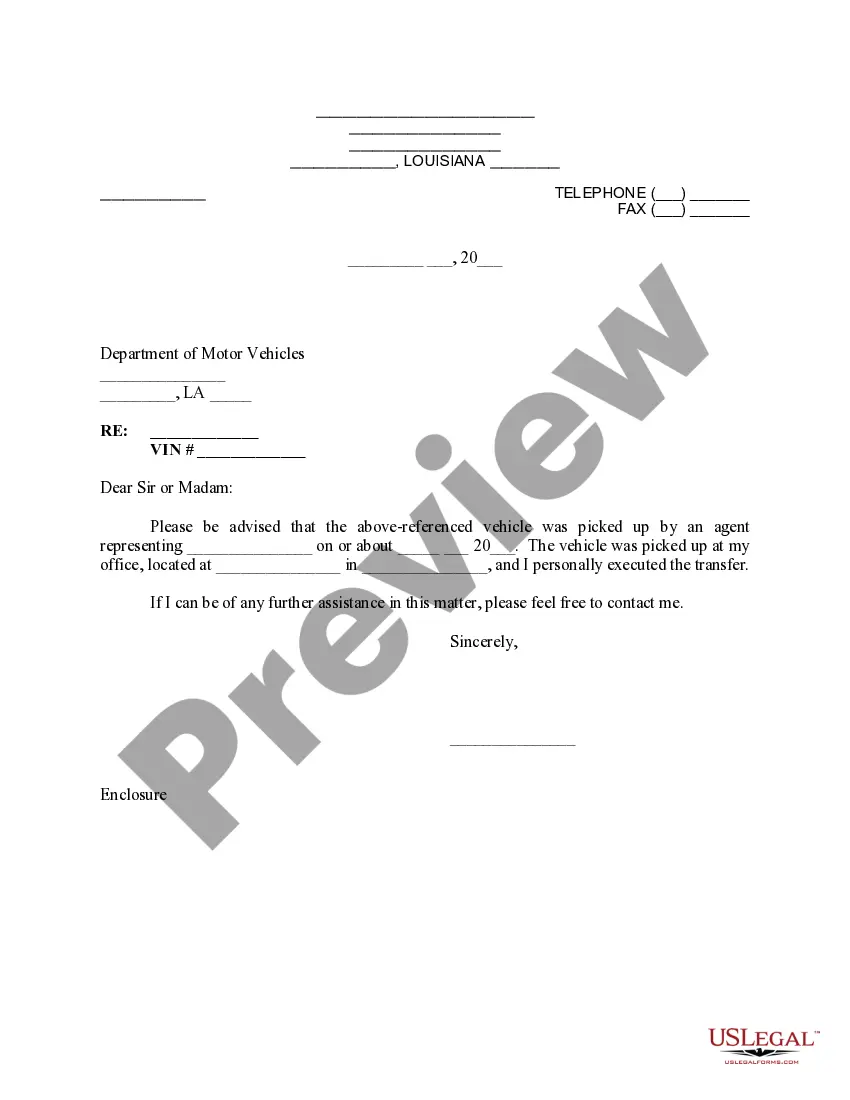

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the San Diego Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!