A Houston Texas Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members is a legally binding document that outlines the structure, responsibilities, and financial agreements within a manager-managed real estate development project in Houston, Texas. This operating agreement is specifically designed for LCS (Limited Liability Companies) that have multiple members with varying amounts of capital contributions. Key Keywords: 1. Houston Texas: Referring to the geographical location where the real estate development is taking place, this keyword ensures the operating agreement complies with the specific laws and regulations of the stated jurisdiction. 2. Limited Liability Operating Agreement: This term signifies that the agreement limits the personal liability of the members involved in the real estate development project. 3. Manager Managed: Indicates that the LLC has appointed a manager who will take charge of the day-to-day operations and decision-making processes, relieving members of active involvement. 4. Real Estate Development: Specifies the nature of the project, which involves acquiring, developing, constructing, or managing real estate properties. 5. Capital Contributions: Refers to the monetary investments made by the LLC members towards the real estate development project. This includes initial contributions as well as additional funding during the course of the venture. Different Types of Houston Texas Limited Liability Operating Agreements for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members could be: 1. Equal Share Capital Contribution Agreement: In this type, all members contribute an equal amount of capital to the LLC. It ensures an equal distribution of profits, losses, and decision-making powers among the members. 2. Proportional Capital Contribution Agreement: This agreement allocates capital contributions in proportion to each member's ownership interest within the LLC. It allows for varying levels of investment, correspondingly influencing profit distribution and decision-making authority. 3. Variable Capital Contribution Agreement: This type of agreement allows for different members to contribute varying amounts of capital based on their financial capacity or agreed-upon terms. It provides flexibility to accommodate differences in resources or investment goals among the LLC members. These are just a few examples of the possible Houston Texas Limited Liability Operating Agreements for Manager Managed Real Estate Development. The specific terms and conditions within each agreement depend on the preferences and objectives of the LLC members and should be tailored as per their requirements.

Houston Texas Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members

Description

How to fill out Houston Texas Limited Liability Operating Agreement For Manager Managed Real Estate Development With Specification Of Different Amounts Of Capital Contributions By Members?

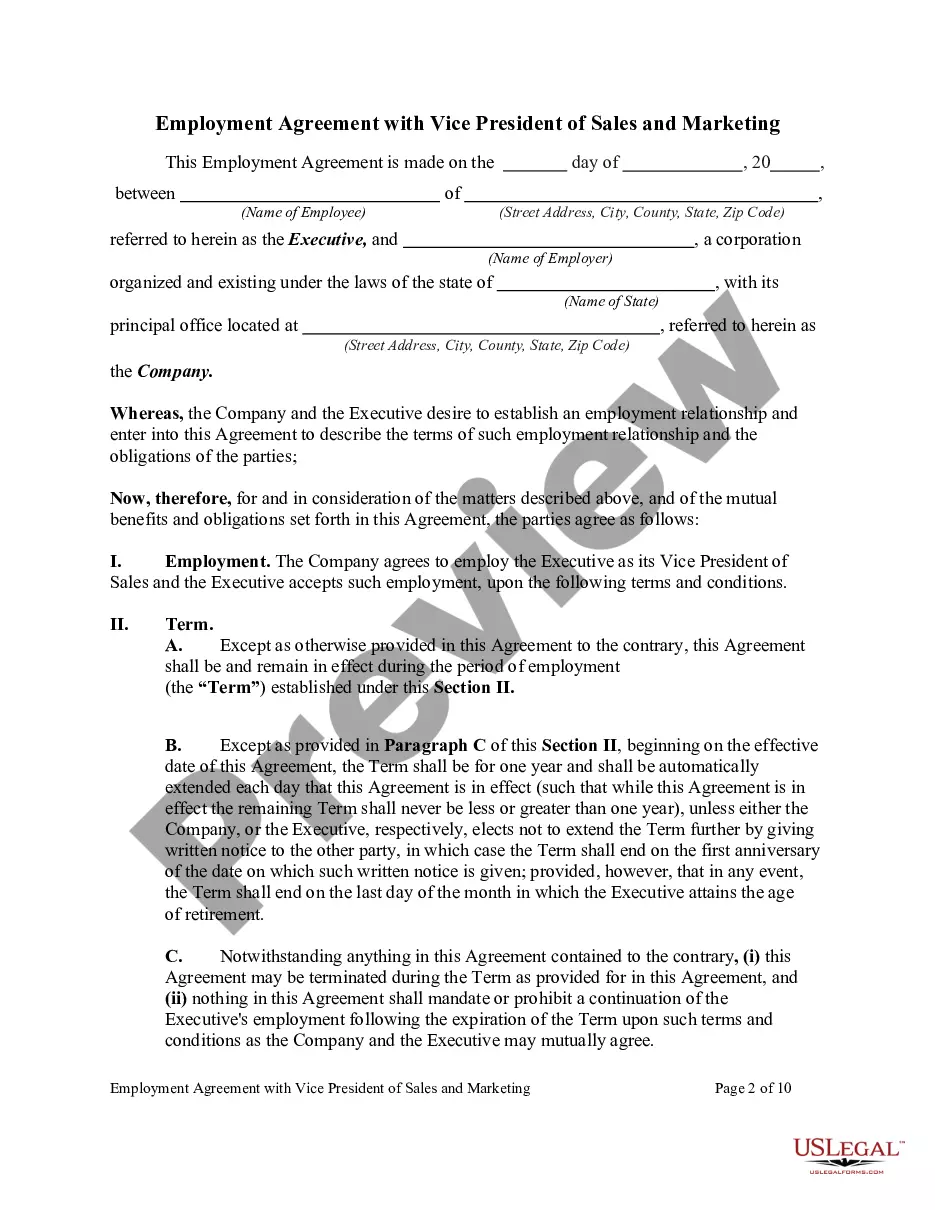

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Houston Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the latest version of the Houston Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Houston Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Houston Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!