Maricopa Arizona Sample Letter for Delinquent Taxes

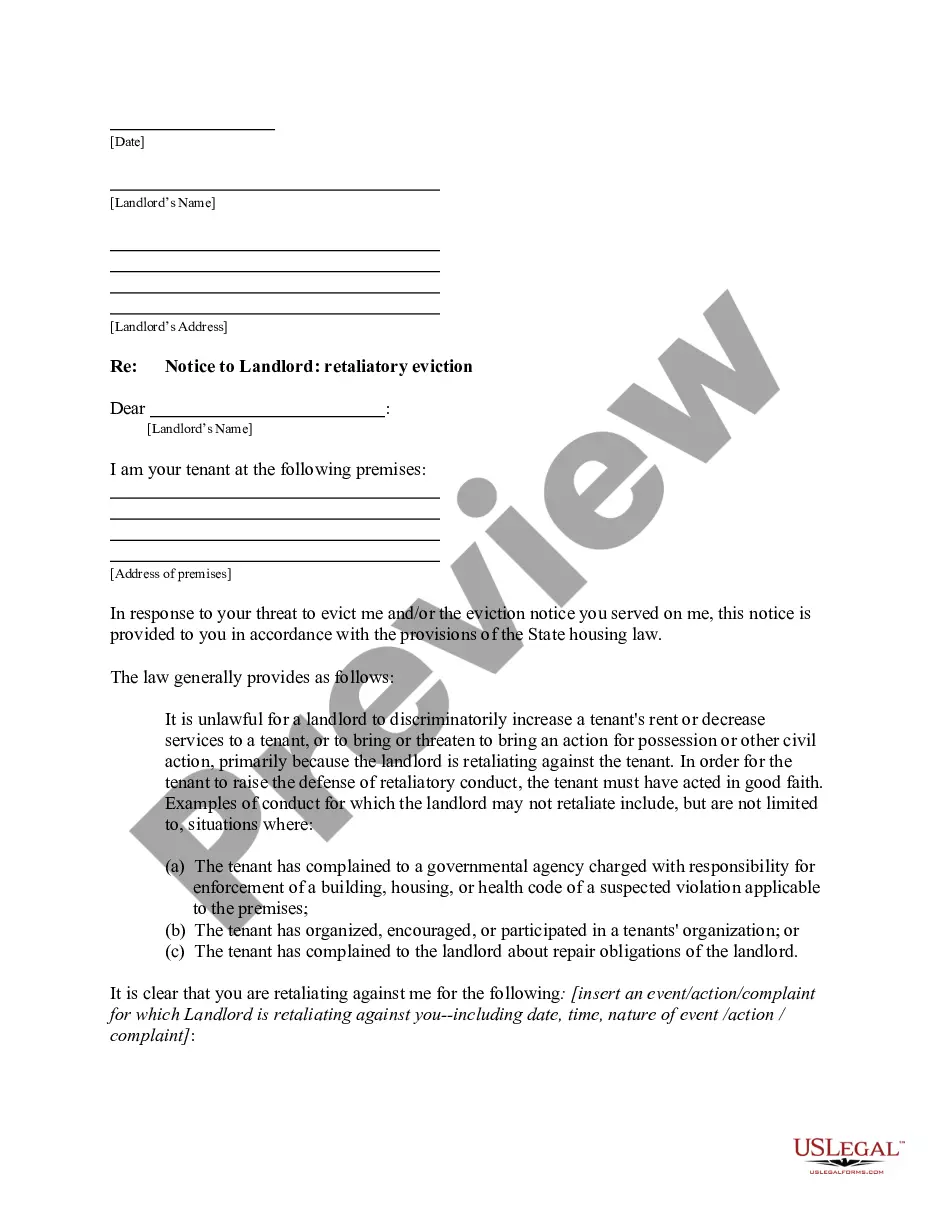

Description

How to fill out Sample Letter For Delinquent Taxes?

Legislation and rules in every sector vary across the nation.

If you are not an attorney, it's simple to become confused by the different standards when it comes to creating legal documents.

To prevent expensive legal help when crafting the Maricopa Sample Letter for Unpaid Taxes, you require a validated template applicable to your area.

This is the simplest and most cost-effective approach to obtain current templates for any legal needs. Find them all in a few clicks and maintain your paperwork organized with US Legal Forms!

- Review the page content to make sure you have located the suitable template.

- Use the Preview feature or examine the form description if available.

- Look for an alternative document if there are discrepancies with any of your criteria.

- Click the Buy Now button to acquire the document once you identify the correct one.

- Choose one of the subscription options and Log In or create an account.

- Select how you wish to pay for your subscription (via credit card or PayPal).

- Choose the format you want to store the document in and click Download.

- Fill out and sign the document physically after printing it or complete it all digitally.

Form popularity

FAQ

Property tax statements are mailed in September of each year. (You can also view your property tax statement online at you will need to input your property's assessor number.) Keep in mind that you are receiving your tax bill for the current year. In other words, taxes are paid in arrears.

Mail your payment You may send your check or money order using the envelope and remittance document you received in the mail. Or you may print your tax statement on-line by entering your parcel number here. Please allow 3-5 business days for the payment to post to the Treasurer's database.

Tax Lien Sale The sale takes place in early February of each year online at . Please read the disclaimer before deciding to bid, and see our lien FAQ Page and Lien History Page.

Property owners are required to pay their property taxes on time. If an owner fails to pay on time, the unpaid portion will be considered delinquent and incur a 10% penalty charge and, in the case of second installment, a one-time administrative fee.

Property tax statements are mailed in September of each year. (You can also view your property tax statement online at you will need to input your property's assessor number.) Keep in mind that you are receiving your tax bill for the current year. In other words, taxes are paid in arrears.

Under the deferral program, payment of property taxes is not required until the real property is sold or the person dies or the property becomes income producing. Third, under Proposition 104, which passed in 2000, qualified individuals are granted a property tax freeze.

Arizona is a tax lien state that pays an annualized rate of return of up to 16%. If you don't get paid, you get the property, and you get it without a mortgage. Arizona has 15 counties, and in Maricopa County alone, they could have 15,000 or more tax lien certificates available.

Arizona law allows an investor to receive up to 16% interest per annum on the tax lien certificate. The bidder with the lowest bid on the interest rate wins the auction on each lien. If you are the successful bidder, you pay the outstanding taxes and receive a tax lien certificate.

Tax Lien Sale The sale takes place in early February of each year online at . Please read the disclaimer before deciding to bid, and see our lien FAQ Page and Lien History Page.

Stat. § 42-18152). Once three years pass, the person or entity that bought the lien at the tax sale can start an action in court to foreclose the right to redeem and get title to your home.