Subject: Important Notice Regarding Delinquent Taxes — San Antonio, Texas Dear [Taxpayer's Name], We hope this letter finds you in good health and high spirits. We are writing to inform you about the outstanding tax balance owed on your property in the beautiful city of San Antonio, Texas. It has come to our attention that there is a delinquency in paying your property taxes, which requires immediate attention to avoid further penalties and potential legal actions. In San Antonio, as in any other municipality, property taxes play a vital role in funding essential public services such as education, infrastructure, and community development. Your contribution ensures the continued growth and prosperity of our great city. The purpose of this letter is to serve as a reminder of the current status of your property taxes. As per our records, the total amount due is [Total Amount]. The detailed breakdown of your delinquent taxes is as follows: 1. City Taxes: [Amount] 2. County Taxes: [Amount] 3. School District Taxes: [Amount] 4. Additional fees and interest: [Amount] It is important to note that failure to address this matter promptly will lead to further consequences, including: 1. Accrual of interest and penalties on the outstanding amount. 2. Placement of a tax lien on your property, which could negatively impact your credit rating. 3. Possible initiation of foreclosure proceedings. To avoid these unwanted outcomes, we highly encourage you to take immediate action and resolve the delinquent taxes. Below are the available options for settling the outstanding amount: 1. Pay in full: Submit the full amount due [Amount] by [Due Date]. You can make the payment online through our secure portal at [URL], or alternatively, visit our office in person during business hours. 2. Installment Plan: If paying in full is not feasible for you, we offer the option to set up a monthly installment plan. You can contact our office directly at [Contact Number] to discuss the terms and conditions and arrange a mutually suitable payment schedule. Please be aware that time is of the essence. Ignoring this notice or failing to take action may lead to more severe consequences. We strongly advise you to consult with a financial advisor or attorney to understand the potential implications and explore available alternatives. For your convenience, our office is open from [Working Hours] on weekdays, and our dedicated customer service representatives are ready to assist you with any questions or concerns you may have. We appreciate your attention to this matter and your prompt action in resolving the delinquent taxes on your property. The City of San Antonio greatly values your commitment to being a responsible member of our community. Thank you for your cooperation. Sincerely, [Your Name] [Title] [City of San Antonio Tax Department] [Contact Information]

San Antonio Texas Sample Letter for Delinquent Taxes

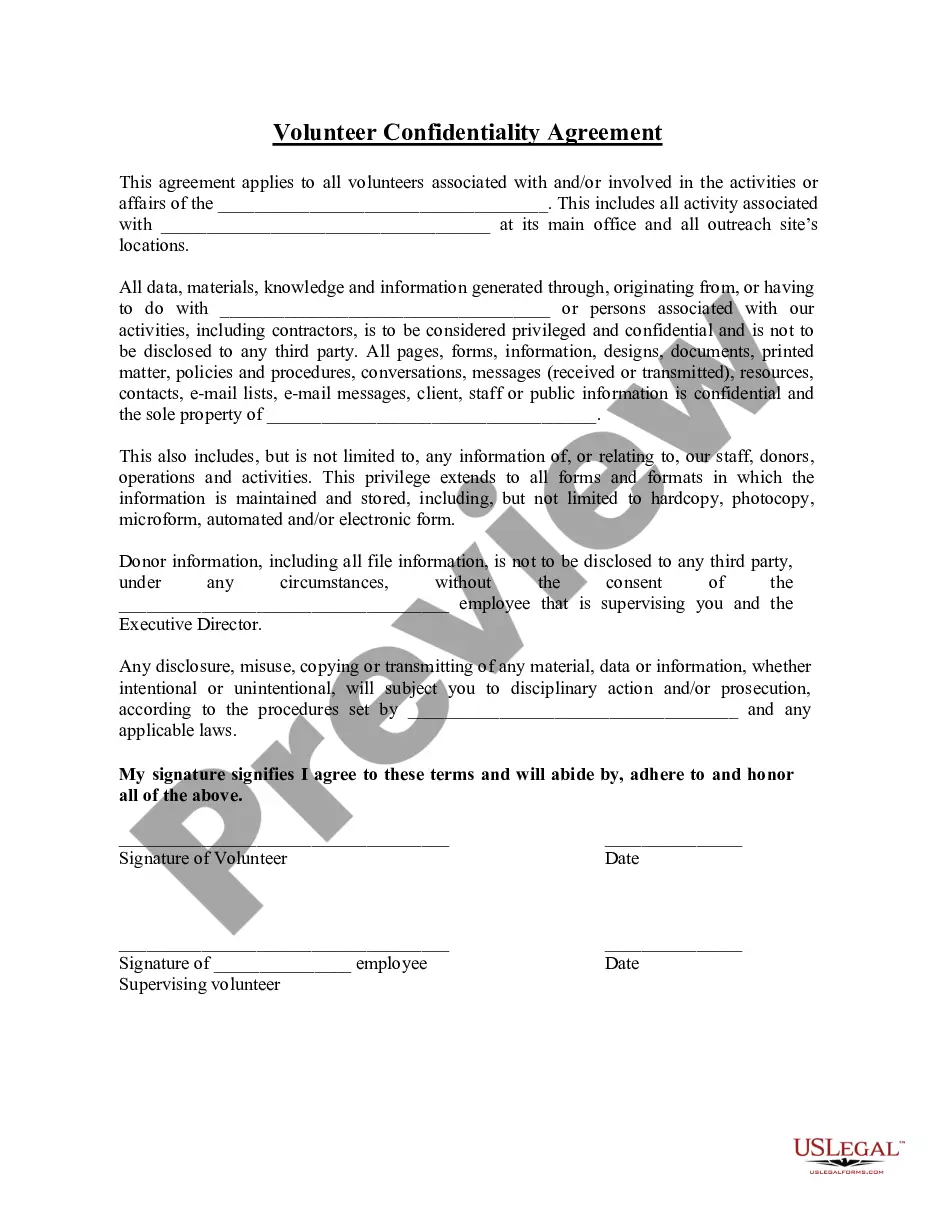

Description

How to fill out San Antonio Texas Sample Letter For Delinquent Taxes?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Antonio Sample Letter for Delinquent Taxes, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the current version of the San Antonio Sample Letter for Delinquent Taxes, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Sample Letter for Delinquent Taxes:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your San Antonio Sample Letter for Delinquent Taxes and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!