Subject: San Diego California Sample Letter for Delinquent Taxes — Take Prompt Action Today! Dear [Taxpayer's Name], RE: NOTICE OF DELINQUENT TAXES — URGENT ACTION REQUIRED We hope this letter finds you in good health and high spirits. As part of the San Diego County Taxation Office, it is our responsibility to ensure that all taxpayers promptly fulfill their civic duty by paying their property taxes. We regret to inform you that our records indicate a delinquency in your property tax payment for the fiscal year [year]. To address this pressing matter, we kindly request your immediate attention to resolve the outstanding balance with utmost urgency. Non-payment or late payment of property taxes can lead to severe consequences, including penalties, interest charges, and potential legal action. San Diego, California, renowned for its picturesque coastline, thriving economy, and vibrant community, takes great pride in offering a range of public amenities and services. The taxes collected ensure the efficient functioning of local schools, infrastructure development, public safety initiatives, and social programs that benefit every resident and enhance our city's appeal. In light of your overdue tax payment, we have prepared a San Diego California Sample Letter for Delinquent Taxes to assist you in adhering to your tax obligations. This sample letter serves as a template to communicate with our office and includes essential information regarding your unpaid balance, payment options, and possible consequences if prompt action is not taken. We strongly advise customizing the letter to include your account specifics before mailing it to our office. Different Types of San Diego California Sample Letter for Delinquent Taxes: 1. Initial Notice of Delinquency: Sent when a property tax balance remains outstanding beyond the due date or grace period. This letter serves as a reminder and urges prompt payment. 2. Warning Notice: Issued if no response or payment is received after the initial notice. This notice outlines the potential consequences of non-payment and emphasizes the importance of immediate payment. 3. Final Notice of Delinquency: Sent as a final attempt to secure payment. This notice states the total amount due, including any accrued interest and penalties. Failure to resolve the outstanding balance may result in further collection efforts, enforced liens, or property seizure. Please understand that the prompt resolution of this issue is essential to avoid further complications. We encourage you to seize this opportunity to reconcile your delinquent taxes by referring to the San Diego California Sample Letter for Delinquent Taxes attached to this mailing or by contacting our office directly for further guidance. In the interest of assisting you, we remain committed to providing support and answering any questions you may have regarding payment plans, potential tax exemptions, or other available alternatives. Act now and demonstrate your commitment to fulfilling your civic duty. Pay your delinquent taxes promptly, ensuring a brighter future for San Diego and your property's continued prosperity. Thank you for your prompt attention to this matter. Sincerely, [Your Name] [Your Title] San Diego County Taxation Office

San Diego California Sample Letter for Delinquent Taxes

Description

How to fill out San Diego California Sample Letter For Delinquent Taxes?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the San Diego Sample Letter for Delinquent Taxes, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Diego Sample Letter for Delinquent Taxes from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Diego Sample Letter for Delinquent Taxes:

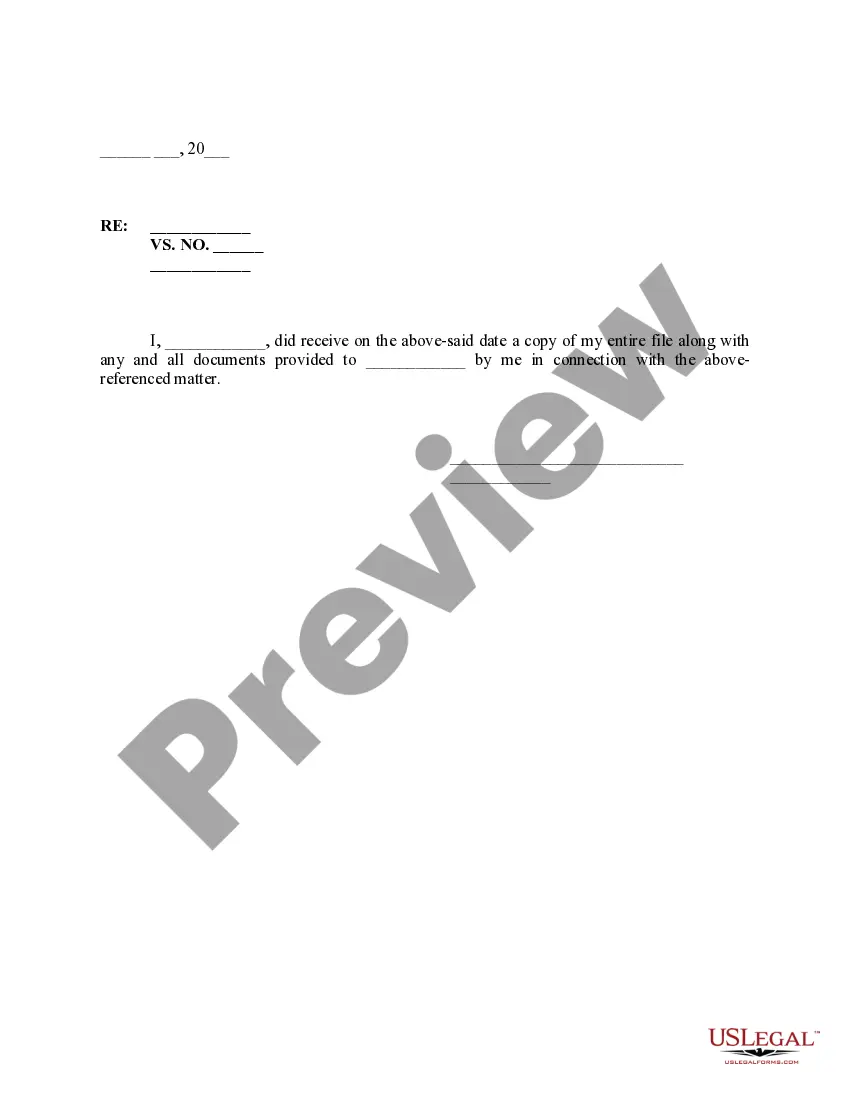

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!