[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP Code] Subject: San Jose California Sample Letter for Delinquent Taxes Dear [Recipient's Name], I hope this letter finds you well. I am writing to discuss the matter of delinquent taxes in the beautiful city of San Jose, California. As a responsible citizen, it is essential to address any outstanding tax obligations promptly to avoid potential legal consequences and further financial burdens. San Jose, located in Silicon Valley, is the largest city in Northern California and serves as the economic, cultural, and political center of the region. With its booming tech industry, vibrant arts scene, and diverse population, San Jose offers its residents and businesses numerous opportunities for growth and success. However, it is crucial to uphold our civic duty by fulfilling our tax obligations accurately and punctually. In certain circumstances, individuals or businesses may have difficulty meeting their tax obligations, leading to delinquency. If you find yourself in such a situation, it is important to take immediate action to rectify this issue. Sample Letter Types for Delinquent Taxes: 1. Initial Notice (Friendly Reminder): In this type of sample letter, the purpose is to provide a gentle reminder regarding the delinquent taxes. It informs the recipient of the outstanding balance, penalties, and the importance of addressing the issue promptly. 2. Second Notice (Demand for Payment): If the initial notice fails to yield any response or payment, a more assertive approach may be necessary. This type of letter emphasizes the consequences of continued delinquency, urges immediate payment, and may include the details of potential legal actions. 3. Final Notice (Legal Warning): When previous notices are ignored, this type of letter serves as a final warning before legal action. It informs the recipient about the impending consequences, such as tax liens, wage garnishment, or property seizures, if the delinquent taxes remain unpaid. 4. Installment Agreement Proposal: In cases where immediate payment of the outstanding balance is not feasible, individuals or businesses can propose a structured payment plan. This letter outlines the proposed installment agreement terms, including monthly payments, interest, and penalties, allowing the delinquent taxpayer to gradually satisfy their tax liabilities. Remember, it is important to consult a tax professional or contact the San Jose Revenue Division directly to ensure appropriate guidance tailored to your specific circumstances. Ignoring delinquent taxes can worsen the situation and lead to more severe consequences. In conclusion, addressing delinquent taxes in San Jose, California, is a responsibility that should not be taken lightly. By taking timely and appropriate action, you can rectify this issue, avoid legal complications, and continue to contribute to the prosperity of our vibrant city. Thank you for your attention to this matter. Sincerely, [Your Name]

San Jose California Sample Letter for Delinquent Taxes

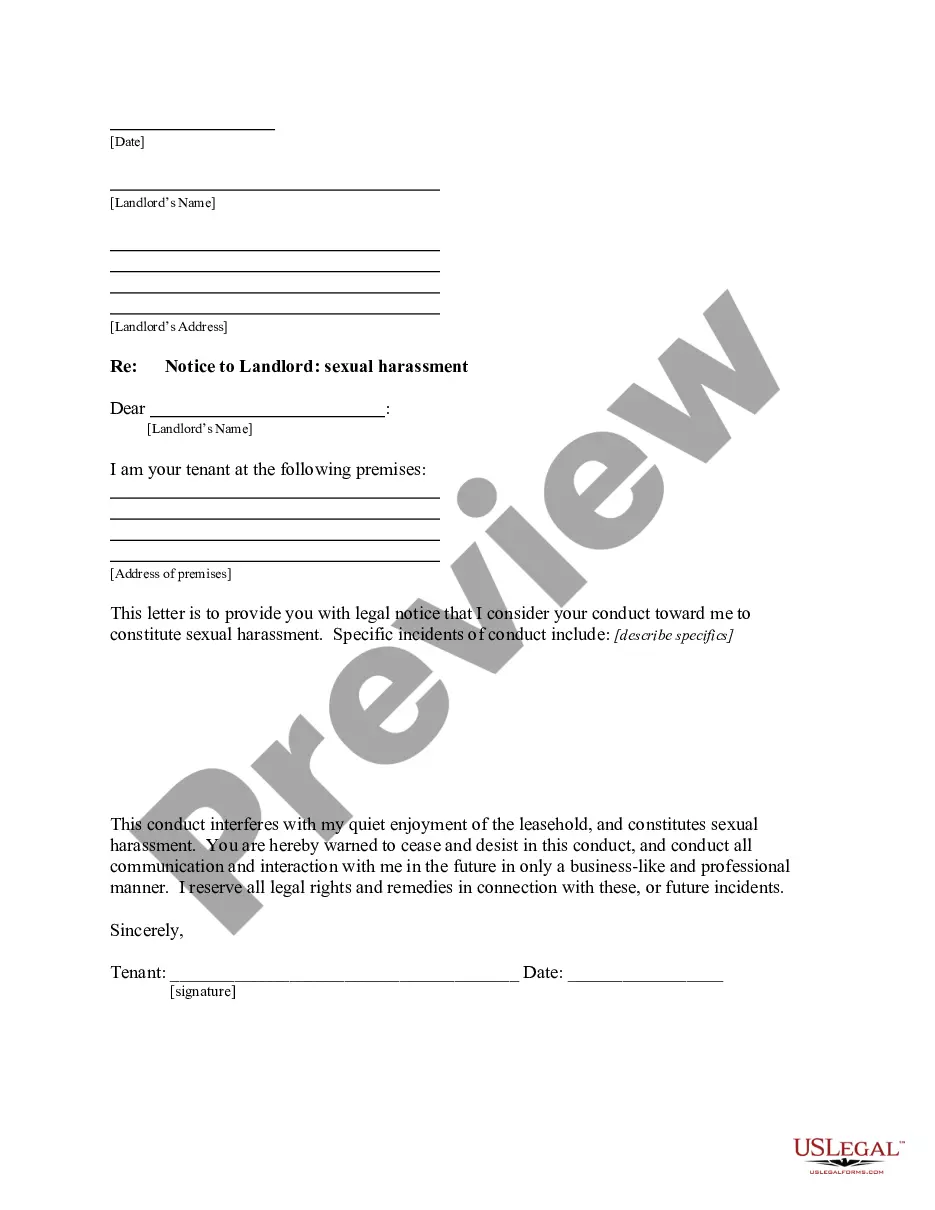

Description

How to fill out San Jose California Sample Letter For Delinquent Taxes?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business objective utilized in your county, including the San Jose Sample Letter for Delinquent Taxes.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the San Jose Sample Letter for Delinquent Taxes will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the San Jose Sample Letter for Delinquent Taxes:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the San Jose Sample Letter for Delinquent Taxes on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!