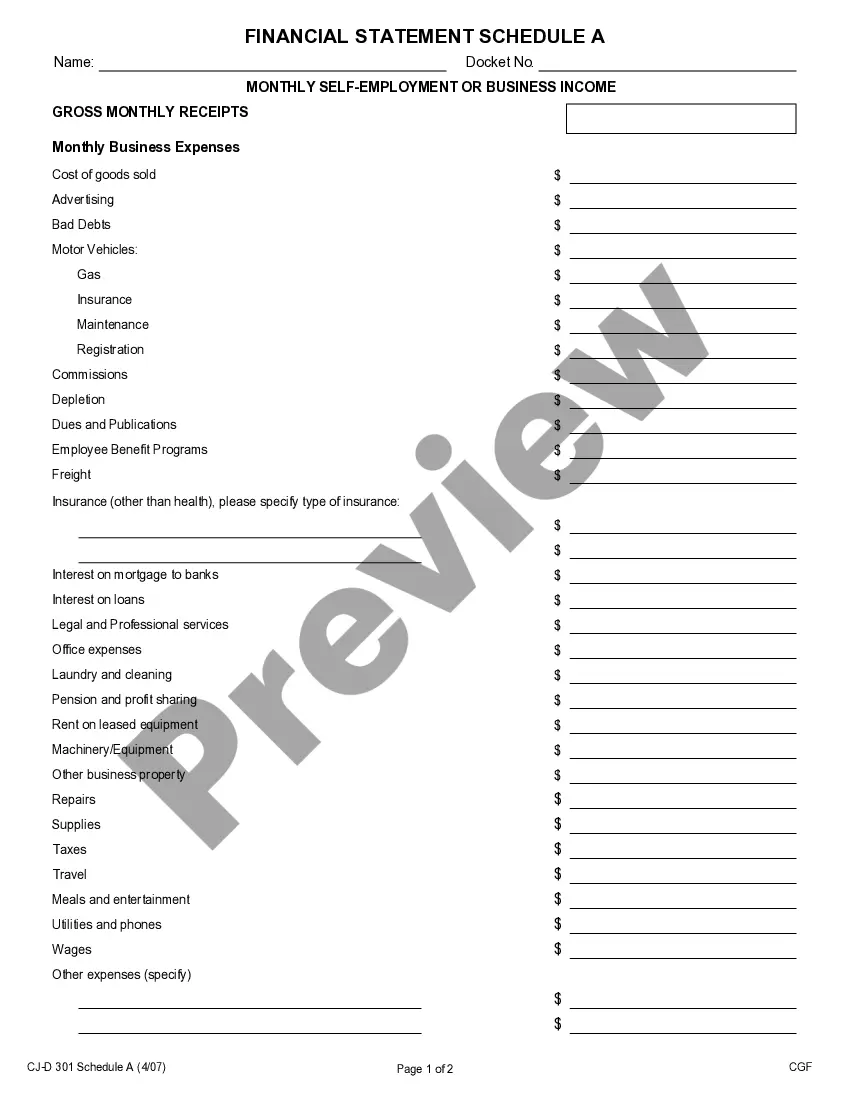

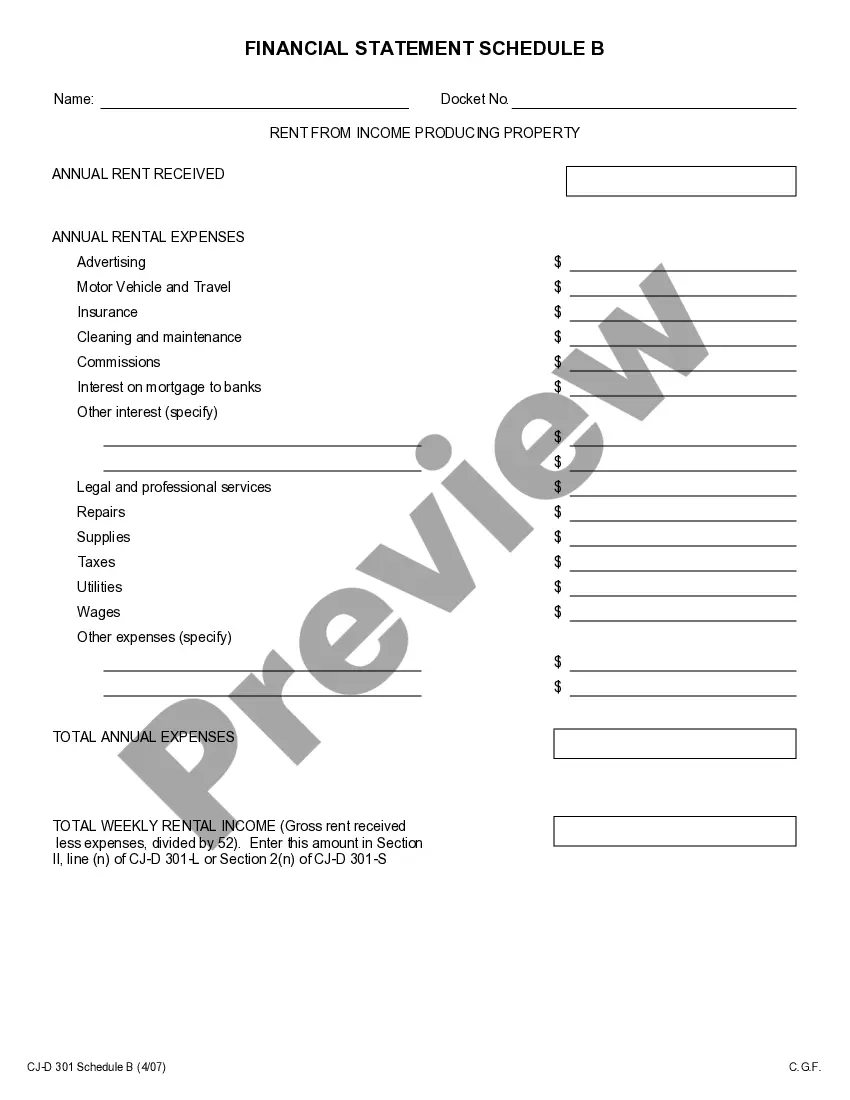

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Kings New York Income Statement is a financial document that provides a detailed overview of the revenue, expenses, and profitability of Kings New York, a company operating in New York. It helps to analyze and assess the financial performance of the company over a specific period, usually quarterly or annually. The income statement showcases the company's ability to generate revenue, manage expenses, and determine its net income or loss. Keywords: Kings New York, income statement, financial document, revenue, expenses, profitability, financial performance, net income, loss. There are different types of income statements that Kings New York might utilize: 1. Single-Step Income Statement: This type of income statement presents revenue and gains followed by expenses and losses, resulting directly in the calculation of net income or loss. It is a straightforward and concise format. 2. Multi-Step Income Statement: Unlike the single-step income statement, the multi-step format presents multiple subtotals before reaching the net income or loss figure. It categorizes revenue, cost of goods sold, operating expenses, and non-operating expenses separately, providing more detailed insights into the company's financial performance. 3. Comparative Income Statement: This type of income statement compares the financial data of Kings New York over different periods, typically year-on-year or quarter-on-quarter. It allows stakeholders to evaluate trends, identify growth or decline patterns, and make informed decisions based on historical data. 4. Projected Income Statement: A projected income statement estimates the future financial performance of Kings New York based on anticipated revenues, expected expenses, and assumptions. It helps in forecasting profitability and planning potential strategies. 5. Consolidated Income Statement: If Kings New York has multiple subsidiaries or business units, a consolidated income statement gathers the financial results of these entities to provide a comprehensive view of the organization's overall performance. By regularly preparing and analyzing income statements, Kings New York can gain valuable insights into its financial health, identify strengths and weaknesses, assess profitability, and make data-driven decisions to drive growth and success.Kings New York Income Statement is a financial document that provides a detailed overview of the revenue, expenses, and profitability of Kings New York, a company operating in New York. It helps to analyze and assess the financial performance of the company over a specific period, usually quarterly or annually. The income statement showcases the company's ability to generate revenue, manage expenses, and determine its net income or loss. Keywords: Kings New York, income statement, financial document, revenue, expenses, profitability, financial performance, net income, loss. There are different types of income statements that Kings New York might utilize: 1. Single-Step Income Statement: This type of income statement presents revenue and gains followed by expenses and losses, resulting directly in the calculation of net income or loss. It is a straightforward and concise format. 2. Multi-Step Income Statement: Unlike the single-step income statement, the multi-step format presents multiple subtotals before reaching the net income or loss figure. It categorizes revenue, cost of goods sold, operating expenses, and non-operating expenses separately, providing more detailed insights into the company's financial performance. 3. Comparative Income Statement: This type of income statement compares the financial data of Kings New York over different periods, typically year-on-year or quarter-on-quarter. It allows stakeholders to evaluate trends, identify growth or decline patterns, and make informed decisions based on historical data. 4. Projected Income Statement: A projected income statement estimates the future financial performance of Kings New York based on anticipated revenues, expected expenses, and assumptions. It helps in forecasting profitability and planning potential strategies. 5. Consolidated Income Statement: If Kings New York has multiple subsidiaries or business units, a consolidated income statement gathers the financial results of these entities to provide a comprehensive view of the organization's overall performance. By regularly preparing and analyzing income statements, Kings New York can gain valuable insights into its financial health, identify strengths and weaknesses, assess profitability, and make data-driven decisions to drive growth and success.