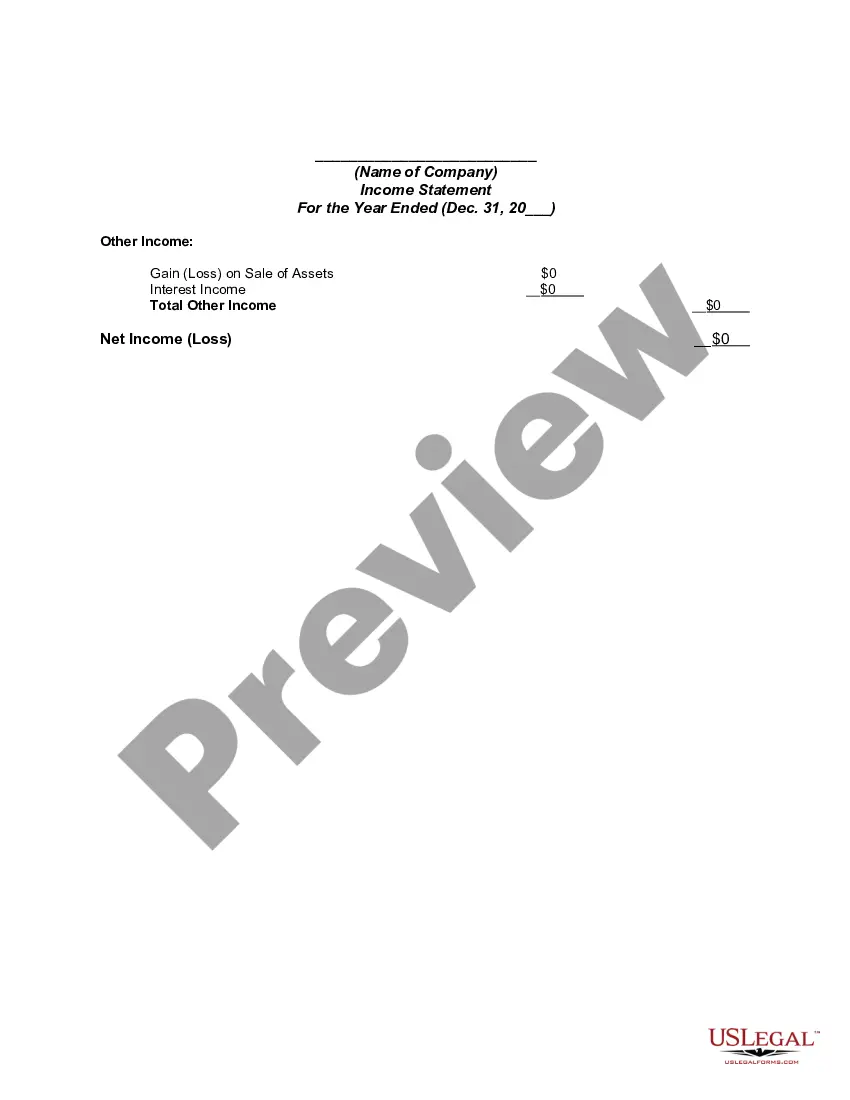

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Philadelphia Pennsylvania Income Statement is a financial document that provides a comprehensive overview of the income and expenses incurred by individuals, businesses, or organizations operating in Philadelphia, Pennsylvania. It presents a detailed breakdown of revenues, costs, gains, and losses, giving an accurate representation of financial performance within a specified period. This income statement serves as a crucial tool for assessing the financial health of entities in Philadelphia, enabling them to make informed decisions and evaluate profitability. It is typically prepared annually, although some businesses might produce them quarterly or monthly to monitor fiscal progress. The Philadelphia Pennsylvania Income Statement typically includes the following key elements: 1. Revenues: This section highlights all sources of income generated within the reporting period. It encompasses sales revenue, service fees, rental income, and any other earnings resulting from the entity's operations. 2. Costs of Goods Sold (COGS): These are the direct expenses directly incurred in producing or acquiring the goods or services sold. COGS include raw materials, manufacturing costs, and labor expenses related to the production process. 3. Operating Expenses: These are expenses associated with day-to-day business activities, such as rent, utilities, salaries, marketing expenses, and insurance costs. Operating expenses also cover administrative and general expenses necessary for the entity's operations. 4. Gross Profit: This represents the revenue remaining after subtracting the COGS from total revenue. Gross profit indicates the profitability of the core business activities before considering operating expenses. 5. Operating Income: Calculated by subtracting operating expenses from gross profit, operating income reflects the profitability of ongoing operations. It represents the revenue generated after accounting for both the direct costs and overhead expenses. 6. Other Income and Expenses: This section includes revenue or expenses not directly connected to the primary business activities. Examples may include gains or losses from investments, interest income, or one-time non-recurring expenses. 7. Net Income: This represents the entity's final profit or loss for the reporting period. It is calculated by subtracting total expenses from total revenue. A positive net income indicates profitability, while a negative result signifies a loss. Different types of Philadelphia Pennsylvania Income Statements may vary based on factors such as the nature of the business, legal structure, and industry-specific requirements. However, the underlying components mentioned above remain consistent across most income statements. By analyzing Philadelphia Pennsylvania Income Statements, individuals and organizations gain insights into their financial performance and can identify areas requiring improvement or adjustments. Furthermore, these statements are valuable for complying with tax regulations, securing financing, attracting investors, and providing transparency to stakeholders.Philadelphia Pennsylvania Income Statement is a financial document that provides a comprehensive overview of the income and expenses incurred by individuals, businesses, or organizations operating in Philadelphia, Pennsylvania. It presents a detailed breakdown of revenues, costs, gains, and losses, giving an accurate representation of financial performance within a specified period. This income statement serves as a crucial tool for assessing the financial health of entities in Philadelphia, enabling them to make informed decisions and evaluate profitability. It is typically prepared annually, although some businesses might produce them quarterly or monthly to monitor fiscal progress. The Philadelphia Pennsylvania Income Statement typically includes the following key elements: 1. Revenues: This section highlights all sources of income generated within the reporting period. It encompasses sales revenue, service fees, rental income, and any other earnings resulting from the entity's operations. 2. Costs of Goods Sold (COGS): These are the direct expenses directly incurred in producing or acquiring the goods or services sold. COGS include raw materials, manufacturing costs, and labor expenses related to the production process. 3. Operating Expenses: These are expenses associated with day-to-day business activities, such as rent, utilities, salaries, marketing expenses, and insurance costs. Operating expenses also cover administrative and general expenses necessary for the entity's operations. 4. Gross Profit: This represents the revenue remaining after subtracting the COGS from total revenue. Gross profit indicates the profitability of the core business activities before considering operating expenses. 5. Operating Income: Calculated by subtracting operating expenses from gross profit, operating income reflects the profitability of ongoing operations. It represents the revenue generated after accounting for both the direct costs and overhead expenses. 6. Other Income and Expenses: This section includes revenue or expenses not directly connected to the primary business activities. Examples may include gains or losses from investments, interest income, or one-time non-recurring expenses. 7. Net Income: This represents the entity's final profit or loss for the reporting period. It is calculated by subtracting total expenses from total revenue. A positive net income indicates profitability, while a negative result signifies a loss. Different types of Philadelphia Pennsylvania Income Statements may vary based on factors such as the nature of the business, legal structure, and industry-specific requirements. However, the underlying components mentioned above remain consistent across most income statements. By analyzing Philadelphia Pennsylvania Income Statements, individuals and organizations gain insights into their financial performance and can identify areas requiring improvement or adjustments. Furthermore, these statements are valuable for complying with tax regulations, securing financing, attracting investors, and providing transparency to stakeholders.