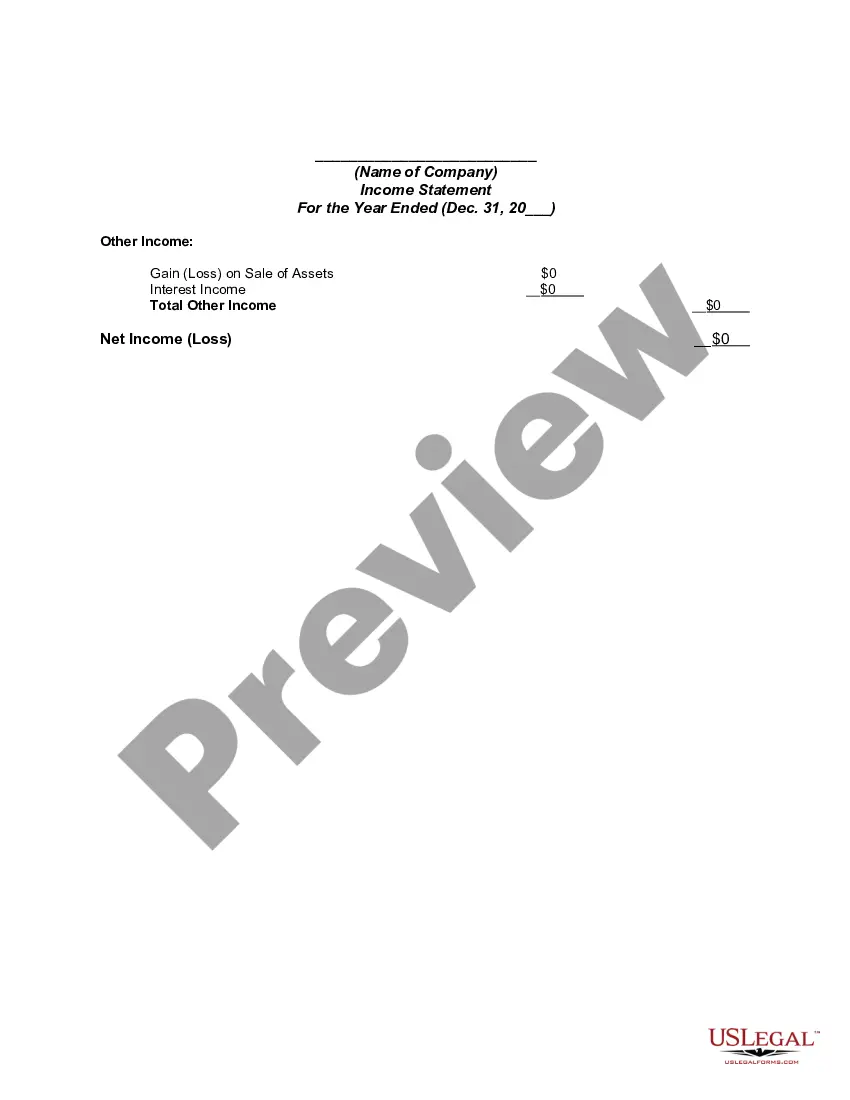

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

San Bernardino California Income Statement is a financial document that presents the financial performance of individuals, businesses, or organizations residing in San Bernardino, California. It provides a summary of revenues, expenses, gains, and losses during a specific period, typically on a monthly, quarterly, or annual basis. A San Bernardino California Income Statement is a crucial tool to analyze the financial health and profitability of an individual or entity operating within the region. Keywords: San Bernardino, California, income statement, financial document, financial performance, revenues, expenses, gains, losses, specific period, monthly, quarterly, annual, financial health, profitability, region. There are different types of San Bernardino California Income Statements that cater to various entities and purposes. Some of these include: 1. Individual Income Statement: This type of income statement is specific to individuals residing in San Bernardino, California. It outlines the sources of income, such as salaries, wages, investments, and rentals, along with expenses and deductions, such as taxes, mortgage/rent payments, utilities, and other personal expenses. The individual income statement helps individuals evaluate their financial position and aids in tax planning. 2. Business Income Statement: This type of income statement is applicable to businesses operating in San Bernardino, California. It reflects revenues generated from sales of goods or services, cost of goods sold, operating expenses, non-operating income, and any extraordinary items. The business income statement is vital for assessing profitability, making informed decisions, securing loans, and attracting investors. 3. Non-Profit Organization Income Statement: Non-profit organizations based in San Bernardino, California utilizes this type of income statement. It highlights revenue sources such as donations, grants, and membership fees, while outlining expenses related to program delivery, administration, fundraising, and other activities. The non-profit organization income statement helps assess the organization's financial sustainability and fulfill the reporting requirements of stakeholders. 4. Government Agency Income Statement: Government agencies operating in San Bernardino, California prepare income statements to track revenue sources like taxes, fees, fines, and grants, along with expenses incurred in delivering public services. These income statements aid in evaluating the financial efficiency of government agencies and serve as transparency tools for taxpayers. 5. Educational Institution Income Statement: Educational institutions in San Bernardino, California maintain income statements that outline revenue sources like tuition fees, grants, endowments, and expenses related to salaries, infrastructure, educational materials, and student services. These income statements help assess the financial viability of educational institutions and ensure proper allocation of resources. Keywords: Individual Income Statement, Business Income Statement, Non-Profit Organization Income Statement, Government Agency Income Statement, Educational Institution Income Statement.San Bernardino California Income Statement is a financial document that presents the financial performance of individuals, businesses, or organizations residing in San Bernardino, California. It provides a summary of revenues, expenses, gains, and losses during a specific period, typically on a monthly, quarterly, or annual basis. A San Bernardino California Income Statement is a crucial tool to analyze the financial health and profitability of an individual or entity operating within the region. Keywords: San Bernardino, California, income statement, financial document, financial performance, revenues, expenses, gains, losses, specific period, monthly, quarterly, annual, financial health, profitability, region. There are different types of San Bernardino California Income Statements that cater to various entities and purposes. Some of these include: 1. Individual Income Statement: This type of income statement is specific to individuals residing in San Bernardino, California. It outlines the sources of income, such as salaries, wages, investments, and rentals, along with expenses and deductions, such as taxes, mortgage/rent payments, utilities, and other personal expenses. The individual income statement helps individuals evaluate their financial position and aids in tax planning. 2. Business Income Statement: This type of income statement is applicable to businesses operating in San Bernardino, California. It reflects revenues generated from sales of goods or services, cost of goods sold, operating expenses, non-operating income, and any extraordinary items. The business income statement is vital for assessing profitability, making informed decisions, securing loans, and attracting investors. 3. Non-Profit Organization Income Statement: Non-profit organizations based in San Bernardino, California utilizes this type of income statement. It highlights revenue sources such as donations, grants, and membership fees, while outlining expenses related to program delivery, administration, fundraising, and other activities. The non-profit organization income statement helps assess the organization's financial sustainability and fulfill the reporting requirements of stakeholders. 4. Government Agency Income Statement: Government agencies operating in San Bernardino, California prepare income statements to track revenue sources like taxes, fees, fines, and grants, along with expenses incurred in delivering public services. These income statements aid in evaluating the financial efficiency of government agencies and serve as transparency tools for taxpayers. 5. Educational Institution Income Statement: Educational institutions in San Bernardino, California maintain income statements that outline revenue sources like tuition fees, grants, endowments, and expenses related to salaries, infrastructure, educational materials, and student services. These income statements help assess the financial viability of educational institutions and ensure proper allocation of resources. Keywords: Individual Income Statement, Business Income Statement, Non-Profit Organization Income Statement, Government Agency Income Statement, Educational Institution Income Statement.