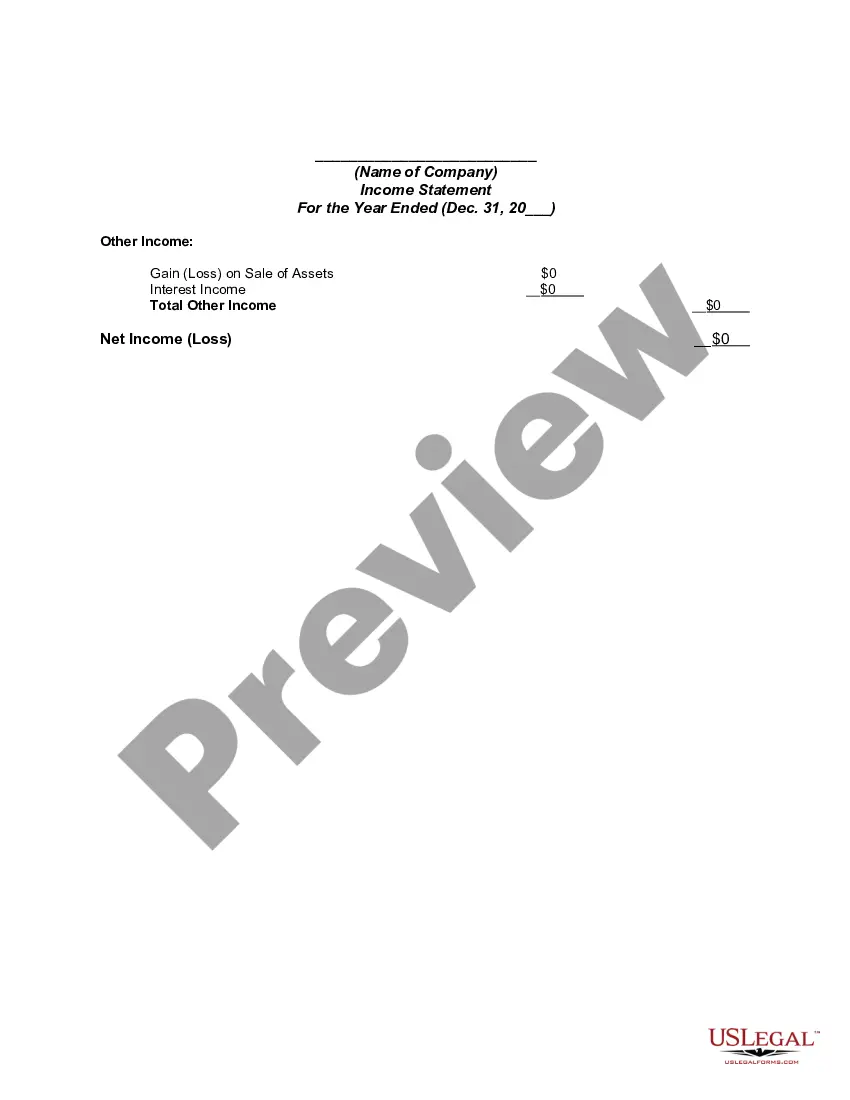

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Travis Texas Income Statement is a financial document that provides a detailed summary of the financial performance of Travis County, Texas over a specific period. It demonstrates the organization's revenue, expenses, gains, and losses, resulting in either a net profit or net loss for the given time frame. The Travis Texas Income Statement follows a specific format, typically consisting of various sections that help stakeholders understand the county's financial health. These sections may include: 1. Revenue: This section records the various income sources for Travis County, such as taxes, grants, fees, and fines. It showcases the total revenue generated during the period under consideration. 2. Operating Expenses: Here, all the county's regular and recurring expenses are listed, such as personnel costs, maintenance expenses, supplies, utilities, and other day-to-day expenditures. This section helps evaluate the efficiency of Travis County's operations. 3. Non-operating Revenue and Expenses: Travis County might have additional revenues or expenses that are not directly related to its core operations. Non-operating revenue can include investment income or proceeds from the sale of assets, while non-operating expenses may encompass interest payments, legal charges, or losses from investments. 4. Gains and Losses: This section includes any extraordinary gains or losses incurred during the reporting period. For example, Travis County might have gains from the sale of land or property or losses due to natural disasters, litigation, or impairment charges. 5. Net Income or Loss: The bottom line of the income statement reflects the overall financial performance of Travis County for the period. If the total revenue exceeds the total expenses, it indicates a net profit, while if expenses surpass revenue, it signifies a net loss. Different types of Travis Texas Income Statements may include: 1. Consolidated Income Statement: This statement consolidates the financial data from various departments, agencies, or districts within Travis County and presents a comprehensive overview of the county's financial performance. 2. Departmental Income Statements: A county may split its income statement into departmental statements, providing a breakdown of revenue, expenses, and net income or loss for each specific department. This approach allows for a granular analysis of individual unit performances within Travis County. 3. Comparative Income Statements: A comparative income statement compares financial data across multiple periods, such as year-to-year or quarter-to-quarter. It enables stakeholders to assess the financial progress, identify trends, and evaluate the effectiveness of Travis County's financial strategies over time. Understanding the Travis Texas Income Statement is crucial for decision-makers, county officials, taxpayers, and investors as it offers valuable insights into the financial well-being and efficiency of Travis County, Texas.Travis Texas Income Statement is a financial document that provides a detailed summary of the financial performance of Travis County, Texas over a specific period. It demonstrates the organization's revenue, expenses, gains, and losses, resulting in either a net profit or net loss for the given time frame. The Travis Texas Income Statement follows a specific format, typically consisting of various sections that help stakeholders understand the county's financial health. These sections may include: 1. Revenue: This section records the various income sources for Travis County, such as taxes, grants, fees, and fines. It showcases the total revenue generated during the period under consideration. 2. Operating Expenses: Here, all the county's regular and recurring expenses are listed, such as personnel costs, maintenance expenses, supplies, utilities, and other day-to-day expenditures. This section helps evaluate the efficiency of Travis County's operations. 3. Non-operating Revenue and Expenses: Travis County might have additional revenues or expenses that are not directly related to its core operations. Non-operating revenue can include investment income or proceeds from the sale of assets, while non-operating expenses may encompass interest payments, legal charges, or losses from investments. 4. Gains and Losses: This section includes any extraordinary gains or losses incurred during the reporting period. For example, Travis County might have gains from the sale of land or property or losses due to natural disasters, litigation, or impairment charges. 5. Net Income or Loss: The bottom line of the income statement reflects the overall financial performance of Travis County for the period. If the total revenue exceeds the total expenses, it indicates a net profit, while if expenses surpass revenue, it signifies a net loss. Different types of Travis Texas Income Statements may include: 1. Consolidated Income Statement: This statement consolidates the financial data from various departments, agencies, or districts within Travis County and presents a comprehensive overview of the county's financial performance. 2. Departmental Income Statements: A county may split its income statement into departmental statements, providing a breakdown of revenue, expenses, and net income or loss for each specific department. This approach allows for a granular analysis of individual unit performances within Travis County. 3. Comparative Income Statements: A comparative income statement compares financial data across multiple periods, such as year-to-year or quarter-to-quarter. It enables stakeholders to assess the financial progress, identify trends, and evaluate the effectiveness of Travis County's financial strategies over time. Understanding the Travis Texas Income Statement is crucial for decision-makers, county officials, taxpayers, and investors as it offers valuable insights into the financial well-being and efficiency of Travis County, Texas.