A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

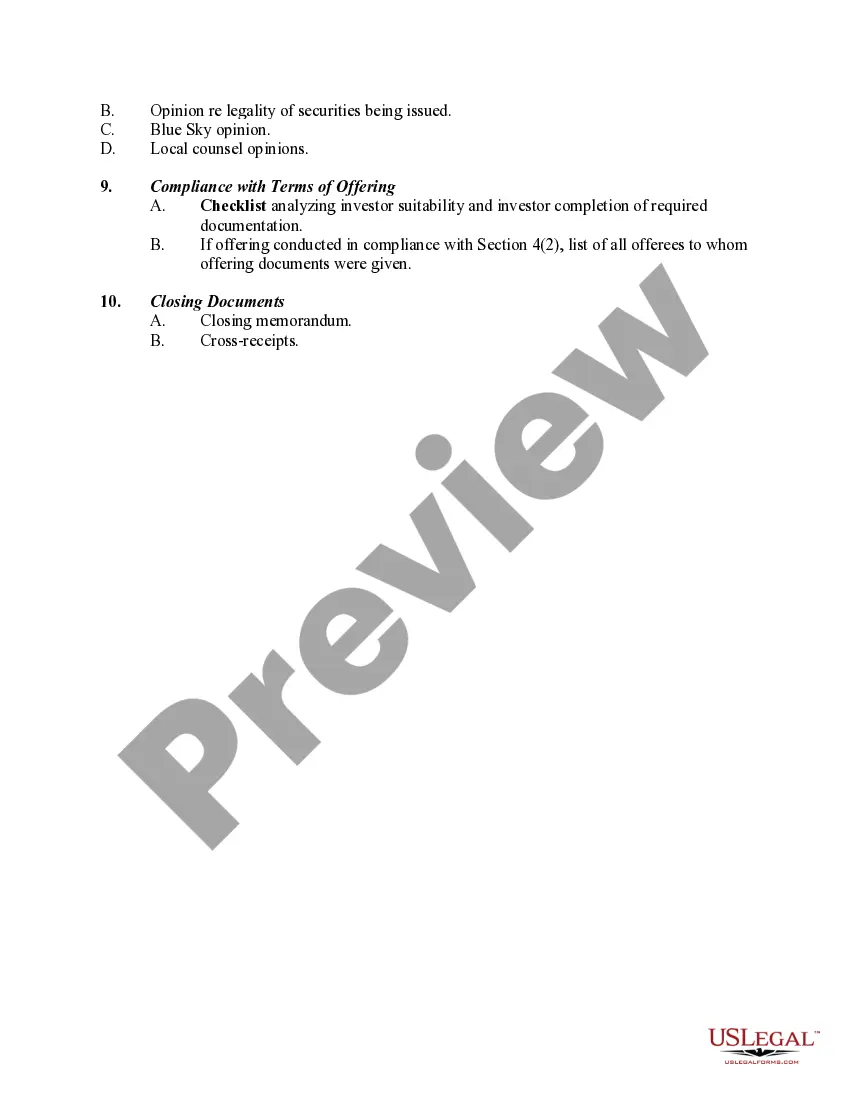

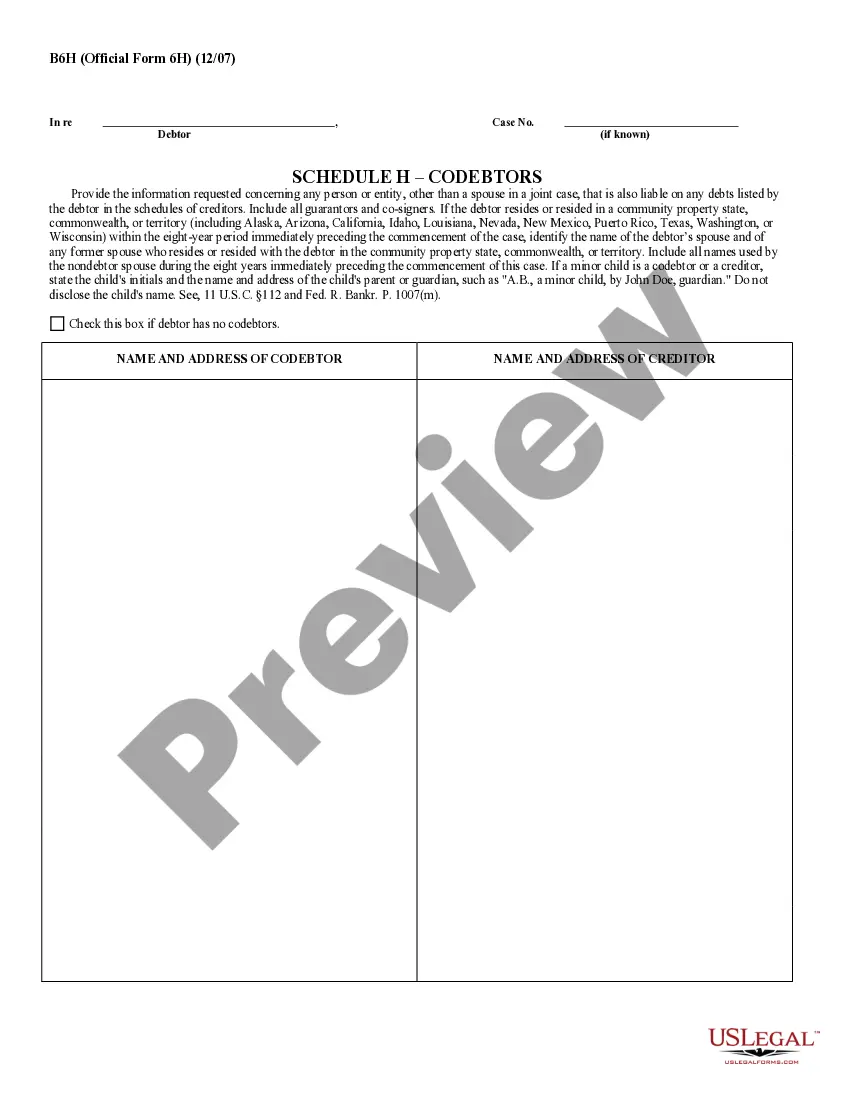

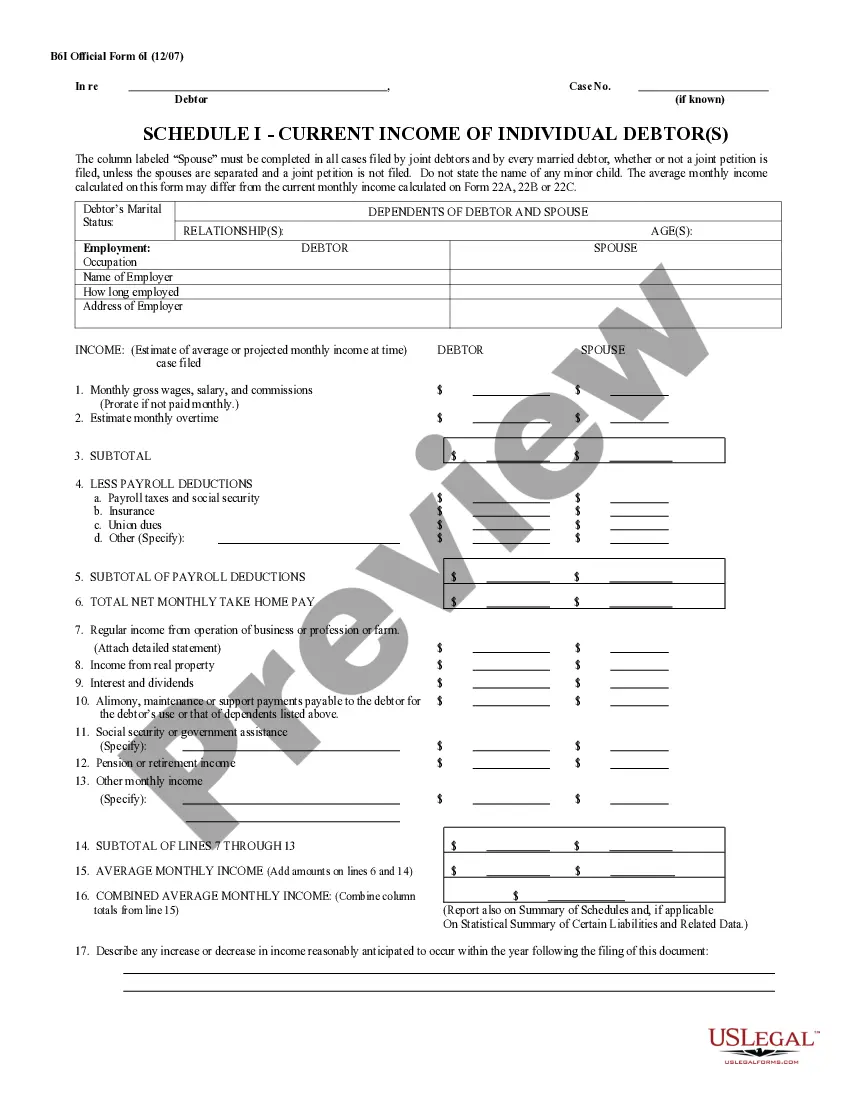

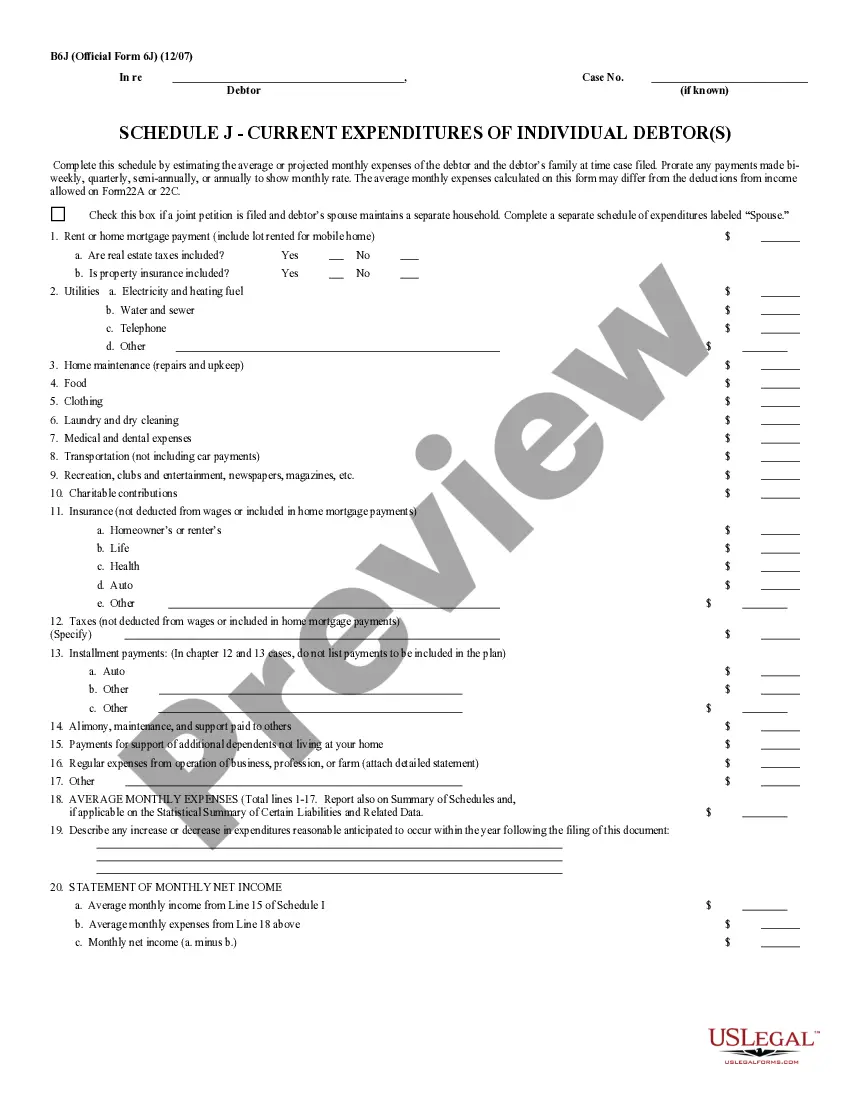

Queens, New York is a vibrant and diverse borough located within New York City. It is home to a wide range of industries, businesses, and organizations, including those involved in limited security offering. A Limited Security Offering (LSO) refers to the process of raising capital by offering securities, such as stocks or bonds, to a limited number of investors. In Queens, New York, there are several types of checklists available for Limited Security Offerings, each serving a specific purpose. These checklists are designed to ensure compliance with regulatory requirements and to facilitate a smooth and successful offering process. Here are some types of Queens New York Checklist for Limited Security Offering: 1. Legal Compliance Checklist: This checklist focuses on ensuring that the limited security offering adheres to all relevant federal and state securities laws and regulations. It includes items like filing the necessary forms with the Securities and Exchange Commission (SEC) and the New York State Department of Financial Services (DFS), conducting a due diligence review, and ensuring proper disclosures are made to potential investors. 2. Investor Documentation Checklist: This checklist is concerned with gathering and organizing the necessary documentation from potential investors. It includes items like investor questionnaires, subscription agreements, accredited investor verification forms, and any other documents required to verify investor eligibility and suitability. 3. Offering Memorandum Checklist: The offering memorandum, also known as the private placement memorandum (PPM), is a crucial document that outlines the terms and conditions of the limited security offering. This checklist ensures that the memorandum is comprehensive and covers all required information, such as the company's business plan, financial projections, risk factors, and legal disclosures. 4. Marketing and Advertising Checklist: This checklist focuses on the promotion and advertising of the limited security offering. It includes items like reviewing marketing materials for accuracy, ensuring compliance with advertising laws, and incorporating required disclaimers. This checklist helps maintain the integrity of the offering and prevent misleading or deceptive practices. 5. Investor Protection Checklist: This checklist aims to safeguard the interests of investors participating in the limited security offering. It includes items like implementing appropriate data security measures, maintaining investor confidentiality, and providing regular updates and communications to investors about the progress of the offering. 6. Reporting and Filing Checklist: After the limited security offering is completed, this checklist ensures that the necessary reporting and filing requirements are met. It includes items like filing Form D with the SEC, submitting annual reports to regulatory authorities, and maintaining proper records for audit and compliance purposes. These Queens New York checklists for Limited Security Offering provide a comprehensive framework for businesses and organizations to navigate the complex process of raising capital through the issuance of securities. Adhering to these checklists helps mitigate legal and regulatory risks, protects investor interests, and promotes transparency in the fundraising process.Queens, New York is a vibrant and diverse borough located within New York City. It is home to a wide range of industries, businesses, and organizations, including those involved in limited security offering. A Limited Security Offering (LSO) refers to the process of raising capital by offering securities, such as stocks or bonds, to a limited number of investors. In Queens, New York, there are several types of checklists available for Limited Security Offerings, each serving a specific purpose. These checklists are designed to ensure compliance with regulatory requirements and to facilitate a smooth and successful offering process. Here are some types of Queens New York Checklist for Limited Security Offering: 1. Legal Compliance Checklist: This checklist focuses on ensuring that the limited security offering adheres to all relevant federal and state securities laws and regulations. It includes items like filing the necessary forms with the Securities and Exchange Commission (SEC) and the New York State Department of Financial Services (DFS), conducting a due diligence review, and ensuring proper disclosures are made to potential investors. 2. Investor Documentation Checklist: This checklist is concerned with gathering and organizing the necessary documentation from potential investors. It includes items like investor questionnaires, subscription agreements, accredited investor verification forms, and any other documents required to verify investor eligibility and suitability. 3. Offering Memorandum Checklist: The offering memorandum, also known as the private placement memorandum (PPM), is a crucial document that outlines the terms and conditions of the limited security offering. This checklist ensures that the memorandum is comprehensive and covers all required information, such as the company's business plan, financial projections, risk factors, and legal disclosures. 4. Marketing and Advertising Checklist: This checklist focuses on the promotion and advertising of the limited security offering. It includes items like reviewing marketing materials for accuracy, ensuring compliance with advertising laws, and incorporating required disclaimers. This checklist helps maintain the integrity of the offering and prevent misleading or deceptive practices. 5. Investor Protection Checklist: This checklist aims to safeguard the interests of investors participating in the limited security offering. It includes items like implementing appropriate data security measures, maintaining investor confidentiality, and providing regular updates and communications to investors about the progress of the offering. 6. Reporting and Filing Checklist: After the limited security offering is completed, this checklist ensures that the necessary reporting and filing requirements are met. It includes items like filing Form D with the SEC, submitting annual reports to regulatory authorities, and maintaining proper records for audit and compliance purposes. These Queens New York checklists for Limited Security Offering provide a comprehensive framework for businesses and organizations to navigate the complex process of raising capital through the issuance of securities. Adhering to these checklists helps mitigate legal and regulatory risks, protects investor interests, and promotes transparency in the fundraising process.