Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

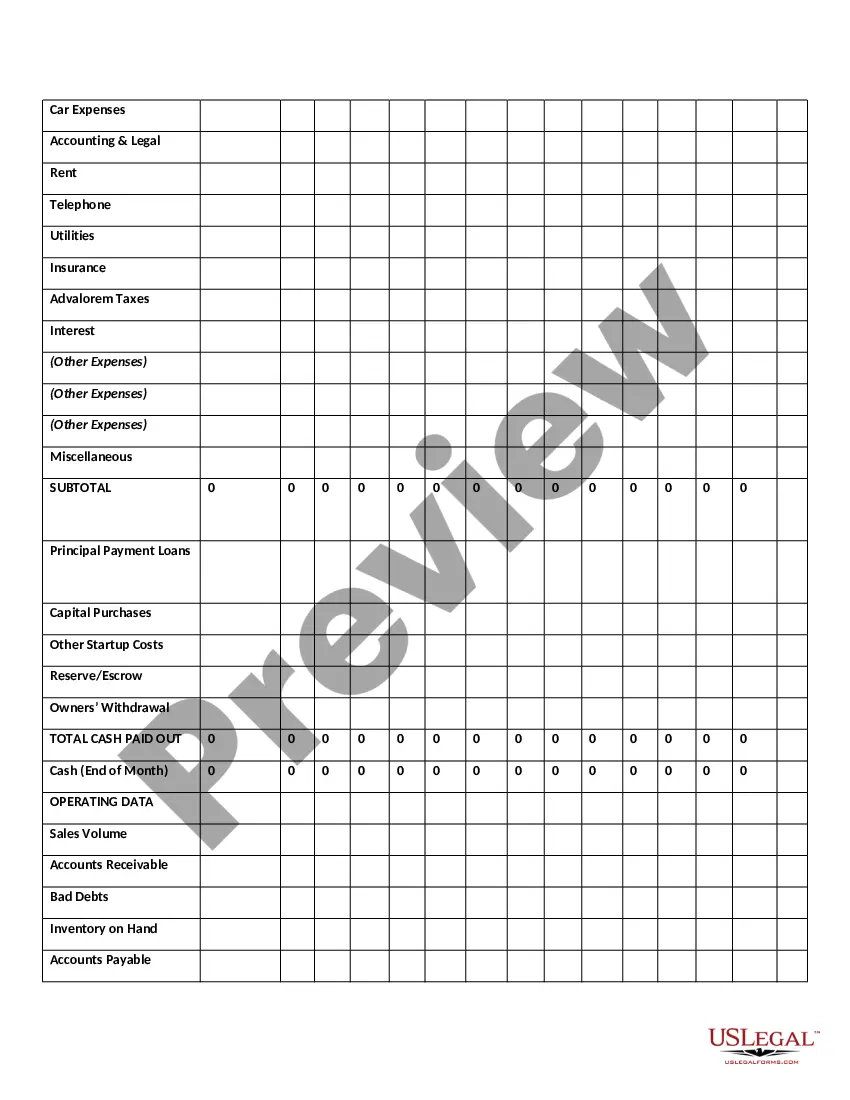

Allegheny Pennsylvania Twelve-Month Cash Flow refers to a comprehensive financial statement that provides an overview of the inflows and outflows of cash for a specific period of twelve consecutive months in the Allegheny County of Pennsylvania. This document aims to depict the financial health and sustainability of businesses, organizations, or even individuals operating within the region. Understanding the Allegheny Pennsylvania Twelve-Month Cash Flow is crucial for making informed decisions regarding investments, budgeting, and financial planning. The Allegheny Pennsylvania Twelve-Month Cash Flow statement consists of several key components that enable a thorough analysis of cash movements. These components include cash inflows, cash outflows, cash flow from operations, cash flow from investing activities, and cash flow from financing activities. Cash inflows represent the money received during the twelve-month period and can originate from various sources such as sales of goods or services, interest or dividend income, grants, donations, or loans. Cash outflows, on the other hand, refer to the cash spent over the same twelve-month period to cover expenses, such as salaries and wages, rental or mortgage payments, utilities, inventory purchases, taxes, and debt repayments. Cash flow from operations indicates the cash generated or consumed by regular business activities within Allegheny County. This section reflects the core cash-generating activities, which typically include revenue from sales and services, expenses related to operations, and changes in working capital. Cash flow from investing activities focuses on the cash effects of investment decisions made within the region. This section comprises cash flows from the purchase or sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies, stocks, or bonds. Cash flow from financing activities highlights the cash inflows and outflows that result from financing activities undertaken in Allegheny County. This includes activities such as issuing or repurchasing stocks, issuing or paying off debt (e.g., loans or bonds), and dividend payments. Different types of Allegheny Pennsylvania Twelve-Month Cash Flow reports may exist, depending on the sector or entity being analyzed. For instance, a local small business owner might prepare a cash flow statement specific to their enterprise, while a municipality might generate a cash flow statement for a particular fiscal year. Additionally, organizations operating in Allegheny County, such as non-profit organizations or government entities, will have their distinct cash flow reports relevant to their respective operations. In conclusion, the Allegheny Pennsylvania Twelve-Month Cash Flow statement is a vital financial tool that provides a comprehensive overview of cash inflows and outflows within the Allegheny County of Pennsylvania for a specific twelve-month period. By analyzing this statement, businesses, organizations, and individuals gain insights into their financial performance, make sound financial decisions, and strategize for future growth and sustainability.Allegheny Pennsylvania Twelve-Month Cash Flow refers to a comprehensive financial statement that provides an overview of the inflows and outflows of cash for a specific period of twelve consecutive months in the Allegheny County of Pennsylvania. This document aims to depict the financial health and sustainability of businesses, organizations, or even individuals operating within the region. Understanding the Allegheny Pennsylvania Twelve-Month Cash Flow is crucial for making informed decisions regarding investments, budgeting, and financial planning. The Allegheny Pennsylvania Twelve-Month Cash Flow statement consists of several key components that enable a thorough analysis of cash movements. These components include cash inflows, cash outflows, cash flow from operations, cash flow from investing activities, and cash flow from financing activities. Cash inflows represent the money received during the twelve-month period and can originate from various sources such as sales of goods or services, interest or dividend income, grants, donations, or loans. Cash outflows, on the other hand, refer to the cash spent over the same twelve-month period to cover expenses, such as salaries and wages, rental or mortgage payments, utilities, inventory purchases, taxes, and debt repayments. Cash flow from operations indicates the cash generated or consumed by regular business activities within Allegheny County. This section reflects the core cash-generating activities, which typically include revenue from sales and services, expenses related to operations, and changes in working capital. Cash flow from investing activities focuses on the cash effects of investment decisions made within the region. This section comprises cash flows from the purchase or sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies, stocks, or bonds. Cash flow from financing activities highlights the cash inflows and outflows that result from financing activities undertaken in Allegheny County. This includes activities such as issuing or repurchasing stocks, issuing or paying off debt (e.g., loans or bonds), and dividend payments. Different types of Allegheny Pennsylvania Twelve-Month Cash Flow reports may exist, depending on the sector or entity being analyzed. For instance, a local small business owner might prepare a cash flow statement specific to their enterprise, while a municipality might generate a cash flow statement for a particular fiscal year. Additionally, organizations operating in Allegheny County, such as non-profit organizations or government entities, will have their distinct cash flow reports relevant to their respective operations. In conclusion, the Allegheny Pennsylvania Twelve-Month Cash Flow statement is a vital financial tool that provides a comprehensive overview of cash inflows and outflows within the Allegheny County of Pennsylvania for a specific twelve-month period. By analyzing this statement, businesses, organizations, and individuals gain insights into their financial performance, make sound financial decisions, and strategize for future growth and sustainability.