Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

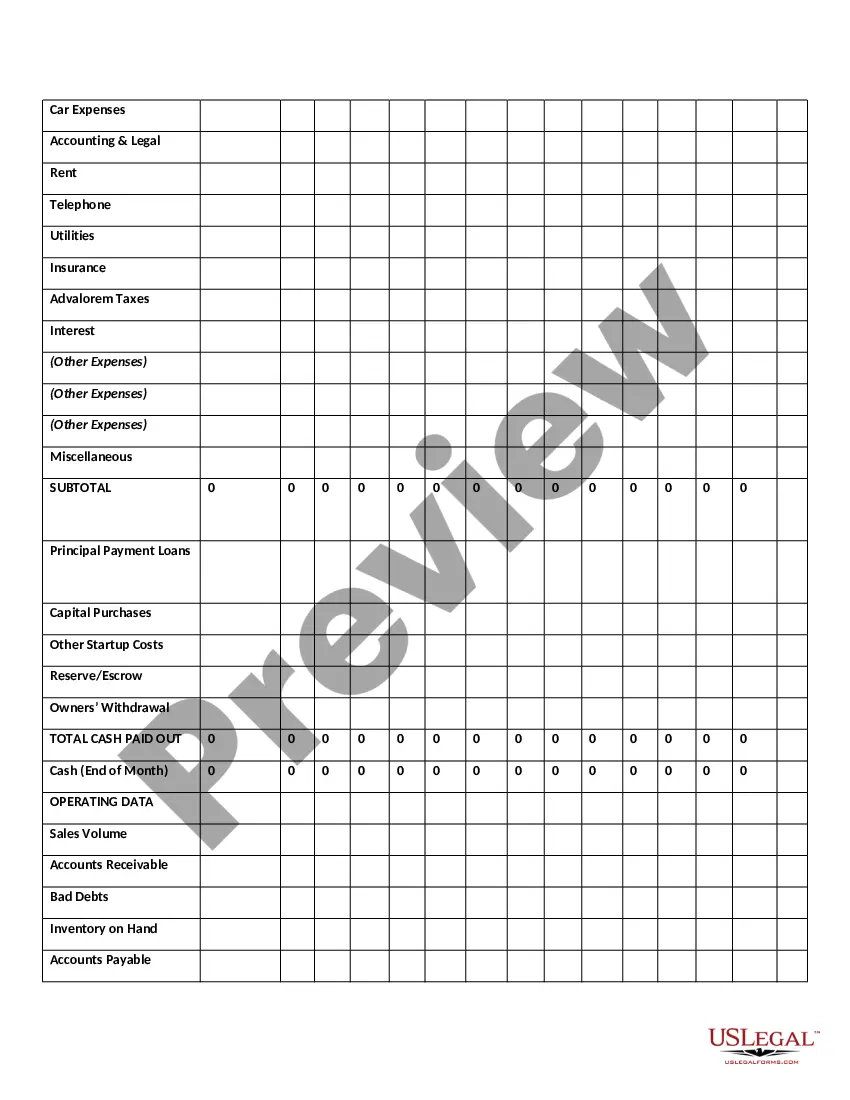

Cuyahoga Ohio Twelve-Month Cash Flow refers to a comprehensive financial analysis that outlines the inflows and outflows of cash over a period of twelve months in Cuyahoga County, Ohio. This analysis enables individuals, businesses, and government entities to gauge the financial health and stability of the county. The Cuyahoga Ohio Twelve-Month Cash Flow captures all the cash-related activities within the county, including revenue generation, expenses, investments, borrowing, and debt payments. By closely examining these factors, stakeholders can make precise financial forecasts, evaluate the county's ability to meet its financial obligations, and identify opportunities for improvement or potential risks. Keywords: — Cuyahoga CountyOHIhi— - Twelve-Month Cash Flow Analysis — FinanciaHealthlt— - Financial Stability — Inflows and OutflowOctCSASas— - Revenue Generation — County Expense— - Investments in Cuyahoga County — Borrowing and Debt Payment— - Financial Forecasts — Meeting Financial Obligation— - Improvement Opportunities — Potential Risks Different types of Cuyahoga Ohio Twelve-Month Cash Flow can be categorized based on their purpose or the entities conducting the analysis. Some common types are: 1. Cuyahoga Ohio County Government Cash Flow: This analysis specifically focuses on the cash flow of the county government, including its revenue sources (taxes, grants, fees, etc.) and expenditures (salaries, public services, infrastructure investments, etc.). 2. Cuyahoga Ohio Business Cash Flow: This analysis is conducted by businesses operating within Cuyahoga County to assess their cash flow position and manage their financial activities, such as sales revenue, operating costs, capital investments, and cash reserves. 3. Cuyahoga Ohio Non-profit Organization Cash Flow: Non-profit organizations in Cuyahoga County conduct this analysis to track their cash inflows, which primarily consist of grants, donations, and funding, as well as their cash outflows, including program expenses, administrative costs, and fundraising efforts. 4. Cuyahoga Ohio Personal Cash Flow: This analysis is performed on an individual level to assess personal income, expenses, savings, and investments, which helps individuals manage their finances effectively, plan for future expenses, and achieve financial goals. By conducting these specific types of Cuyahoga Ohio Twelve-Month Cash Flow analyses, stakeholders can gain valuable insights into the financial dynamics of the respective entities and make informed decisions to optimize their financial strategies.