Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

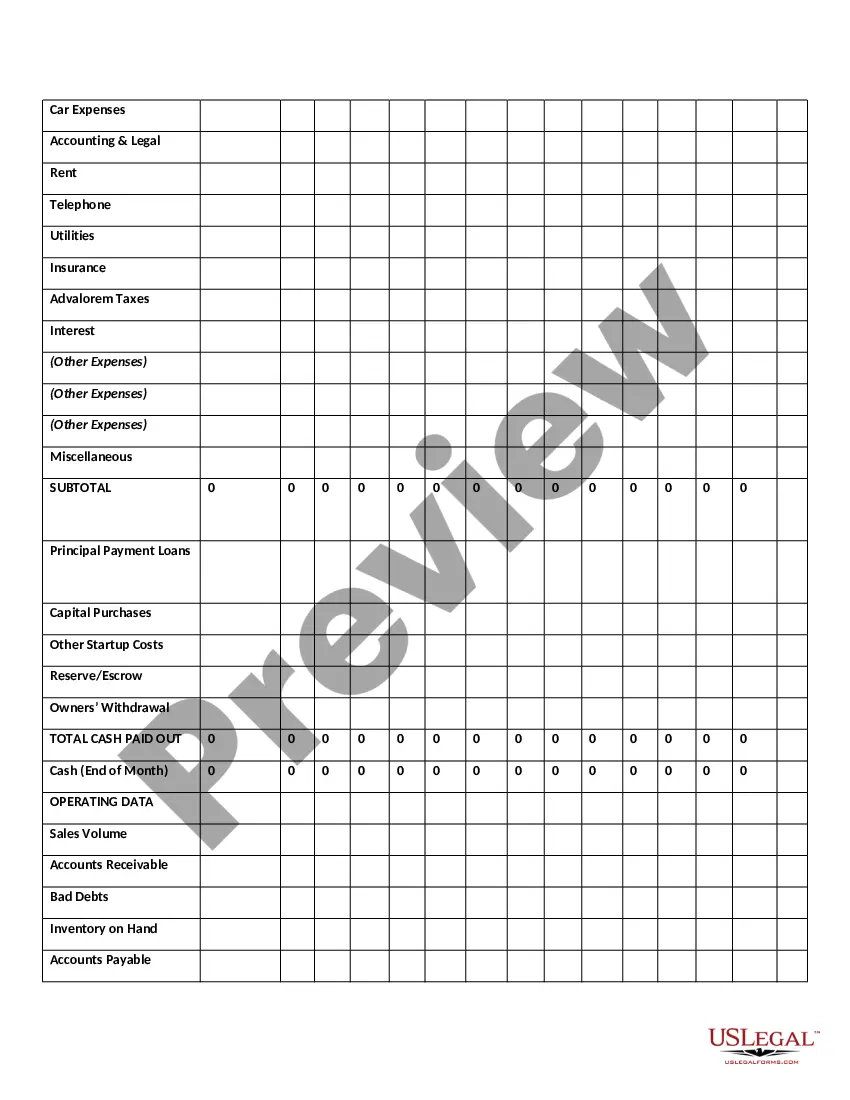

Maricopa Arizona Twelve-Month Cash Flow refers to the comprehensive financial analysis of a business or individual's income and expenses over a period of twelve months specific to the Maricopa region in Arizona. The cash flow statement projects the inflow and outflow of cash during this duration, providing insights into the financial health and sustainability of the entity. The Maricopa Arizona Twelve-Month Cash Flow statement includes various key components that offer a detailed understanding of the financial activities and performance within the designated timeframe. These components might include: 1. Revenue Sources: This section outlines the various sources of income for the business or individual, such as sales, services rendered, rental income, investments, and any other cash-generating activities within Maricopa Arizona. 2. Operating Expenses: The cash flow statement includes a breakdown of all the operational costs incurred over the twelve-month period. This may encompass expenses like rent, utilities, employee salaries, advertising, equipment maintenance, and other day-to-day expenditures in Maricopa Arizona. 3. Capital Expenditures: Capital expenditures refer to any large-scale investments made during the twelve-month period. This includes significant purchases or improvements to assets, such as manufacturing equipment, real estate properties, vehicles, or technology systems within the Maricopa region. 4. Loan Repayments: If the business or individual has taken any loans or credits, the cash flow statement would incorporate the monthly repayments made towards those debts. It would specify the principal and interest payments made and the impact on cash flow. 5. Operating Cash Flow: The statement computes the net cash inflow or outflow resulting from the operational activities within the twelve-month period. It helps evaluate the profitability and sustainability of the entity's primary business operations in Maricopa Arizona. 6. Investing and Financing Activities: Besides operating cash flow, the report may highlight any cash flow resulting from investments, such as the acquisition or sale of assets, as well as cash flow from financing activities like new equity issuance, debt financing, or dividend payments. 7. Cash Position: The cash flow statement concludes by presenting the closing cash balance at the end of the twelve-month period, reflecting the total cash available to the business or individual within Maricopa Arizona. Different types of Maricopa Arizona Twelve-Month Cash Flow statements may vary based on the specific industry, entity size, and reporting requirements. For instance, a real estate company in Maricopa might have separate cash flow statements for rental properties, development projects, and property sales. Similarly, an individual may have different cash flow statements for their personal finances and a business they own in Maricopa. In summary, the Maricopa Arizona Twelve-Month Cash Flow statement analyzes the inflow and outflow of cash over a one-year period, providing valuable insights into the financial well-being of a business or individual operating within the Maricopa region. It encompasses revenue sources, operational and capital expenses, loan repayments, operating cash flow, investing and financing activities, and closing cash position.Maricopa Arizona Twelve-Month Cash Flow refers to the comprehensive financial analysis of a business or individual's income and expenses over a period of twelve months specific to the Maricopa region in Arizona. The cash flow statement projects the inflow and outflow of cash during this duration, providing insights into the financial health and sustainability of the entity. The Maricopa Arizona Twelve-Month Cash Flow statement includes various key components that offer a detailed understanding of the financial activities and performance within the designated timeframe. These components might include: 1. Revenue Sources: This section outlines the various sources of income for the business or individual, such as sales, services rendered, rental income, investments, and any other cash-generating activities within Maricopa Arizona. 2. Operating Expenses: The cash flow statement includes a breakdown of all the operational costs incurred over the twelve-month period. This may encompass expenses like rent, utilities, employee salaries, advertising, equipment maintenance, and other day-to-day expenditures in Maricopa Arizona. 3. Capital Expenditures: Capital expenditures refer to any large-scale investments made during the twelve-month period. This includes significant purchases or improvements to assets, such as manufacturing equipment, real estate properties, vehicles, or technology systems within the Maricopa region. 4. Loan Repayments: If the business or individual has taken any loans or credits, the cash flow statement would incorporate the monthly repayments made towards those debts. It would specify the principal and interest payments made and the impact on cash flow. 5. Operating Cash Flow: The statement computes the net cash inflow or outflow resulting from the operational activities within the twelve-month period. It helps evaluate the profitability and sustainability of the entity's primary business operations in Maricopa Arizona. 6. Investing and Financing Activities: Besides operating cash flow, the report may highlight any cash flow resulting from investments, such as the acquisition or sale of assets, as well as cash flow from financing activities like new equity issuance, debt financing, or dividend payments. 7. Cash Position: The cash flow statement concludes by presenting the closing cash balance at the end of the twelve-month period, reflecting the total cash available to the business or individual within Maricopa Arizona. Different types of Maricopa Arizona Twelve-Month Cash Flow statements may vary based on the specific industry, entity size, and reporting requirements. For instance, a real estate company in Maricopa might have separate cash flow statements for rental properties, development projects, and property sales. Similarly, an individual may have different cash flow statements for their personal finances and a business they own in Maricopa. In summary, the Maricopa Arizona Twelve-Month Cash Flow statement analyzes the inflow and outflow of cash over a one-year period, providing valuable insights into the financial well-being of a business or individual operating within the Maricopa region. It encompasses revenue sources, operational and capital expenses, loan repayments, operating cash flow, investing and financing activities, and closing cash position.