Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

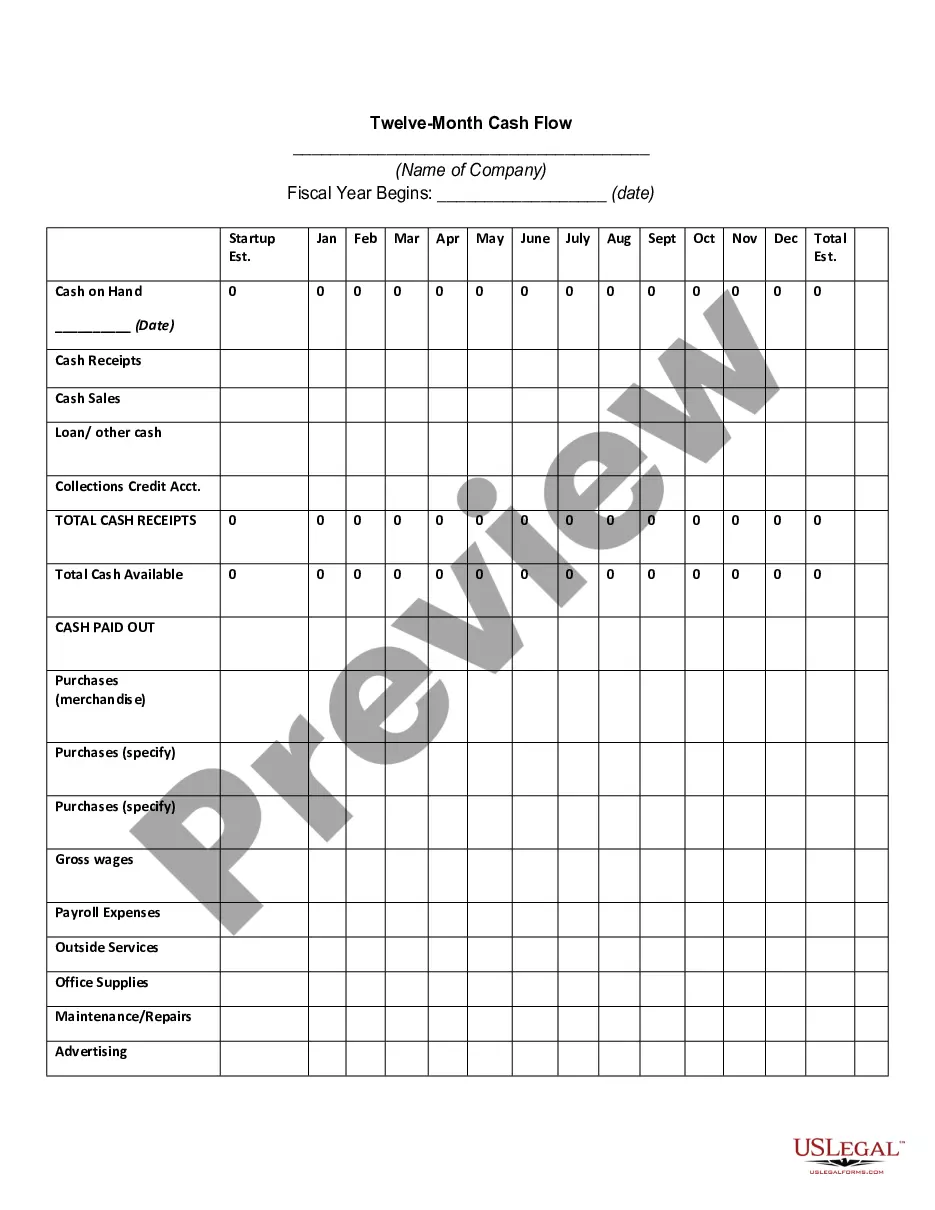

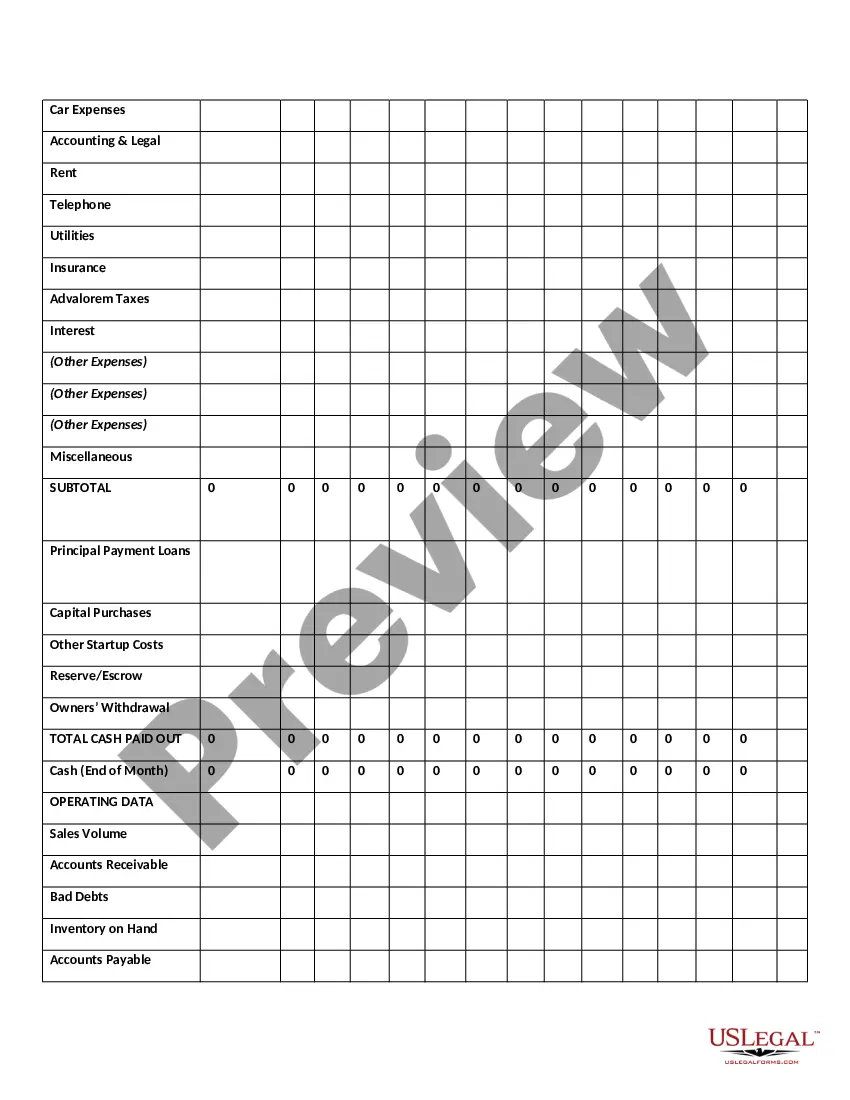

Nassau New York Twelve-Month Cash Flow is a comprehensive financial statement that provides a detailed overview of the cash inflows and outflows for individuals or businesses located in Nassau County, New York over a twelve-month period. This financial document is crucial for various purposes, including budgeting, financial planning, and investment analysis. It enables individuals or businesses to evaluate their cash position, forecast future cash flows, and make informed decisions regarding expenses, income generation, and investment opportunities. The Nassau New York Twelve-Month Cash Flow includes several key components that are critical in understanding the financial health of an individual or business. These components typically encompass the following: 1. Cash Inflows: This section outlines all the sources of cash inflows over the twelve-month period. It includes incomes from various sources such as salary, business revenue, investments, rental properties, and any other cash receipts. 2. Cash Outflows: This section details all the cash outflows during the twelve-month period. It encompasses expenses related to rent or mortgage payments, utility bills, groceries, transportation costs, insurance premiums, loan repayments, taxes, and any other regular or irregular expenses. 3. Net Cash Flow: The net cash flow is calculated by deducting the total cash outflows from the total cash inflows. It represents the surplus or shortfall of cash over a specific period. A positive net cash flow indicates that more cash is coming in than going out, while a negative net cash flow indicates a shortage of cash. 4. Cash Flow Forecast: This segment provides a projection of future cash flows based on historical data and expected changes in income and expenses. It assists individuals or businesses in planning for the future, identifying potential financial gaps, and making necessary adjustments to maintain a healthy cash flow. Different types of Nassau New York Twelve-Month Cash Flow may exist depending on the specific sector or purpose. For instance, there might be unique cash flow statements for businesses operating in the retail industry, real estate sector, or healthcare field in Nassau County, New York. These specialized cash flow statements would incorporate industry-specific revenue streams, expenses, and considerations. In conclusion, Nassau New York Twelve-Month Cash Flow is a comprehensive financial statement that provides a detailed overview of the cash inflows and outflows for individuals or businesses in Nassau County, New York over a specific period. It serves as a crucial tool for financial analysis, planning, and decision-making, allowing individuals or businesses to effectively manage their cash position and achieve their financial goals.Nassau New York Twelve-Month Cash Flow is a comprehensive financial statement that provides a detailed overview of the cash inflows and outflows for individuals or businesses located in Nassau County, New York over a twelve-month period. This financial document is crucial for various purposes, including budgeting, financial planning, and investment analysis. It enables individuals or businesses to evaluate their cash position, forecast future cash flows, and make informed decisions regarding expenses, income generation, and investment opportunities. The Nassau New York Twelve-Month Cash Flow includes several key components that are critical in understanding the financial health of an individual or business. These components typically encompass the following: 1. Cash Inflows: This section outlines all the sources of cash inflows over the twelve-month period. It includes incomes from various sources such as salary, business revenue, investments, rental properties, and any other cash receipts. 2. Cash Outflows: This section details all the cash outflows during the twelve-month period. It encompasses expenses related to rent or mortgage payments, utility bills, groceries, transportation costs, insurance premiums, loan repayments, taxes, and any other regular or irregular expenses. 3. Net Cash Flow: The net cash flow is calculated by deducting the total cash outflows from the total cash inflows. It represents the surplus or shortfall of cash over a specific period. A positive net cash flow indicates that more cash is coming in than going out, while a negative net cash flow indicates a shortage of cash. 4. Cash Flow Forecast: This segment provides a projection of future cash flows based on historical data and expected changes in income and expenses. It assists individuals or businesses in planning for the future, identifying potential financial gaps, and making necessary adjustments to maintain a healthy cash flow. Different types of Nassau New York Twelve-Month Cash Flow may exist depending on the specific sector or purpose. For instance, there might be unique cash flow statements for businesses operating in the retail industry, real estate sector, or healthcare field in Nassau County, New York. These specialized cash flow statements would incorporate industry-specific revenue streams, expenses, and considerations. In conclusion, Nassau New York Twelve-Month Cash Flow is a comprehensive financial statement that provides a detailed overview of the cash inflows and outflows for individuals or businesses in Nassau County, New York over a specific period. It serves as a crucial tool for financial analysis, planning, and decision-making, allowing individuals or businesses to effectively manage their cash position and achieve their financial goals.