Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

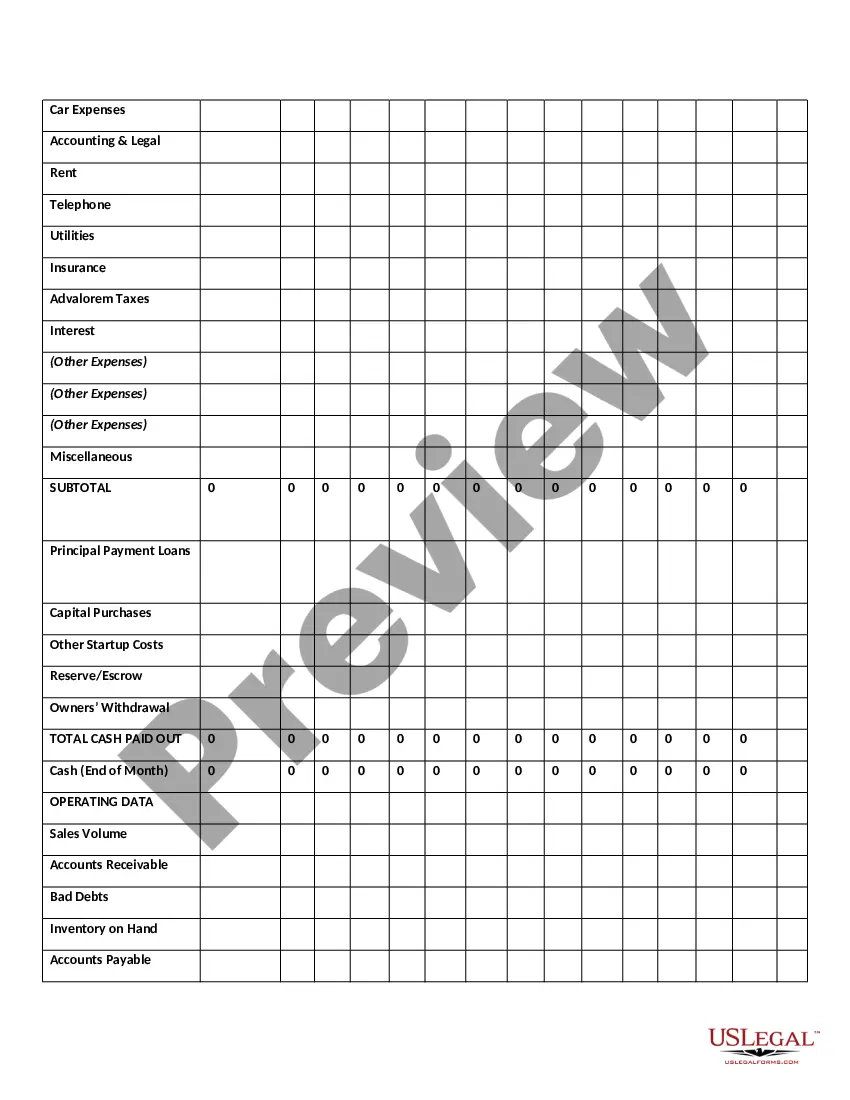

Oakland Michigan Twelve-Month Cash Flow refers to a financial statement that provides a detailed overview of the inflows and outflows of cash in Oakland County, Michigan over a period of twelve months. This cash flow statement plays a crucial role in assessing the financial health and sustainability of Oakland County's government operations. Keywords: Oakland Michigan, twelve-month cash flow, financial statement, inflows, outflows, cash flow statement, financial health, sustainability, government operations. The Oakland Michigan Twelve-Month Cash Flow statement includes various categories of cash flows, each representing different aspects of Oakland County's financial activities. These categories may include: 1. Operating Cash Flow: This category encompasses all cash inflows and outflows resulting from the regular operations of the county. It includes revenues from taxes, grants, fees, and fines, as well as payments for personnel, supplies, and operational expenses. 2. Investing Cash Flow: This section represents cash inflows and outflows associated with long-term investments made by Oakland County. It includes the purchase and sale of assets such as land, buildings, equipment, and investments in securities. 3. Financing Cash Flow: This category accounts for cash flows related to the county's financing activities. It includes debt issuance and repayment, funding from bonds or loans, and dividends or interest payments made to stakeholders. 4. Capital Expenditures: This section specifically highlights cash outflows for the acquisition, construction, or improvement of long-term assets like infrastructure, facilities, and equipment. It helps analyze the county's commitment to the development and maintenance of public resources. 5. Non-operating Activities: Any significant cash flows that do not fall under the previous categories are represented here. These may include one-time proceeds from the sale of assets, settlements, or insurance claims. The Oakland Michigan Twelve-Month Cash Flow statement provides a comprehensive overview of all these cash flow categories, allowing stakeholders to assess the county's financial performance, liquidity, and its ability to meet financial obligations. It helps identify any potential cash flow gaps, highlights spending patterns, and assists in making informed decisions regarding budgeting, investing, and resource allocation. In conclusion, Oakland Michigan Twelve-Month Cash Flow is a crucial financial statement that helps evaluate the cash inflows and outflows of Oakland County over a specific timeframe. It provides valuable insights into the county's financial activities, aiding in strategic planning, budgeting, and overall financial management.Oakland Michigan Twelve-Month Cash Flow refers to a financial statement that provides a detailed overview of the inflows and outflows of cash in Oakland County, Michigan over a period of twelve months. This cash flow statement plays a crucial role in assessing the financial health and sustainability of Oakland County's government operations. Keywords: Oakland Michigan, twelve-month cash flow, financial statement, inflows, outflows, cash flow statement, financial health, sustainability, government operations. The Oakland Michigan Twelve-Month Cash Flow statement includes various categories of cash flows, each representing different aspects of Oakland County's financial activities. These categories may include: 1. Operating Cash Flow: This category encompasses all cash inflows and outflows resulting from the regular operations of the county. It includes revenues from taxes, grants, fees, and fines, as well as payments for personnel, supplies, and operational expenses. 2. Investing Cash Flow: This section represents cash inflows and outflows associated with long-term investments made by Oakland County. It includes the purchase and sale of assets such as land, buildings, equipment, and investments in securities. 3. Financing Cash Flow: This category accounts for cash flows related to the county's financing activities. It includes debt issuance and repayment, funding from bonds or loans, and dividends or interest payments made to stakeholders. 4. Capital Expenditures: This section specifically highlights cash outflows for the acquisition, construction, or improvement of long-term assets like infrastructure, facilities, and equipment. It helps analyze the county's commitment to the development and maintenance of public resources. 5. Non-operating Activities: Any significant cash flows that do not fall under the previous categories are represented here. These may include one-time proceeds from the sale of assets, settlements, or insurance claims. The Oakland Michigan Twelve-Month Cash Flow statement provides a comprehensive overview of all these cash flow categories, allowing stakeholders to assess the county's financial performance, liquidity, and its ability to meet financial obligations. It helps identify any potential cash flow gaps, highlights spending patterns, and assists in making informed decisions regarding budgeting, investing, and resource allocation. In conclusion, Oakland Michigan Twelve-Month Cash Flow is a crucial financial statement that helps evaluate the cash inflows and outflows of Oakland County over a specific timeframe. It provides valuable insights into the county's financial activities, aiding in strategic planning, budgeting, and overall financial management.