Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

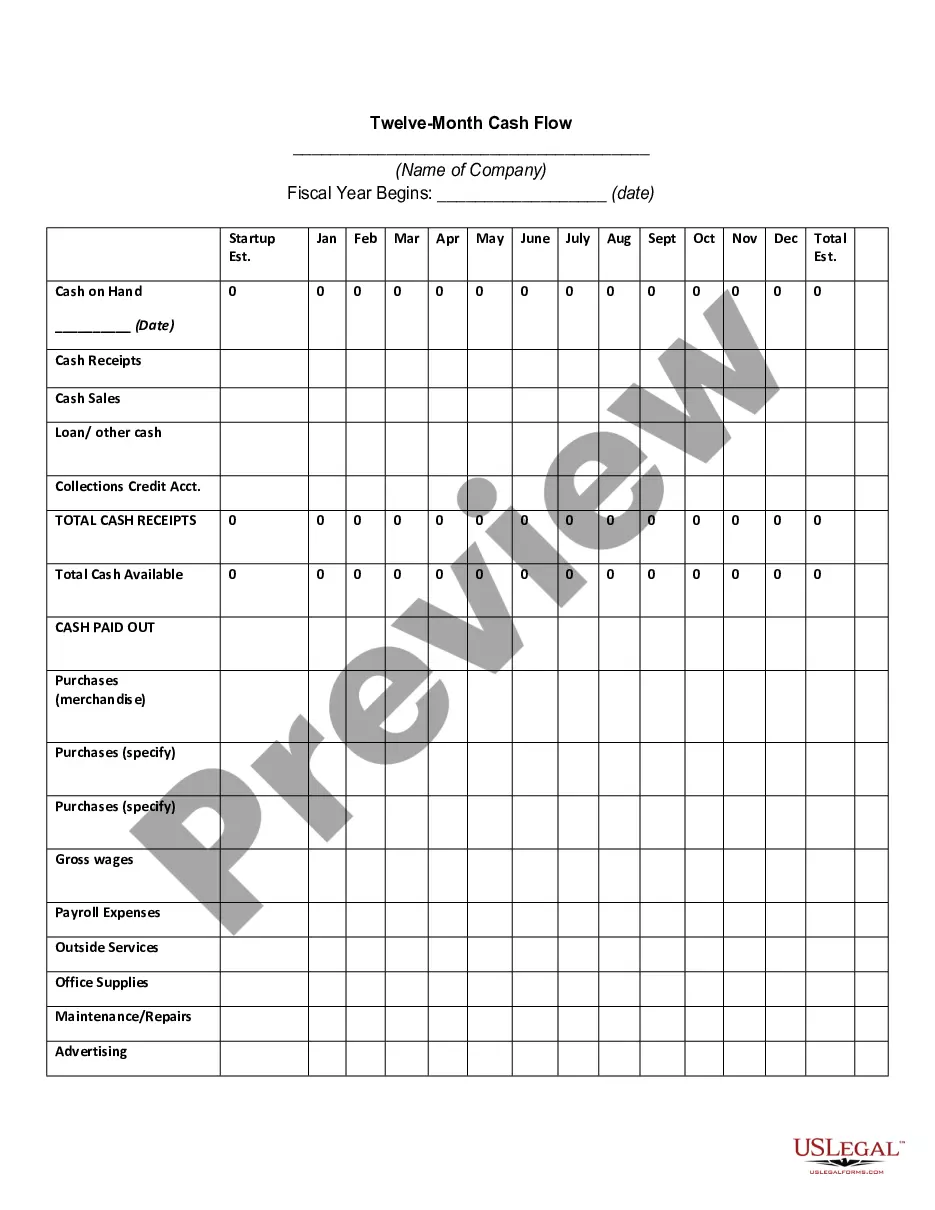

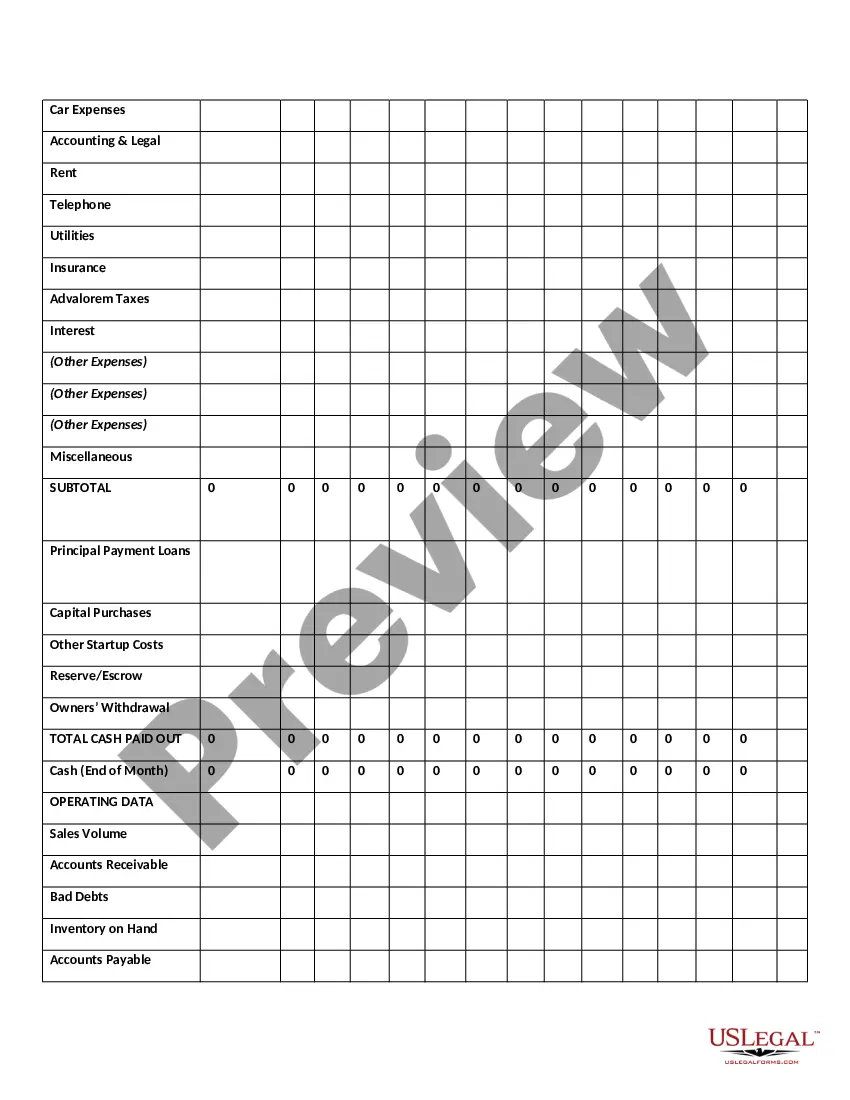

San Diego California Twelve-Month Cash Flow is a financial statement that provides a comprehensive overview of the inflow and outflow of cash within a business, organization, or individual residing in San Diego, California. It outlines the net cash generated or consumed over a period of twelve months. This type of cash flow statement is crucial for businesses and individuals alike as it helps in assessing their financial health, liquidity, and stability. By analyzing the cash flow, one can ascertain if there is sufficient cash to cover expenses, invest in growth opportunities, and overall maintain a positive financial position. Keywords: San Diego California, twelve-month cash flow, financial statement, inflow and outflow of cash, net cash, businesses, individuals, financial health, liquidity, stability, expenses, growth opportunities, positive financial position. Different types of San Diego California Twelve-Month Cash Flow may include: 1. Personal or Individual Cash Flow: This type of cash flow statement focuses on an individual's personal finances in San Diego, California. It includes income from various sources, such as salary, investments, and rental properties, as well as all expenses, including rent/mortgage, utilities, groceries, transportation, and entertainment. 2. Small Business Cash Flow: This type of cash flow statement targets small businesses operating in San Diego, California. It includes detailed information about revenue from sales, loans, or investors, along with all expenses, such as rent, wages, marketing expenses, supplies, and taxes. 3. Real Estate Cash Flow: Specifically applicable to real estate investors in San Diego, California, this cash flow statement outlines income generated from rental properties, including rental income, parking fees, laundry revenue, and other sources. It also encompasses all related expenses, such as mortgage payments, property management fees, repairs, and maintenance costs. 4. Nonprofit Organization Cash Flow: Designed for nonprofit organizations based in San Diego, California, this cash flow statement focuses on revenue from donations, grants, and fundraising events. It also includes expenses related to program activities, administrative costs, and marketing initiatives. 5. Retail/Food Service Cash Flow: Geared towards retail or food service businesses located in San Diego, California, this cash flow statement details income generated from sales, online orders, and dine-in services. It also examines expenses like inventory purchases, employee wages, marketing expenses, utilities, rent, and equipment maintenance. By having specific types of San Diego California Twelve-Month Cash Flow statements, individuals and businesses can have a more accurate understanding of their financial situation, make informed decisions, and plan for future growth and stability.San Diego California Twelve-Month Cash Flow is a financial statement that provides a comprehensive overview of the inflow and outflow of cash within a business, organization, or individual residing in San Diego, California. It outlines the net cash generated or consumed over a period of twelve months. This type of cash flow statement is crucial for businesses and individuals alike as it helps in assessing their financial health, liquidity, and stability. By analyzing the cash flow, one can ascertain if there is sufficient cash to cover expenses, invest in growth opportunities, and overall maintain a positive financial position. Keywords: San Diego California, twelve-month cash flow, financial statement, inflow and outflow of cash, net cash, businesses, individuals, financial health, liquidity, stability, expenses, growth opportunities, positive financial position. Different types of San Diego California Twelve-Month Cash Flow may include: 1. Personal or Individual Cash Flow: This type of cash flow statement focuses on an individual's personal finances in San Diego, California. It includes income from various sources, such as salary, investments, and rental properties, as well as all expenses, including rent/mortgage, utilities, groceries, transportation, and entertainment. 2. Small Business Cash Flow: This type of cash flow statement targets small businesses operating in San Diego, California. It includes detailed information about revenue from sales, loans, or investors, along with all expenses, such as rent, wages, marketing expenses, supplies, and taxes. 3. Real Estate Cash Flow: Specifically applicable to real estate investors in San Diego, California, this cash flow statement outlines income generated from rental properties, including rental income, parking fees, laundry revenue, and other sources. It also encompasses all related expenses, such as mortgage payments, property management fees, repairs, and maintenance costs. 4. Nonprofit Organization Cash Flow: Designed for nonprofit organizations based in San Diego, California, this cash flow statement focuses on revenue from donations, grants, and fundraising events. It also includes expenses related to program activities, administrative costs, and marketing initiatives. 5. Retail/Food Service Cash Flow: Geared towards retail or food service businesses located in San Diego, California, this cash flow statement details income generated from sales, online orders, and dine-in services. It also examines expenses like inventory purchases, employee wages, marketing expenses, utilities, rent, and equipment maintenance. By having specific types of San Diego California Twelve-Month Cash Flow statements, individuals and businesses can have a more accurate understanding of their financial situation, make informed decisions, and plan for future growth and stability.