Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

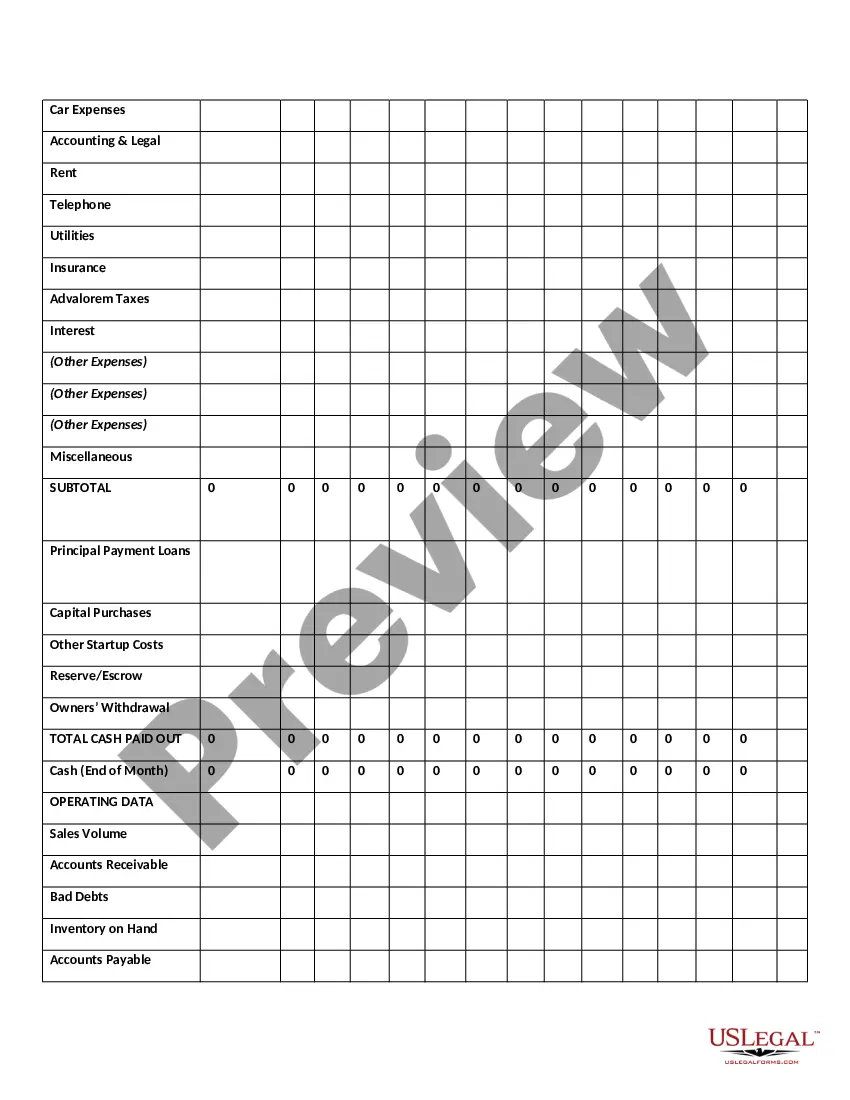

San Jose California Twelve-Month Cash Flow refers to the financial forecast that analyzes the inflows and outflows of cash for a business or individual over a continuous twelve-month period in San Jose, California. This cash flow statement provides a detailed overview of the income generated and expenses incurred during a particular year in San Jose, enabling businesses and individuals to assess their financial health and make informed decisions. Keywords: San Jose California, twelve-month cash flow, cash flow statement, financial forecast, inflows, outflows, income, expenses, financial health, decision-making. Different types of San Jose California Twelve-Month Cash Flow: 1. Business Cash Flow Projection in San Jose California: This type of cash flow projection focuses on tracking the cash inflows and outflows of a business operating in San Jose, California, over the span of twelve months. It includes revenue from sales, investments, loans, and other sources, as well as expenses like rent, payroll, utilities, and taxation. 2. Personal Cash Flow Forecast in San Jose California: Personal cash flow forecasts are relevant for individuals residing in San Jose, California. It involves analyzing the inflows and outflows of their personal finances, including salary, investment income, rental income, and various expenses such as mortgage payments, groceries, transportation, healthcare, and utilities. 3. Real Estate Cash Flow Analysis in San Jose California: This type of cash flow analysis specifically focuses on real estate properties located in San Jose, California. Investors and landlords use it to determine the potential revenue and expenses associated with owning and managing rental properties in the city. It includes rental income, property taxes, mortgage payments, repairs, and maintenance costs. 4. Projected Cash Flow for Startups in San Jose California: Startups and aspiring entrepreneurs in San Jose, California, often create projected cash flow statements to estimate the financial performance of their business over the next twelve months. It considers expected revenue from sales, investments, and funding, along with projected expenses like marketing, research and development, salaries, rent, and utilities. 5. Nonprofit Organization Cash Flow Analysis in San Jose California: Nonprofit organizations operating in San Jose, California, rely on cash flow analysis to monitor their financial activities. It involves tracking cash inflows from donations, grants, fundraisers, and program services, as well as cash outflows for salaries, overhead expenses, program costs, and fundraising efforts. 6. Government Cash Flow Forecast in San Jose California: Governments at different levels may also create cash flow forecasts for San Jose, California. This comprehensive analysis includes revenue sources such as taxes, fees, grants, and intergovernmental transfers, while considering expenditures for public services, infrastructure projects, salaries, benefits, and debt servicing. Keywords: business cash flow projection, personal cash flow forecast, real estate cash flow analysis, projected cash flow for startups, nonprofit organization cash flow analysis, government cash flow forecast, San Jose California.San Jose California Twelve-Month Cash Flow refers to the financial forecast that analyzes the inflows and outflows of cash for a business or individual over a continuous twelve-month period in San Jose, California. This cash flow statement provides a detailed overview of the income generated and expenses incurred during a particular year in San Jose, enabling businesses and individuals to assess their financial health and make informed decisions. Keywords: San Jose California, twelve-month cash flow, cash flow statement, financial forecast, inflows, outflows, income, expenses, financial health, decision-making. Different types of San Jose California Twelve-Month Cash Flow: 1. Business Cash Flow Projection in San Jose California: This type of cash flow projection focuses on tracking the cash inflows and outflows of a business operating in San Jose, California, over the span of twelve months. It includes revenue from sales, investments, loans, and other sources, as well as expenses like rent, payroll, utilities, and taxation. 2. Personal Cash Flow Forecast in San Jose California: Personal cash flow forecasts are relevant for individuals residing in San Jose, California. It involves analyzing the inflows and outflows of their personal finances, including salary, investment income, rental income, and various expenses such as mortgage payments, groceries, transportation, healthcare, and utilities. 3. Real Estate Cash Flow Analysis in San Jose California: This type of cash flow analysis specifically focuses on real estate properties located in San Jose, California. Investors and landlords use it to determine the potential revenue and expenses associated with owning and managing rental properties in the city. It includes rental income, property taxes, mortgage payments, repairs, and maintenance costs. 4. Projected Cash Flow for Startups in San Jose California: Startups and aspiring entrepreneurs in San Jose, California, often create projected cash flow statements to estimate the financial performance of their business over the next twelve months. It considers expected revenue from sales, investments, and funding, along with projected expenses like marketing, research and development, salaries, rent, and utilities. 5. Nonprofit Organization Cash Flow Analysis in San Jose California: Nonprofit organizations operating in San Jose, California, rely on cash flow analysis to monitor their financial activities. It involves tracking cash inflows from donations, grants, fundraisers, and program services, as well as cash outflows for salaries, overhead expenses, program costs, and fundraising efforts. 6. Government Cash Flow Forecast in San Jose California: Governments at different levels may also create cash flow forecasts for San Jose, California. This comprehensive analysis includes revenue sources such as taxes, fees, grants, and intergovernmental transfers, while considering expenditures for public services, infrastructure projects, salaries, benefits, and debt servicing. Keywords: business cash flow projection, personal cash flow forecast, real estate cash flow analysis, projected cash flow for startups, nonprofit organization cash flow analysis, government cash flow forecast, San Jose California.