[Your Name] [Your Business Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Internal Revenue Service] [Department Name] [Address] [City, State, Zip Code] Subject: Request for Extension to File Business Tax Forms Dear Sir/Madam, I hope this letter finds you in good health and high spirits. I am writing to request an extension for filing my business tax forms for the tax year [year]. My business is located in the vibrant city of Chicago, Illinois, and operates under the legal structure of [mention your business structure, e.g., sole proprietorship, partnership, corporation, etc.]. I have thoroughly reviewed my financial records and have been diligently working on compiling all the necessary documents required for filing my business tax forms. However, due to unforeseen circumstances, including [mention any specific reasons such as illness, family emergencies, or other valid reasons], I am unable to meet the original deadline of [original due date] for filing my business tax forms. I understand the importance of meeting tax obligations and respect the due process of the IRS. Therefore, I kindly request an extension of [mention the desired extension period, e.g., three months] to fully complete and submit my business tax forms. I assure you that I am making every effort to finalize all the financial statements, gather relevant documents, and complete the necessary calculations to accurately report my business income, deductions, and credits. The extension will provide me with sufficient time to ensure all necessary information is collected and entered correctly into the tax forms. Moreover, I would like to express my commitment to fulfilling all my tax obligations promptly and accurately. I understand that any delay on my part can have legal and financial consequences. Hence, I am prepared to pay any accrued interest or penalties associated with this extension. Enclosed with this letter, you will find a copy of my previous tax return as well as any supporting documentation available at this time. I will promptly provide any additional documents that may be required by the IRS or further requested by mail or electronically. I kindly request your early and positive consideration of my plea to grant an extension for filing my business tax forms. You're understanding and cooperation during this challenging time would be greatly appreciated. Please feel free to contact me at [phone number] or via email at [email address] if you require any further information or documentation. I sincerely thank you for your attention to this matter and look forward to your favorable response before the original deadline. Yours sincerely, [Your Name] [Your Business Name]

Chicago Illinois Sample Letter for Letter Requesting Extension to File Business Tax Forms

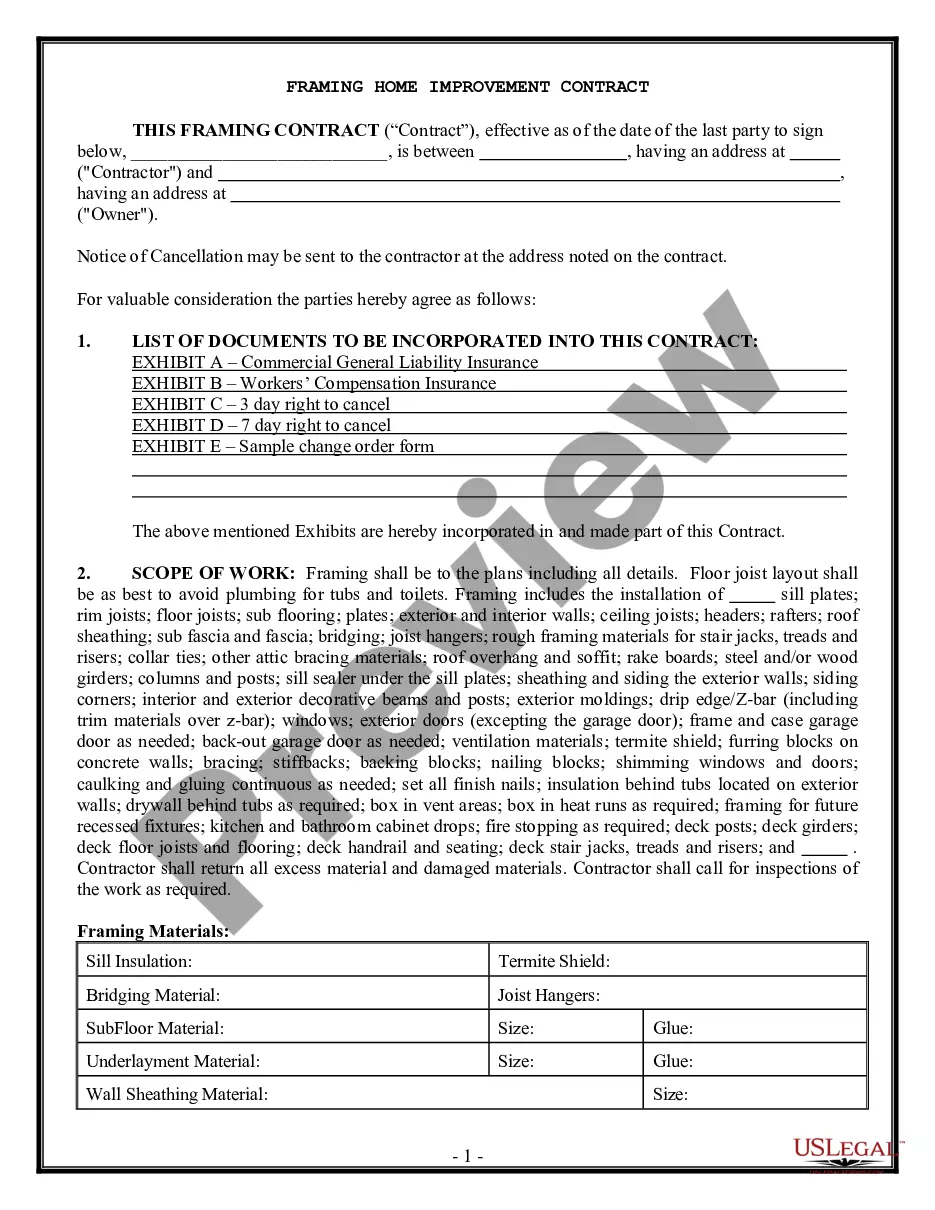

Description

How to fill out Chicago Illinois Sample Letter For Letter Requesting Extension To File Business Tax Forms?

Preparing documents for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Chicago Sample Letter for Letter Requesting Extension to File Business Tax Forms without expert assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Chicago Sample Letter for Letter Requesting Extension to File Business Tax Forms on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Chicago Sample Letter for Letter Requesting Extension to File Business Tax Forms:

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!