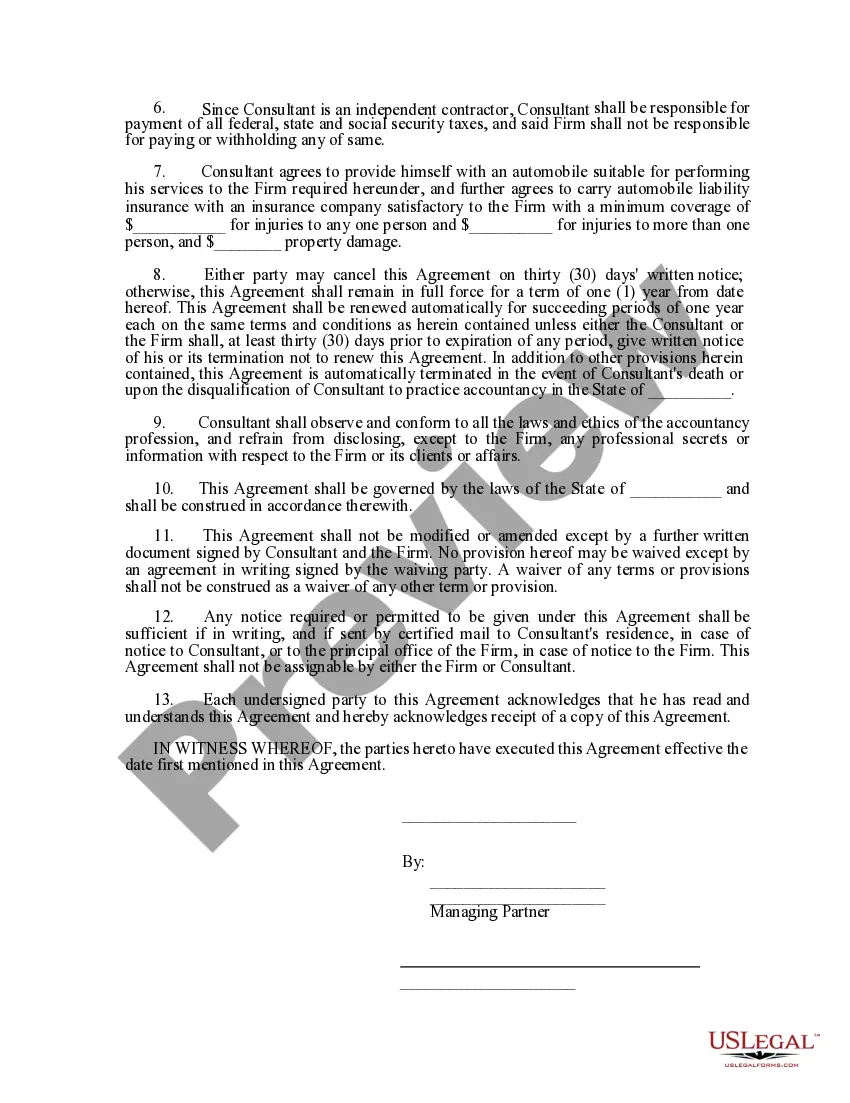

Travis Texas Agreement for Consulting Services is a legal document that serves as a contractual agreement between a consultant and a client for the provision of consulting services in the state of Texas. This agreement outlines the terms, conditions, and obligations that both parties must abide by throughout the course of the consulting engagement. The Travis Texas Agreement for Consulting Services covers various aspects pertinent to the consulting engagement, such as the scope of services, payment terms, deliverables, intellectual property rights, confidentiality, dispute resolution, and termination clauses. It is a legally-binding document that ensures the rights and responsibilities of both the consultant and the client are clearly defined and protected. Different types of Travis Texas Agreement for Consulting Services may exist depending on the specific nature of the consulting services being provided. Some common variations include: 1. IT Consulting Agreement: This type of agreement is tailored for consultants providing information technology (IT) consulting services. It may cover areas such as software development, system implementation, network infrastructure, cybersecurity, and IT strategy. 2. Marketing Consulting Agreement: This agreement is designed for consultants offering marketing and advertising services. It usually includes provisions related to market research, brand development, marketing campaigns, social media strategies, and public relations. 3. Management Consulting Agreement: Management consultants may use this type of agreement for engagements that focus on organizational planning, process improvement, project management, or operational efficiency. 4. Financial Consulting Agreement: This agreement caters to consultants providing financial advisory, accounting, or auditing services. It typically addresses financial analysis, tax planning, financial reporting, or compliance matters. Regardless of the type, a Travis Texas Agreement for Consulting Services ensures a solid foundation for a successful consultation engagement by laying out the expectations, deliverables, and legal rights of both parties involved. It serves to minimize misunderstandings and protects the interests of both the consultant and the client.

Travis Texas Agreement for Consulting Services

Description

How to fill out Travis Texas Agreement For Consulting Services?

Creating documents, like Travis Agreement for Consulting Services, to take care of your legal affairs is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Travis Agreement for Consulting Services template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting Travis Agreement for Consulting Services:

- Ensure that your form is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Travis Agreement for Consulting Services isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and get the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!