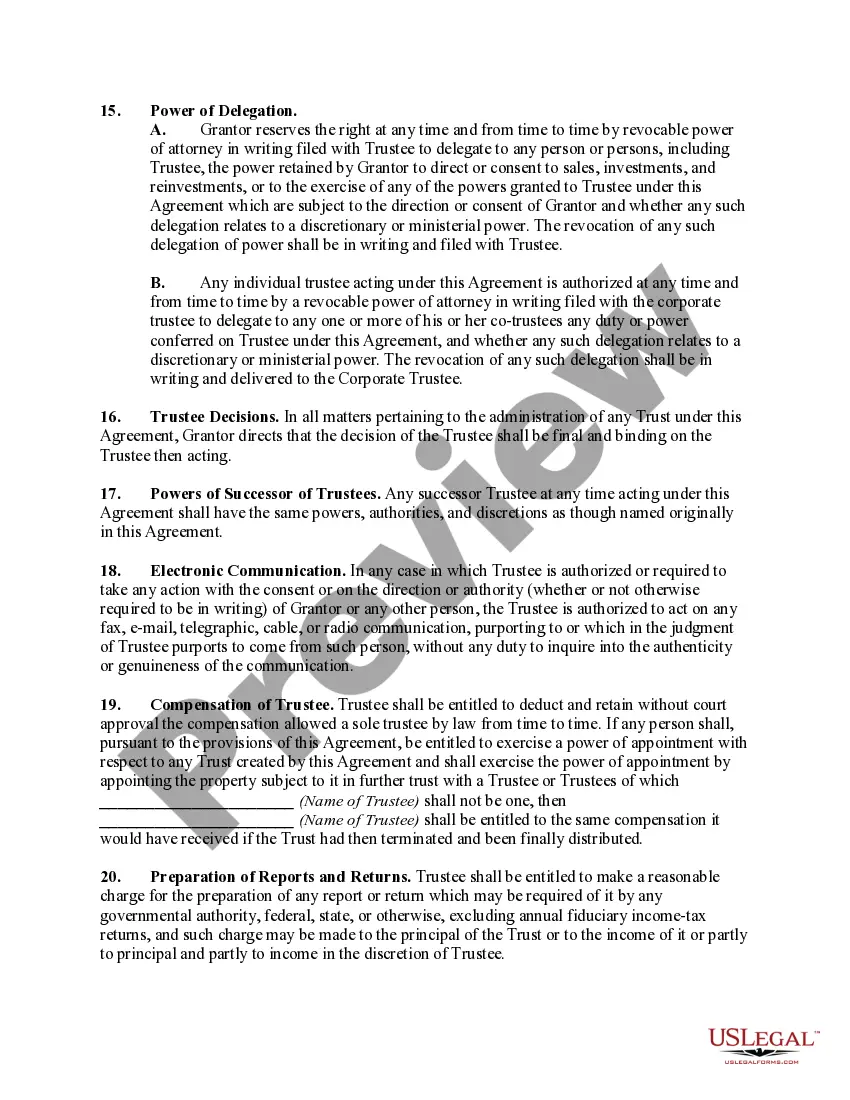

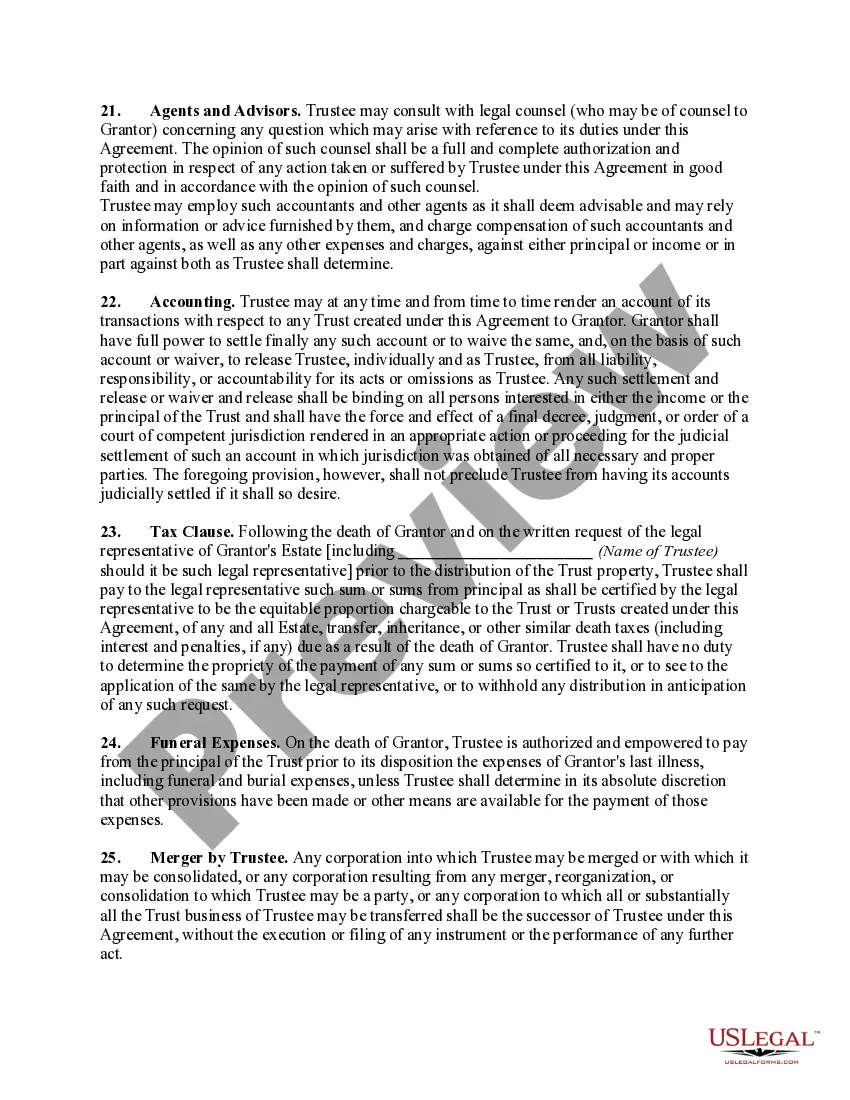

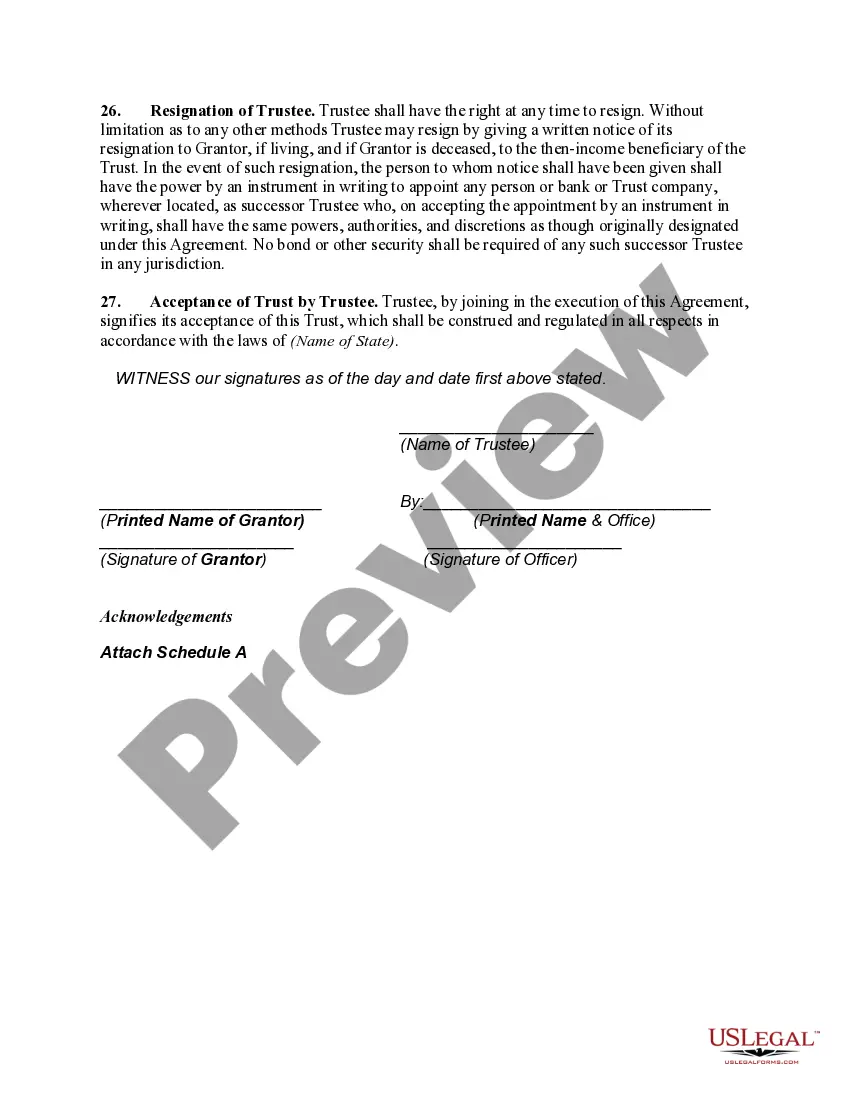

The Harris Texas Revocable Trust Agreement with Corporate Trustee is a legal document that outlines the terms and conditions of a trust established in Harris County, Texas, where a corporate trustee is appointed to oversee the administration and management of the trust assets. This type of trust agreement provides individuals with the flexibility of retaining ownership and control of their assets while ensuring their efficient and secure management during their lifetime and distribution upon their death. There are different types of Harris Texas Revocable Trust Agreements with Corporate Trustees available to suit varying needs and preferences. Some commonly known types include: 1. Individual Revocable Trust: This type of trust agreement allows an individual to establish a trust, appoint a corporate trustee, and transfer their assets into the trust for management and distribution according to their specified instructions. 2. Marital Revocable Trust: Designed for married couples, this trust agreement allows for the transfer of assets into a trust to provide simultaneous management and support for both spouses. In the event of one spouse's death, the surviving spouse retains control and benefits from the trust assets. 3. Family Revocable Trust: This type of trust agreement is aimed at protecting and providing for the financial needs of the entire family. It allows for the preservation and distribution of assets among family members during the lifetime of the granter and after their passing. 4. Charitable Revocable Trust: This trust agreement allows individuals to establish a trust to support charitable causes and organizations of their choice. The corporate trustee ensures the proper administration and management of the trust assets, ensuring that the donor's charitable wishes are fulfilled. By establishing a Harris Texas Revocable Trust Agreement with Corporate Trustee, individuals can protect their assets, ensure their efficient management, and facilitate the smooth transfer of wealth to beneficiaries upon their death. Additionally, this agreement can help individuals mitigate estate taxes, maintain privacy, and avoid the probate process. Whether an individual opts for an individual, marital, family, or charitable revocable trust, having a corporate trustee ensures professional management and adherence to fiduciary responsibilities associated with the trust administration.

Harris Texas Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Harris Texas Revocable Trust Agreement With Corporate Trustee?

Draftwing forms, like Harris Revocable Trust Agreement with Corporate Trustee, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various cases and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Harris Revocable Trust Agreement with Corporate Trustee form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Harris Revocable Trust Agreement with Corporate Trustee:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Harris Revocable Trust Agreement with Corporate Trustee isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!