The Kings New York Revocable Trust Agreement with Corporate Trustee is a legal document that establishes a trust arrangement wherein an individual, referred to as the granter, transfers their assets to a trust for the benefit of named beneficiaries in the event of their death or incapacitation. When it comes to the corporate trustee, a trusted financial institution or company is appointed to manage the trust and ensure its adherence to the terms and conditions set forth in the agreement. There are several types of Kings New York Revocable Trust Agreements with Corporate Trustees available, each designed to meet specific needs and preferences. Some of these variations include: 1. Kings New York Living Revocable Trust Agreement with Corporate Trustee: This agreement is established during the granter's lifetime and can be amended or revoked as desired. It enables the granter to maintain control over their assets while still providing for the efficient management of the trust by a corporate trustee. 2. Kings New York Asset Protection Revocable Trust Agreement with Corporate Trustee: This type of trust agreement aims to protect the granter's assets from potential creditors or legal claims. By transferring assets into this trust, they are shielded from potential risks while still allowing flexibility for the granter. 3. Kings New York Special Needs Revocable Trust Agreement with Corporate Trustee: This trust agreement is designed to support individuals with special needs. It ensures that the beneficiary receives proper care and financial assistance while not impacting their eligibility for government benefits. The corporate trustee plays a crucial role in managing and dispersing funds to cater to the beneficiary's unique circumstances. 4. Kings New York Charitable Revocable Trust Agreement with Corporate Trustee: This type of trust agreement allows the granter to establish a trust to support charitable causes or organizations of their choice. The corporate trustee oversees the distribution of funds to ensure they align with the granter's philanthropic goals. In conclusion, the Kings New York Revocable Trust Agreement with Corporate Trustee is a flexible legal document that enables individuals to protect and manage their assets while providing for their loved ones or supporting charitable causes. Whether it's a living trust, asset protection trust, special needs trust, or a charitable trust, selecting a corporate trustee ensures professional management and adherence to the terms outlined in the agreement.

Kings New York Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Kings New York Revocable Trust Agreement With Corporate Trustee?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business purpose utilized in your region, including the Kings Revocable Trust Agreement with Corporate Trustee.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Kings Revocable Trust Agreement with Corporate Trustee will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Kings Revocable Trust Agreement with Corporate Trustee:

- Make sure you have opened the proper page with your localised form.

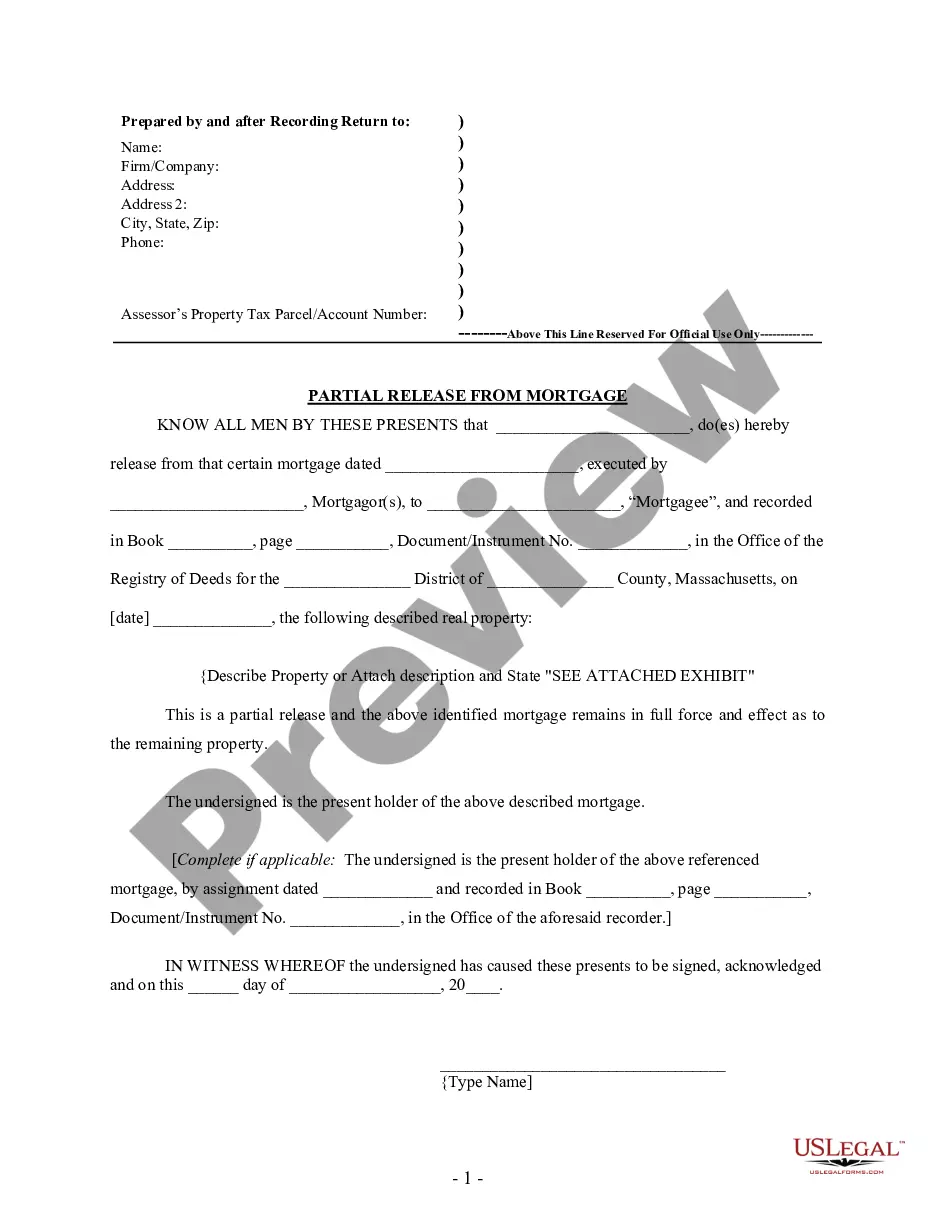

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Kings Revocable Trust Agreement with Corporate Trustee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!