Kings New York Sample Letter for Cancellation of Credit Card

Description

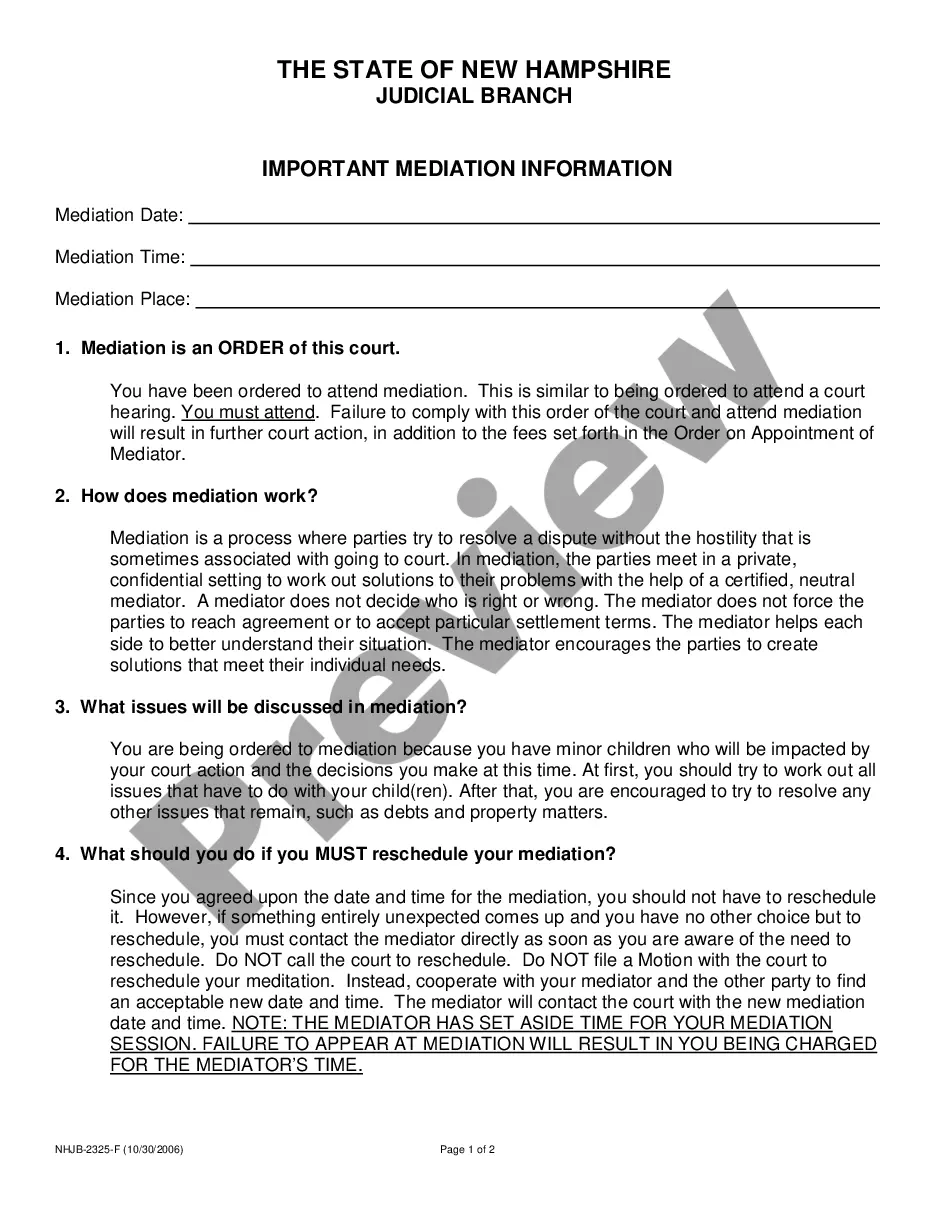

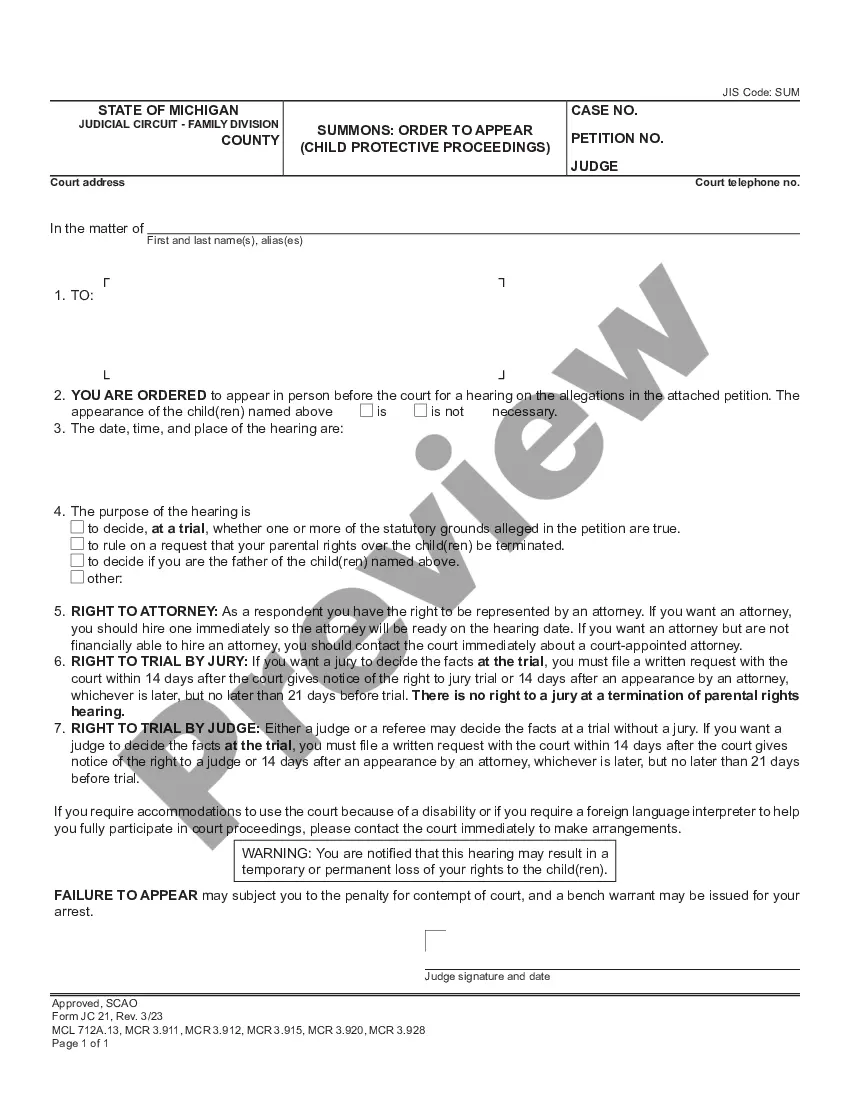

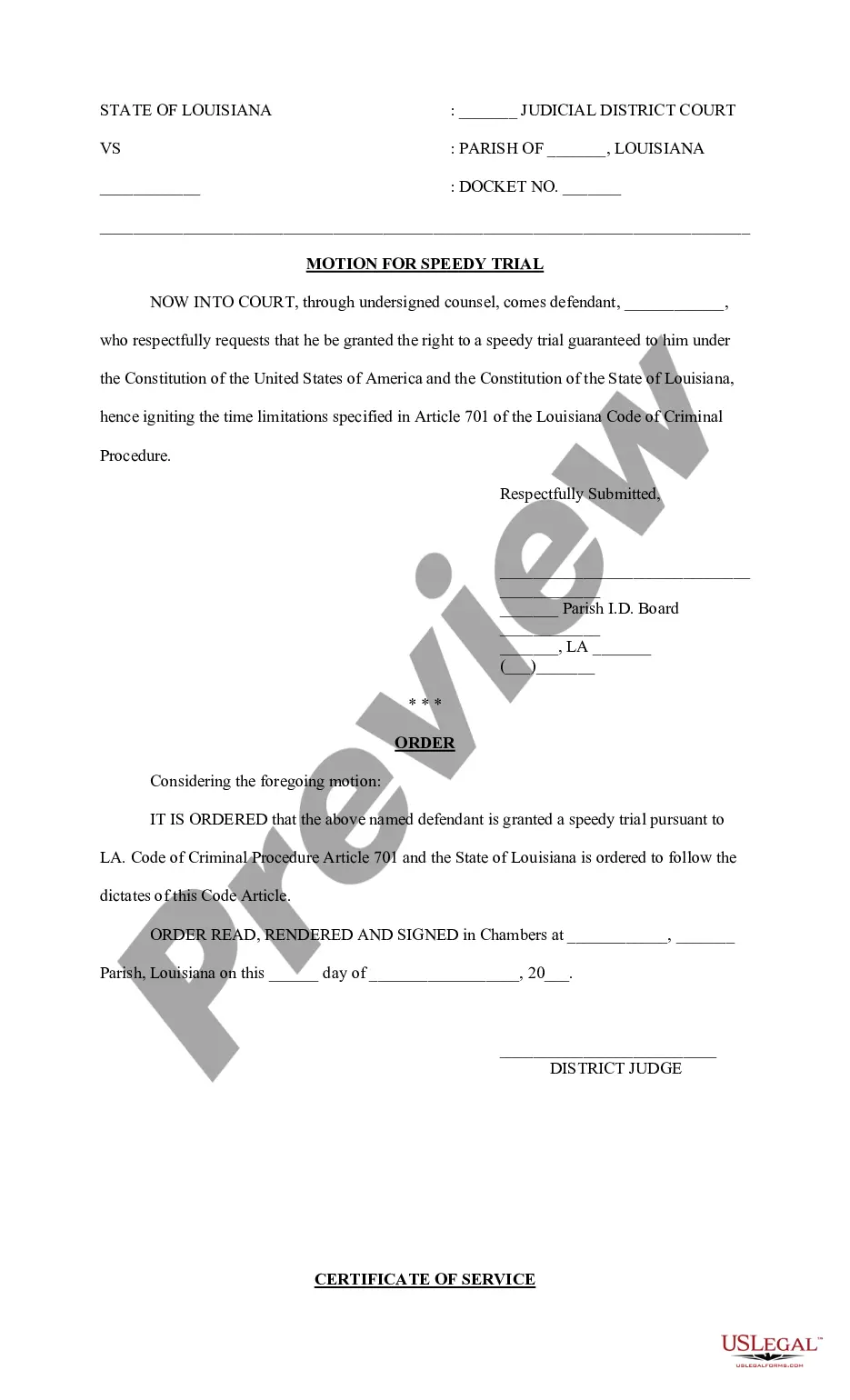

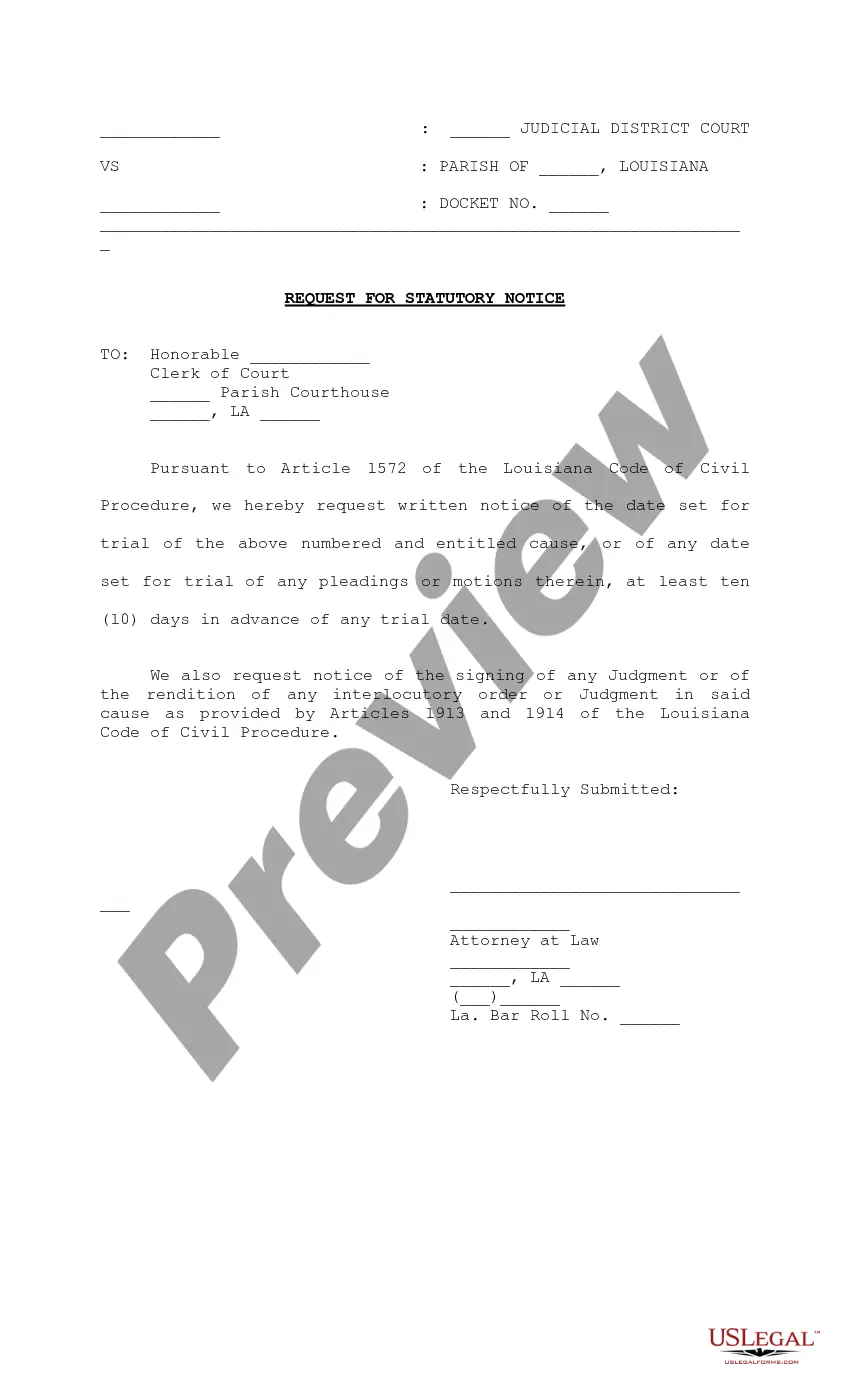

How to fill out Sample Letter For Cancellation Of Credit Card?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job proposition, transferring title, and various other life circumstances require you to prepare formal paperwork that differs across the nation.

That is the reason why having it all gathered in one location is immensely beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This is the most straightforward and dependable method to acquire legal documents. All samples available in our collection are professionally created and verified for alignment with local laws and regulations. Prepare your documentation and handle your legal matters effectively with US Legal Forms!

- Here, you can conveniently find and download a document for any personal or professional purpose used in your area, such as the Kings Sample Letter for Cancellation of Credit Card.

- Finding forms on the website is extraordinarily straightforward.

- If you already possess a subscription to our service, Log In to your account, search for the sample using the search bar, and click Download to save it to your device.

- Subsequently, the Kings Sample Letter for Cancellation of Credit Card will be accessible for future use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the very first time, follow this quick guide to obtain the Kings Sample Letter for Cancellation of Credit Card.

- Ensure you have navigated to the correct page containing your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Examine the description (if any) to confirm the template meets your requirements.

- Search for another document via the search tab if the sample does not fit your needs.

- Click Buy Now once you have located the necessary template.

Form popularity

FAQ

The card issuer should send you a follow-up letter about the account closing. You could also check your credit report to see that the account has been closed. The card issuer can also cancel a credit card at any time.

A credit card can be canceled without harming your credit score2060; just remember that paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

Due to personal reasons, I don't need the credit card. Hence, I request you to terminate / cancel my credit card and the linked card account no. (write the credit card account no.) with immediate effect.

You can close your credit card without writing a letter, but sending a letter gives you physical proof that you requested your account to be closed.

Due to personal reasons, I don't need the credit card. Hence, I request you to terminate / cancel my credit card and the linked card account no. (write the credit card account no.) with immediate effect.

Consider the Timing and Impact on Your Credit. When you close a credit card, your credit score may be affected.Pay Down the Balance.Remember to Redeem Any Rewards.Contact Your Bank to Cancel.Don't Accept Their Offers.Write a Letter for Your Records.Check Your Credit Report to Ensure the Account Is Closed.

Send a cancellation letter Follow up with a brief letter to your card issuer stating your desire to close the credit card. Include that you want the account to be closed at consumer's request and include your name, address, phone number, account number, and the details of your call with the bank's representative.

Sub: Credit Card Cancellation Letter Dear (name), I am writing this letter to inform you that I need to cancel my credit card issued by your bank. I want to terminate the credit card from today. There are no dues on the card.

Dear Sir/Madam, I hereby kindly request you to cancel/close my credit card account. Details of which are mentioned below. Reason for card cancellation/closure: I have been using it recklessly for the last few months and it is affecting my monthly savings.