Dear [Customer], Subject: Breakdown of Account Arbitrage We hope this letter finds you in good health and high spirits. As your trusted financial institution, we always strive to assist you in managing your finances and fulfilling your commitments. This letter aims to provide you with a detailed breakdown of your account arbitrage, specifically for residents of San Antonio, Texas. San Antonio is a vibrant city located in the southern part of the Lone Star State. Known for its rich history, diverse culture, and warm hospitality, San Antonio offers a thriving community with a unique blend of tradition and modernity. Home to famous attractions such as the Alamo, the River Walk, and SeaWorld, San Antonio draws millions of visitors each year. Now, let's focus on the main purpose of this letter — the breakdown of your account arrearage. We understand that unforeseen circumstances can lead to temporary financial difficulties, and we are here to provide the necessary assistance. To help you understand the current status of your account, we have prepared a comprehensive breakdown: 1. Outstanding Balance: This refers to the total amount that you owe on your account, including any unpaid principal, interest, fees, or penalties. 2. Principal: The principal is the original amount of funds you borrowed or the remaining balance of the funds you were granted on credit. 3. Interest: Interest is the additional charge applied to the principal, as defined by your loan terms or account agreement. It accrues over time as a percentage of the principal amount owed. 4. Fees: Depending on your specific account or loan agreement, certain fees may be applicable. These can include late payment fees, transaction fees, or any other charges that have accumulated due to missed payments or other account activities. 5. Penalties: Penalties are charges imposed as a consequence of failing to meet your payment obligations or breaching the terms of your agreement. These penalties are typically outlined in your account or loan agreement. To assist you in resolving your account arbitrage, we recommend taking the following steps: 1. Review your account statement carefully to fully understand the breakdown provided. If you have any questions or concerns regarding specific charges, do not hesitate to contact our customer service team. 2. Develop a budget or financial plan to manage your current and future expenses effectively. Prioritize your payments to address the outstanding balance and minimize future arbitrage. 3. Consider contacting our dedicated financial advisors who can work with you to develop a personalized repayment plan. They can offer insights and flexible options tailored to your unique financial situation. 4. Regularly monitor your account's progress and stay in touch with our customer service team. Open communication can help us understand and address any potential issues that may arise. 5. Take advantage of any financial education resources or workshops that we offer. These resources can empower you with valuable knowledge to better manage your funds, build resilience, and prevent future arbitrage. We hope this breakdown of your account arbitrage helps you understand the circumstances better. We are committed to your financial well-being and are eager to assist you in resolving this matter. Together, we can find a solution that suits your needs and allows you to regain control over your financial future. Warm regards, [Your Name] [Your Title] [Your Institution]

San Antonio Texas Sample Letter for Breakdown of Account Arrearage

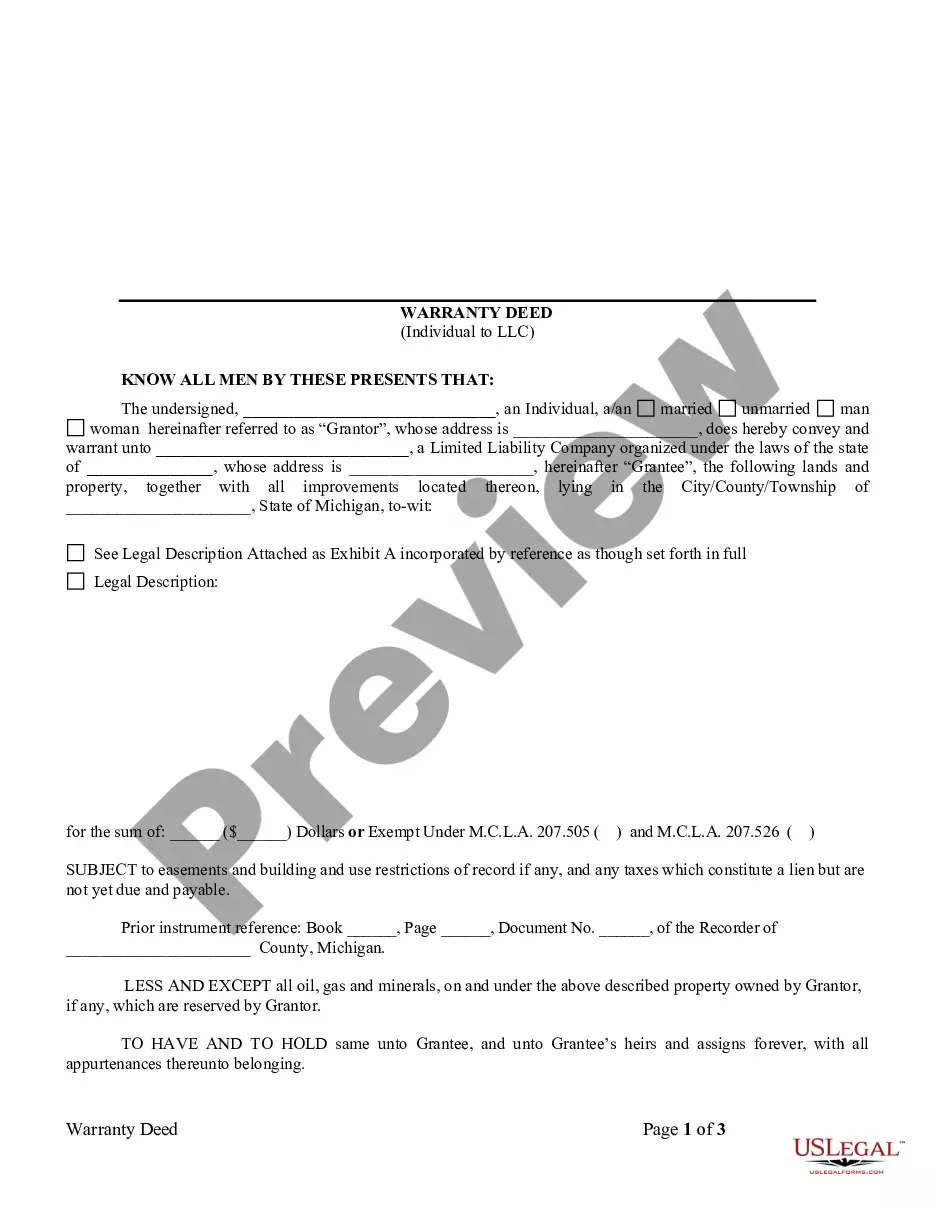

Description

How to fill out Sample Letter For Breakdown Of Account Arrearage?

Drafting legal documents can be challenging. Furthermore, if you choose to consult with a legal expert to create a business agreement, ownership transfer documents, prenuptial agreement, divorce documents, or the San Antonio Sample Letter for Breakdown of Account Arrearage, it could be quite expensive.

So, what is the most sensible method to conserve time and finances while preparing authentic forms in complete adherence to your state and municipal regulations.

Review the form description and utilize the Preview option, if available, to ensure it’s the sample you require. Don't worry if the form does not meet your needs - search for the correct one in the header. Click Buy Now when you find the desired sample and choose the best-fit subscription. Log In or register for an account to buy your subscription. Make a payment with a credit card or through PayPal. Select the file format for your San Antonio Sample Letter for Breakdown of Account Arrearage and download it. Once completed, you can print it out and fill it in on paper or upload the template to an online editor for a quicker and more convenient completion. US Legal Forms allows you to utilize all the documents you have ever acquired multiple times - you can find your templates in the My documents tab in your account. Give it a try now!

- US Legal Forms is an excellent option, whether you are looking for templates for personal or corporate requirements.

- US Legal Forms hosts the largest online repository of state-specific legal forms, offering users the most current and professionally vetted templates for any scenario compiled all in one location.

- Thus, if you require the latest edition of the San Antonio Sample Letter for Breakdown of Account Arrearage, you can easily locate it on our site.

- Acquiring the documents takes minimal time.

- Those with an existing account should verify their subscription is active, Log In, and select the sample using the Download button.

- If you have not yet subscribed, here’s how to obtain the San Antonio Sample Letter for Breakdown of Account Arrearage.

- Browse through the page and confirm there is a sample applicable to your area.

Form popularity

FAQ

To write a letter to cancel debt, begin by providing your account information and the specific balance you wish to address. Clearly articulate your reasons for the cancellation request, including any financial difficulties. Utilizing a San Antonio Texas Sample Letter for Breakdown of Account Arrearage may help ensure your letter has the details needed to effectively communicate your request.

Filling out a hardship letter involves explaining your current financial circumstances and the reasons you cannot meet your payment obligations. Include a summary of your income, expenses, and any unforeseen changes to your situation. A San Antonio Texas Sample Letter for Breakdown of Account Arrearage can guide you on how to articulate your situation clearly and professionally.

In a debt forgiveness letter, you should ask your creditor to forgive a portion or all of your debt. Start by explaining your financial hardships and include documentation if possible. Make your request respectfully, and reference a San Antonio Texas Sample Letter for Breakdown of Account Arrearage for an effective format to follow.

A debt write-off letter should outline your request for a creditor to forgive a specific amount of debt. Include your account number and a brief explanation of your financial difficulties. Be clear about why you are unable to repay the debt, and consider using a San Antonio Texas Sample Letter for Breakdown of Account Arrearage as a resource for structuring your letter.

In Texas, child support arrears are generally not forgivable. However, courts may consider rare circumstances for modification or forgiveness based on significant changes in income or the obligations of the parents. It is essential to back this up with proper documentation. Utilizing a San Antonio Texas Sample Letter for Breakdown of Account Arrearage can help present your case effectively.

In Texas, child support arrears can be collected for up to ten years following the date the payments were originally due. After this period, the right to collect arrears may expire. It's crucial to stay informed and proactive to avoid facing long-lasting implications. Utilizing a San Antonio Texas Sample Letter for Breakdown of Account Arrearage can help clarify your situation when dealing with arrears.

Removing child support arrears in Texas typically involves filing a motion to modify or dismiss the arrears. You will need to provide supporting documentation that outlines why the arrears should be removed. Engaging a legal service that offers a San Antonio Texas Sample Letter for Breakdown of Account Arrearage can streamline your motion and support your argument in court.

To get your child support arrears dismissed in Texas, you need to file a motion in court detailing your justification for the dismissal. This process often requires strong evidence, such as proof of payment or a change in circumstances. Incorporating a San Antonio Texas Sample Letter for Breakdown of Account Arrearage can help present your case clearly and effectively to the judge.

To get child support arrears waived, you must demonstrate a valid reason, such as significant changes in your financial situation. Filing a motion with the court will initiate the process. In your filing, you might reference a San Antonio Texas Sample Letter for Breakdown of Account Arrearage to clearly outline your circumstances and request the waiver effectively.

Yes, Texas has a statute of limitations regarding the collection of child support arrears. Generally, the Texas Family Code allows for the collection of child support arrears for up to ten years after the payments were due. However, to avoid complications, it's crucial to stay informed about any changes to the law over time. For clarity, you can review documents like the San Antonio Texas Sample Letter for Breakdown of Account Arrearage.